Evergrande drags real estate and insurance

Evergrande can't go deep on its own: first of all it brings with it other real estate companies like The Sinic Holding, which lost 87% in one day:

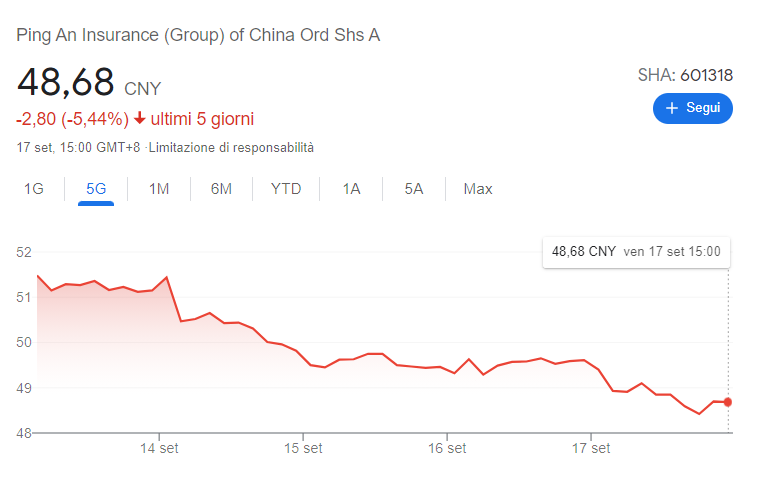

However, the real estate sector was not the only one affected. Following a pattern that recalls the 2007 2008 crisis, investors follow the insurance companies. In this case, Ping An Assicurazioni was hit, which in a few days lost .44% in a few days. So much for a company whose name in Chinese means "Safe and healthy":

The company had to release a statement on Friday stating that its insurance funds have "zero exposure" to Evergrande and other real estate companies "that the market has been paying attention to." According to Bloomberg Intelligence, the real estate sector accounts for about 4.9% of Ping An Insurance's investments, compared to an average of 3.2% for peers.

"For real estate firms that the market has been paying attention to, PA insurance funds have no exposure to equity or debt, including China Evergrande," Ping An said in a statement as he hurried to reassure investors.

While it may have no exposure, Ping An has RMB 63.1 billion or $ 9.8 billion of exposure to Chinese real estate through its RMB 3.8 billion ($ 590 billion) of insurance funds and has suffered a $ 3.2 billion hit in the first half of the year following the default of another developer, China Fortune Land Development. Among other things, some China Future projects have been taken over by Evergrande.

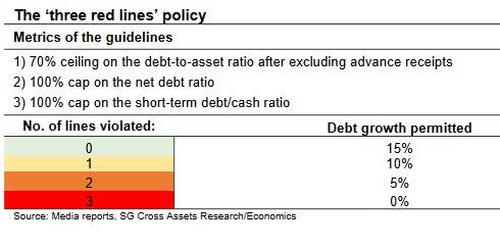

Chinese politicians, instead of intervening and limiting the damage, perhaps limiting the development of the sector, have instead tried to repress the excessive financial leverage in its vast real estate sector, which constitutes more than a quarter of the economy, by imposing a fixed threshold. known as "3 red lines". This has limited, at least in theory, debt growth to a maximum of 15%.

This move will also have slowed the growth of debt in the short term, but for many developers it has also meant slowing down the conclusion, and therefore the collection of projects already started. So far the government has limited itself to intervening in this repressive way, but this often discharges problems on customers and suppliers. Especially the latter have often become the financial outlet for developers.

As discussed earlier, Xi faces a difficult balance as he seeks to deleverage the real estate sector and make housing more affordable without causing too much short-term damage to the financial system and economy. In China, concerns are spreading and spreading to other sectors as well.

–

–

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Evergrande drags real estate and insurance comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/evergrande-trascina-immobiliare-e-assicurativo/ on Tue, 21 Sep 2021 06:00:05 +0000.