FED raises rates, government bond rates are reversed, recession is brewing …

The Fed has raised its rates by 25BP, 0.25%, to fight inflation above 7.9%, the stuff of 1982. In doing so, however, it has officially started the countdown to the next recession (and the next rate cut). Here's the current increase in perspective:

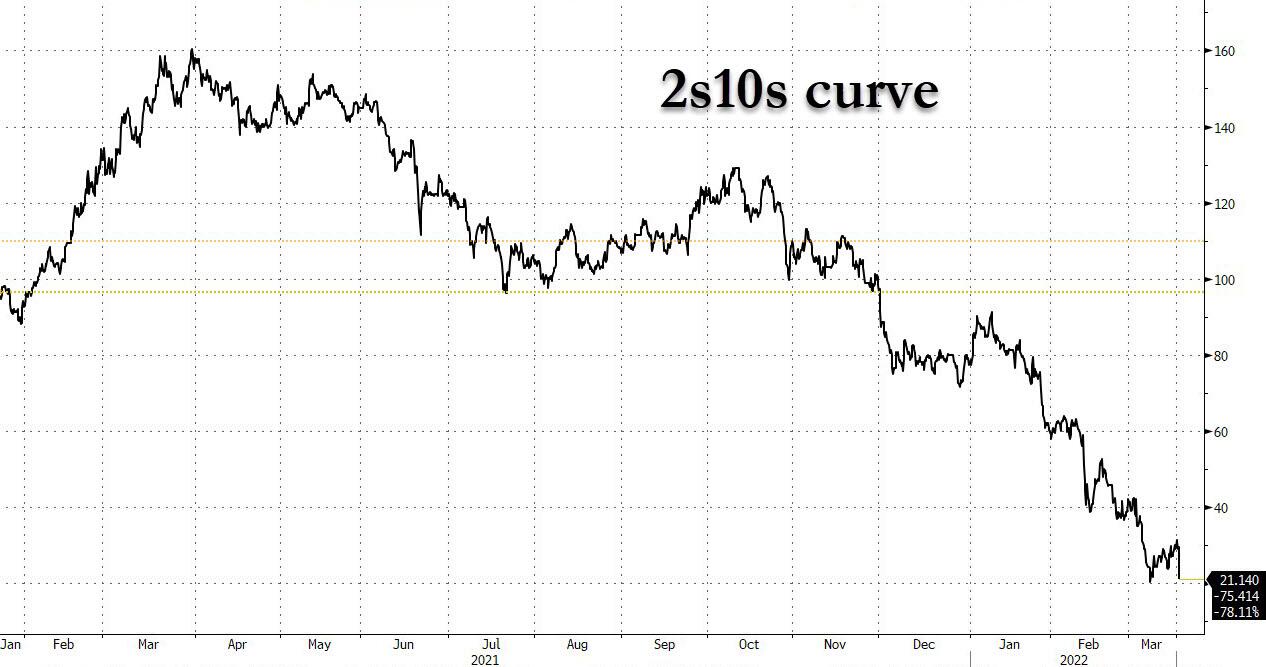

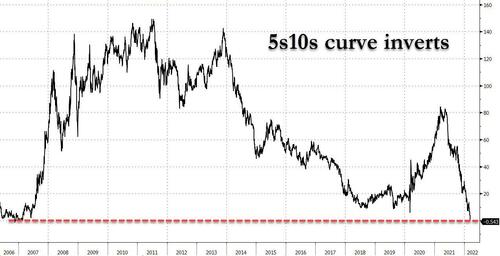

This became evident when 5-year and 10-year bond rates reversed (the latter outstripped the former) moments after Powell's speech began. DB's Jim Reid writes that although not all Fed rate hike cycles led to a recession, all reversed hiking cycles led to recessions within 1-3 years. And the problem with the Fed's bullish cycle starting today has seen an immediate, and never seen before, two-year and five-year rate reversal.

Recall that while not as popular as two-year bonds, five-year bonds are also a harbinger of recessions and usually precede two-year rate reversals by weeks. It is this curve that has reversed today.

The problem is that these rate reversals occur with inflation at 7.9%, so the FED cannot immediately stop its rate hike path, but will be forced to continue for several steps. Now, by calculating an average delay of the recession with respect to the rate reversal, we expect a recession within about 24 months. So we will have a particular condition in which the increase in rates will separate the recession itself by only a few months, making the link between the two factors evident. The U-turn of the FED will have to be decisive and quick.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The FED article raises rates, government bond rates are reversed, recession is preparing… comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/fed-aumenta-i-tassi/ on Thu, 17 Mar 2022 10:00:13 +0000.