Fear and Greed and VIX indices: how they indicate the mood of the financial markets

The Fear & Greed Index, created and popularized by CNN, is a powerful tool that captures investor sentiment and confidence levels. It rises when markets are greedy and falls when investors are fearful. After all, what moves the markets, if not fear and greed, the two great forces of life.

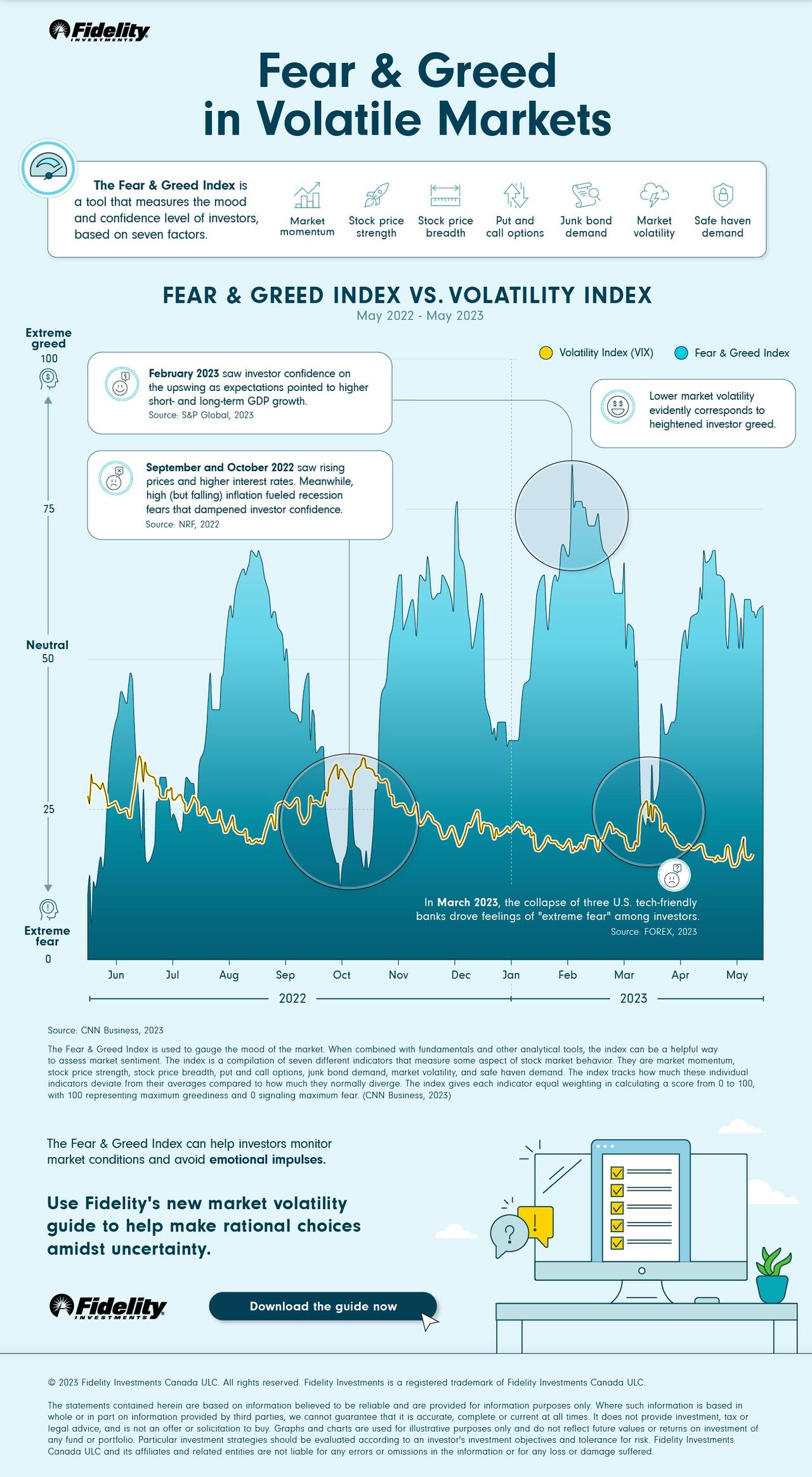

In this infographic sponsored by Fidelity Investments , Visual Capitalist's Rida Khan and Alejandra Dander compare the Fear & Greed Index to the CBOE Volatility Index (VIX) to see the connection between volatile markets and investor impulses.

The index of fear and greed

The Fear & Greed Index combines the following indicators to see how much they differ from their averages.

- Market momentum

- Stock price strength

- Breadth of the share price

- Put and call options

- Application for junk bonds

- Market volatility

- Safe investment requests

The index assigns each indicator equal weighting in calculating a score from 0 to 100, where 100 represents the greatest greed and 0 indicates the greatest fear.

CBOE Volatility Index (VIX)

The VIX measures expected price changes in S&P 500 index options over the next month, indicating market volatility. It has lower values during up markets and higher values during down markets.

When these two indices are correlated, it becomes apparent that as market volatility decreases, investor greed increases.

Impact of key events on investor sentiment

This infographic highlights significant points by emphasizing the relationship between the two indices.

September and October 2022

During this period, rising prices, rising interest rates and the possibility of a recession led to the highest level of fear observed between May 2022 and May 2023.

February 2023

February brought a breath of fresh air as GDP growth led to the highest levels of investor confidence during the review period.

March 2023

The collapse of three medium-sized tech banks has triggered a wave of extreme fear. It served as a stark reminder of the inherent vulnerability of financial markets and how quickly panic can spread.

Withstand the storm

Investors should resist their instincts, not sell on collective sentiment, be clear-headed, evaluate the outlook, and then make their own decisions. However, the indices are useful for understanding the general trend and also for understanding which types of news objectively influence the market. Read us and you will get the right information, from a better punt

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Fear and Greed Indices and VIX: how they indicate the mood of the financial markets comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/vix-greed-fear-indici/ on Mon, 14 Aug 2023 06:00:57 +0000.