FROM GOLD TO BITCOIN: the transaction of interest from material to electronic for those who fear inflation

There is no denying it: Central bank QE and the introduction of BTC and other cryptocurrencies into Paypal alternatives have blown mainstream interest in this world and are pushing the value of virtual currencies to levels that have only been reached for a short time. period between 2017 and 2018.

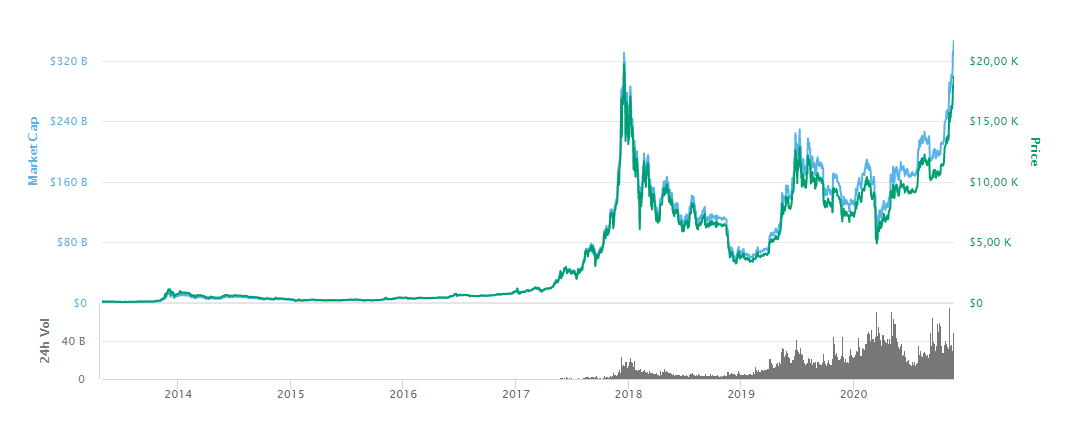

Let's see the growth of the present value:

And we notice how we are approaching the all-time highs reached by BTC

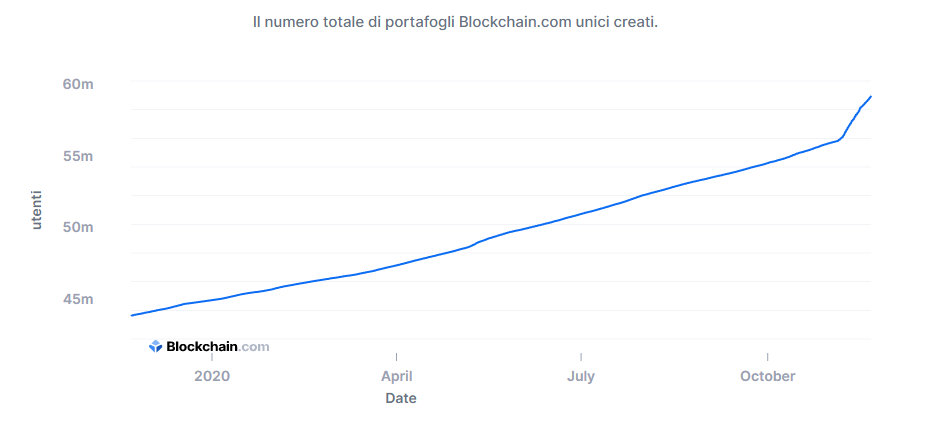

The number of new BTC wallets is also growing, and this is a true indicator of a spread of interest in virtual currencies.

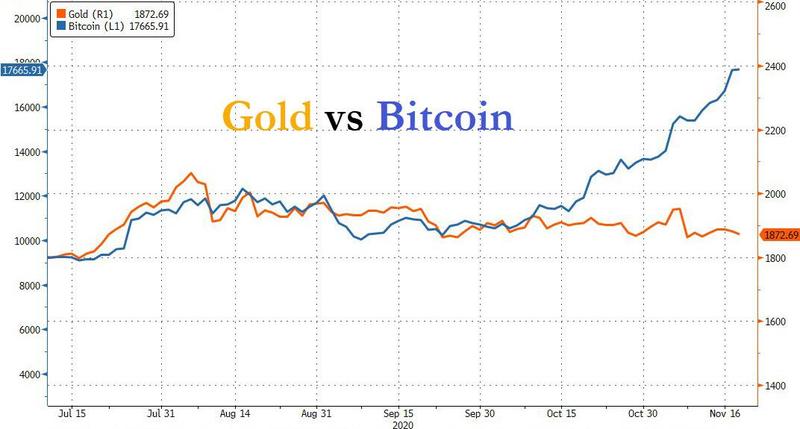

We are witnessing a differentiation between the trend of gold and that of Bitcoin. Until now, the trend of the two safe-haven assets, the physical and the virtual one, have always been rather parallel: both acted as a clearinghouse, we could say, for the excess liquidity introduced by central banks. The more liquidity was injected, the greater the part that ended up in these two assets. But now we have a division of the paths:

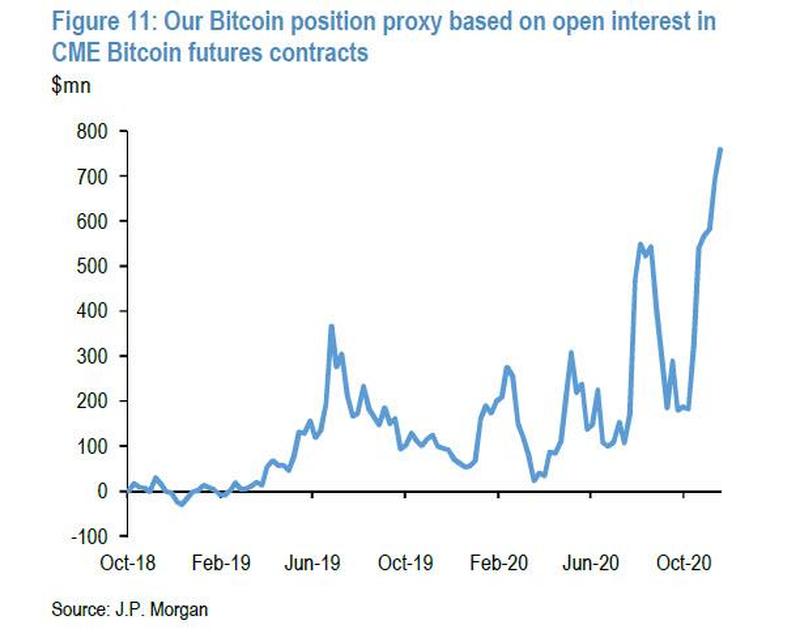

If we analyze future market data, we see a decline in interest in gold which is gradually being replaced by Bitcoin. Let's see how open positions on the CME futures market are growing dramatically:

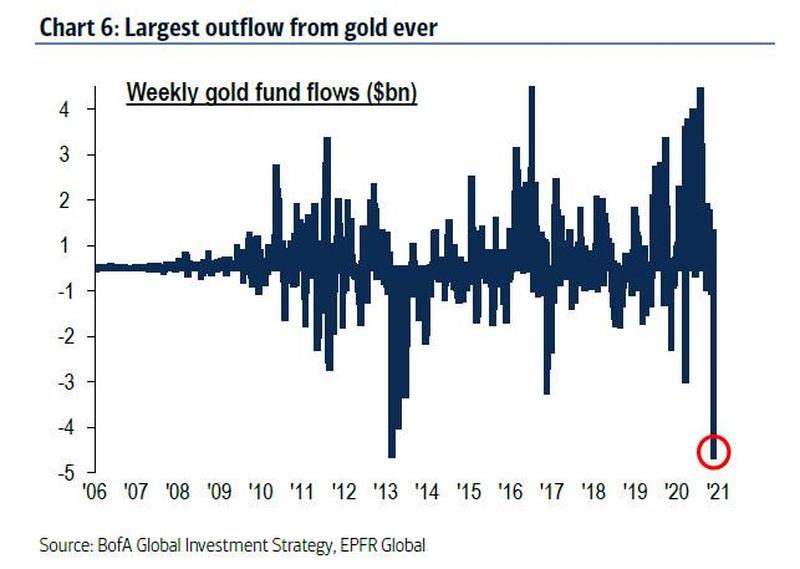

While the interest on gold is progressively decreasing, with an outflow that feeds the virtual currency:

What conclusions to draw from these movements: there is probably a real generational replacement and older investors leave, for reasons of convenience or necessity, their investments in gold to be replaced by younger generations who instead invest in virtual currency, seen as the new “stable asset”, due to its deflationary and predetermined issue over time. This makes BTC on the one hand as the "Safe Harbor" par excellence, but also as the one most subjected to speculative pressures due to the inability of demand to adapt to supply and due to the still insufficient practical use. Even if the growth will continue, for some time, in the face of the continuation of monetary issues, it is not certain that this is not yet another bubble destined to deflate in unpredictable times.

Critpovalute telegram channel: https://t.me/TWOCBLConsulting

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article FROM GOLD TO BITCOIN: the transaction of interest from material to electronic for those who fear inflation comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/dalloro-a-bitcoin-la-transazione-dellinteresse-dal-materiale-allelettronico-di-chi-teme-linflazione/ on Sat, 21 Nov 2020 09:15:00 +0000.