French real estate: why prices haven’t plummeted yet, despite high interest and falling incomes

The increase in interest rates initiated by the ECB, combined with the reduction in households' borrowing capacity, has led to a decline in real estate transactions. Prices have not yet fallen enough to offset this loss of purchasing power. If would-be buyers need to be patient, it's mostly because sellers on the other side of the market are playing for time to avoid pushing prices too low.

Since the European Central Bank (ECB) turned off the financial tap by increasing interest rates, the French real estate market has come to a standstill. With the same repayment burden, a household's debt capacity has decreased by 25% since June 2022, according to our calculations based on the Meilleurtaux simulator.

And if the French wanted to compensate with greater indebtedness, their desire to do so would be limited by the rules that regulate the size of loans and link them to salaries: the increase in remuneration has so far still been far from being able to compensate for the high inflation experienced since 2020, so real incomes, and therefore borrowing capacity, has not increased.

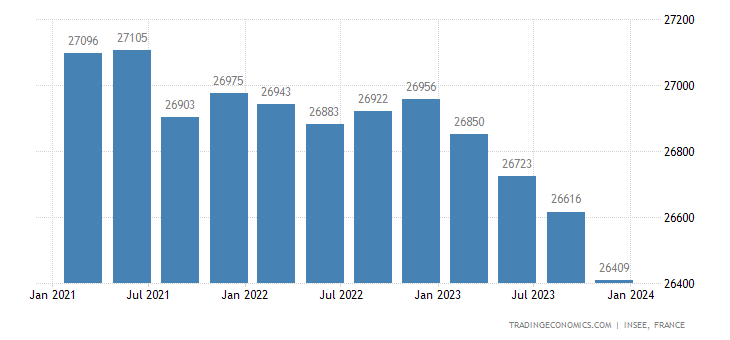

The result is a decline in transactions, the number of which last year returned to the same level as 2017 , according to the French Inspectorate General for the Environment and Sustainable Development (IGEDD). If would-be buyers are forced to wait, it's because sellers on the other side are playing with time to avoid lowering prices too much. There was also a sharp drop in the number of properties offered for rent, with a -34% between 2022 and 2023.

Transactions at peak, but prices that don't drop enough

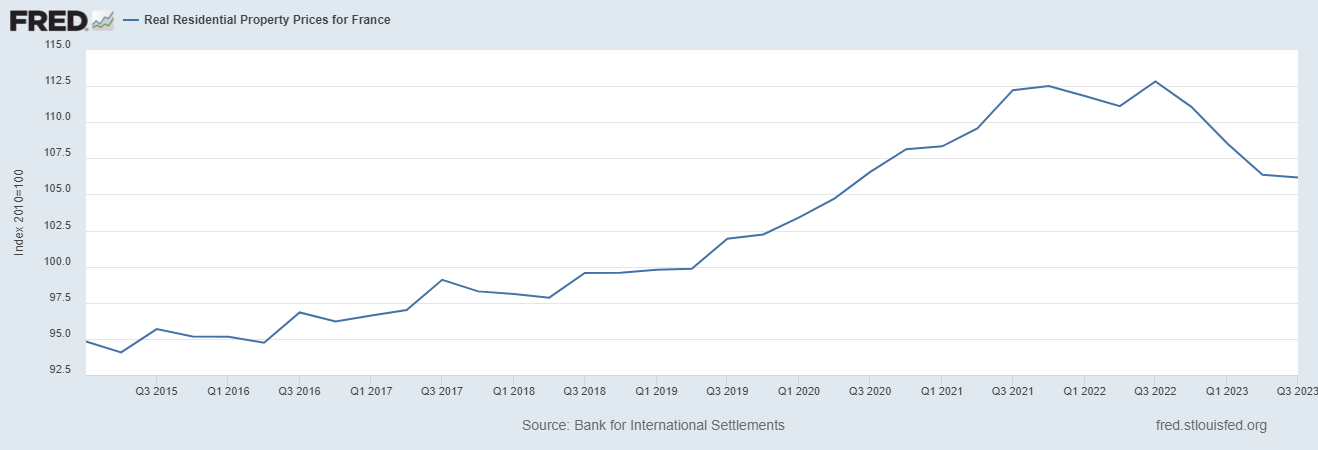

If we evaluate an external price indicator, the Saint Louis Fed indicator, we see that a correction in real estate prices in France is underway, but not yet adequate to the collapse in real estate transactions.

What is happening explains it”When owners are in a hurry to sell their property, we offer a price at the lower end of the market range and, in the opposite case, at the higher end for those who are willing to wait. The latter then gradually adapt if they don't find a buyer,” explains Luc Millet, director of a real estate agency in Chalon-sur-Saône.

Of all those offering houses, "about half are in a hurry to sell", calculates Jacques Friggit, general engineer of Igedd. Approximately one sale in three is due to a change of residence of the owner, who generally wants to conclude the deal quickly.

Then there are transactions following an inheritance: a third of sales take place in this context and in half of the cases the legatees are in a hurry, especially because they have to divide the profit with other people". This assumes that, in addition to receiving the property, they also have solid financial savings or have sufficient assets of their own to wait for and even pay inheritance taxes.

Patient sellers also include those who wish to sell a second home or a rental property. In other words, "multi-owner" families, who are significantly better off than average: according to a 2021 INSEE study, one in four French people who own at least two homes is part of the richest 10%. So they are rich enough that they don't have to sell

Alongside these families with comfortable assets, "we also see young pensioners who wish to move to the city or to the coast, but who are in no hurry to do so", adds Laurent Simon, director of the Pinoy immobilier agency in Voulx (Seine-et-Marne ).

Sellers think they are at their lowest

Sellers have even less reason to rush because they do not expect a drop in market prices, if the BPCE banking group's barometers are to be believed. In November, 40% of sellers interviewed expected an increase in prices in the next twelve months and only 25% expected a decrease,” reports Alain Tourdjman, head of economic research at the company. They are slow to perceive, or even struggle to recognize, a drop in prices that is already evident in light of general inflation. “The fact remains that, in the long term, “prices and the purchasing power of families will eventually align,” predicts Jacques Friggit.

The fact that there are no sales, combined with restrictive property performance regulations, may even lead to a recovery in the French construction sector. Because the contribution of the construction sector to the French GDP has fallen heavily in recent years:

Methods could be studied to revive construction, perhaps by taxing unused real estate land or by applying stricter standards for the efficiency of houses, but the latter fact would only lower expectations on the prices of existing houses on the market, causing a the value of the properties themselves further.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article French real estate: why prices have not yet plummeted, despite high interest and declining incomes comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/immobiliare-francese-perche-i-prezzi-non-sono-ancora-precipitati-nonostante-gli-alti-interessi-e-i-redditi-calanti/ on Sun, 25 Feb 2024 13:15:32 +0000.