FED: Are we ready for the latest rate hike? Inflation or recession

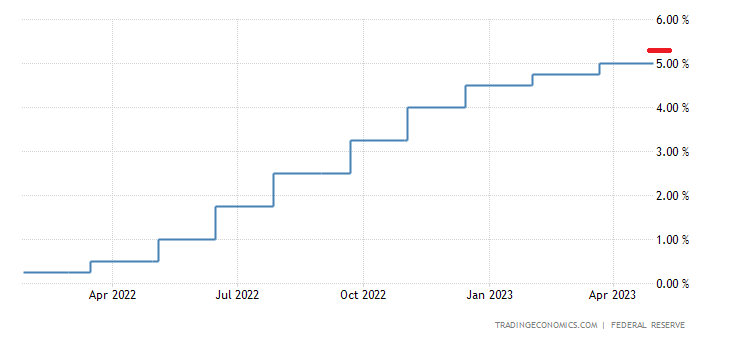

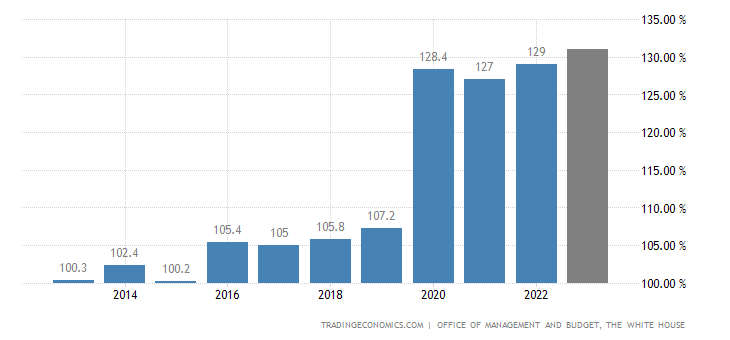

Just over a year into Volcker's fastest tightening cycle since the 1980s, the Fed is set to hike rates for the last time tomorrow, with a 0.25% (25bps) hike per arrive at a rate of 5.25%. All with the US public debt reaching its limit, very high, for which there will be yet another impact on interest expenditure. Here are the stars and stripes interest rates and public debt

Debt

The Fed is already in possession of the latest Senior Loan Officer Opinion Survey (SLOOS) report, which will be released next week and which will show the full extent of the credit crunch in US banks, with a strong possibility of recession and rising unemployment. This will readily deflate much of the inflation triggered by the Fed's own post-covid actions, if only temporarily, or at least until its own expansionary policy.

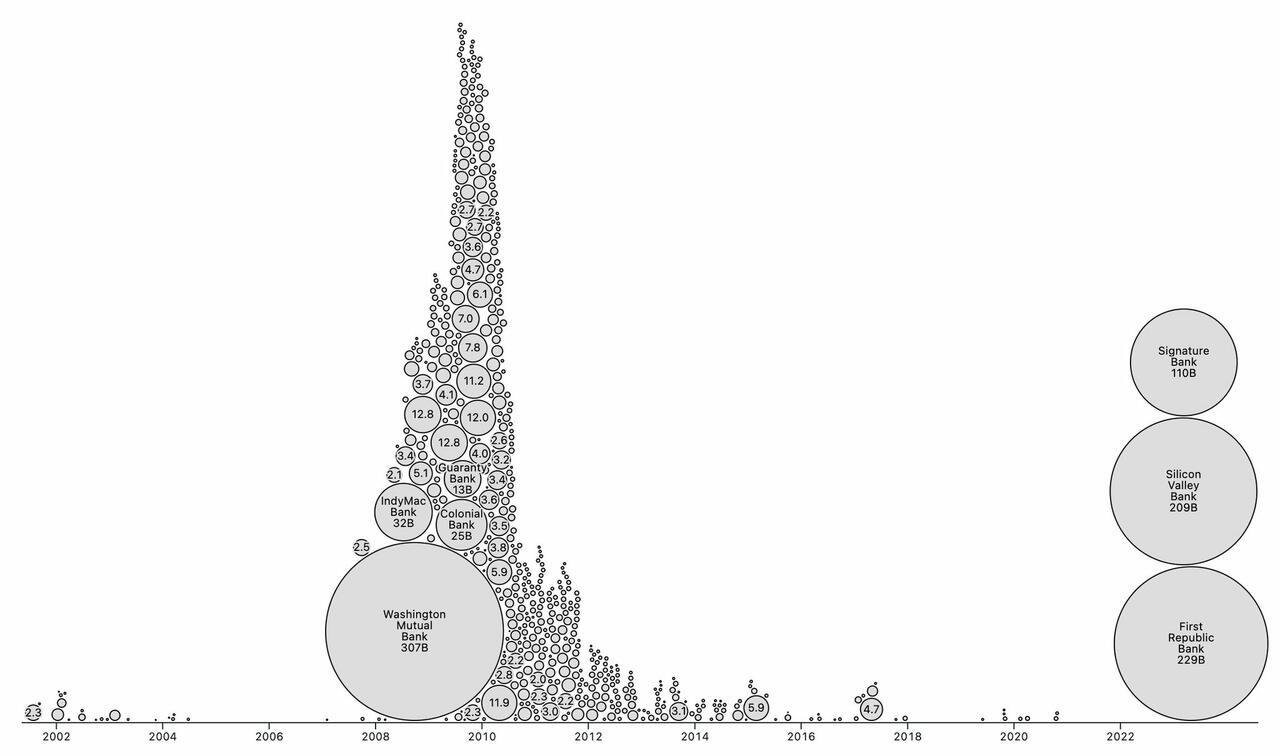

In the meantime, only three banks have created losses equal to 2/3 of the losses of the 2008 crisis. It is true that there is greater liquidity, but we are only at the beginning of the credit crisis. What will happen if it goes on?

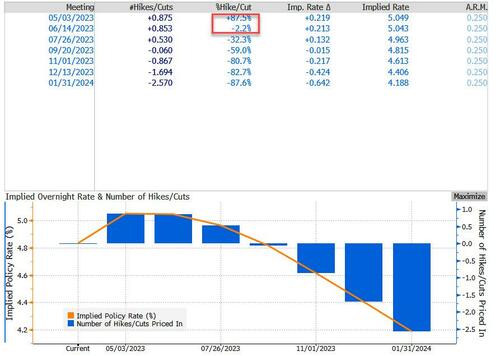

The Fed is all but ready to lift FFR by 25bps to 5.00-5.25% (88% implied/12% unchanged via money markets, down from 95% yesterday following the collapse of the regional banks today), with the consensus now expecting not only a lull in June but also a 2% chance of a cut, down from a 20% chance of a hike on Monday. However, expectations are for a decline in 2024.

The FED's statements will reflect the internal struggle between doves and hawks, between fearful inflation recession. They will likely give an accurate indication of what to expect going forward, although the fact that this is the latest hike from the Fed seems very likely.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The FED article: are we heading towards the latest rate hike? Inflation or recession comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/fed-andiamo-incontro-allultimo-aumento-dei-tassi-inflazione-o-recessione/ on Wed, 03 May 2023 09:00:08 +0000.