Flop of the US economy: GDP growth target senselessly missed

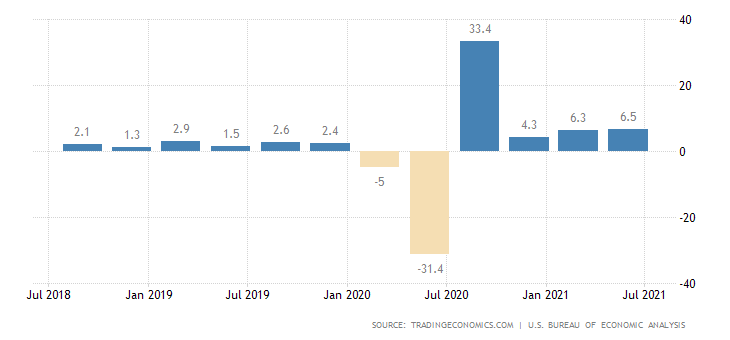

The US economy recorded annualized progress of 6.5% in the second quarter of 2021, well below the market forecast of 8.5%, and political authorities' expectations. Growth was driven by rising personal consumption expenditures (11.8%), especially services (12%) and non-durable goods (12.6%), as vaccinated Americans travel and engage in activities that before they were limited. Non-residential fixed investment (8%), exports (6%) and state and local government spending (0.8%) also increased, while there were contractions in investments in private stocks, in fixed residential investments ( -9.8%) and in federal government spending (- 10.4%). Imports also increased (7.8%). The rapid spread of the delta variant of the coronavirus, supply chain disruptions, shortages in the workforce and a cooling housing market weigh on growth for the rest of the year. The Fed sees the economy grow 7% in 2021 and 3.3% in 2022, at present.

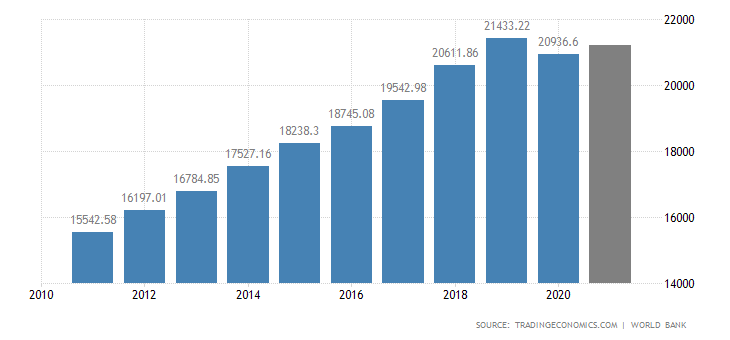

The level of GDP, although growing compared to 2020, will not reach the value of 2019. So the return to 2019 will only take place in 2022, as we can see from the following graph.

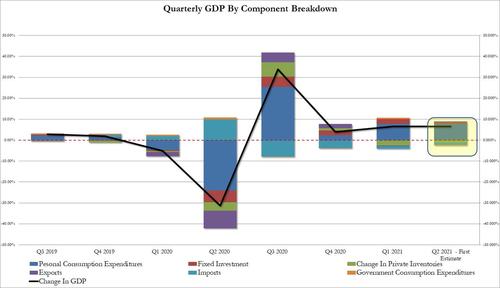

Wanting to go a little deeper:

- The rise in consumer spending reflects the rise in services (led by food and lodging services) and goods (led by other non-durable goods, especially pharmaceuticals).

- The increase in business investment reflects the increase in equipment (driven by means of transport) and intellectual property products (driven by research and development).

- The rise in exports reflects an increase in goods (driven by non-automotive capital goods) and services (driven by travel).

- The decrease in investments in inventories was driven by a decrease in retail inventories, linked to deficiencies in the production system that is unable to keep them at an adequate level.

- The decrease in federal government spending primarily reflects a decrease in non-defense spending on intermediate goods and services. In the second quarter, these declined as the processing and administration of Paycheck Protection Program (PPP) loan applications by banks on behalf of the federal government declined.

Here is a graph showing the breakdown in changes in GDP

How does this mean for the economy in general:

- the Fed has a minor push towards Tapering, that is towards the conclusion of the expansionary monetary policy. A higher value of GDP growth would have meant less need for stimulus. And if there is no improvement in employment, tapering will move even further in time;

- Biden is creating an economy dependent on public subsidies. A very dangerous situation and perhaps the greatest sign of decline in the US.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The Flop article of the US economy: a sensationally missed GDP growth target comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/flop-delleconomia-usa-obiettivo-di-crescita-del-pil-mancato-clamorosamente/ on Thu, 29 Jul 2021 14:18:43 +0000.