Gas in Europe: winter could bring bad surprises

The spot liquefied natural gas (LNG) market is calmer than usual for this time of year as inventories in both Europe and Asia are high and the weather is still mild, but things could change very quickly.

Demand in Europe and Asia is rising in November compared to warmer October, but spot LNG prices in Asia have fallen in the past three weeks, and benchmark prices in Europe have also fallen in recent days due to the easing supply concerns in the Eastern Mediterranean and near complete natural gas storage sites in the EU.

Let's see the trend of the Dutch TTF market, where gas is traded on the European market. This is the six month view:

This is the one-year price chart.

As you can see we are far from the highs of 2022.

As you can see we are far from the highs of 2022.

However, governments should be careful, because, however full, the deposits may not be enough for the whole winter in the event of cold spells and sudden increases in demand, especially if international prices were to suddenly rise.

The slight increase in demand has not increased spot LNG prices, at least for now

LNG demand in both Asia and Europe increased this month compared to October, according to Kpler data cited by Reuters columnist Clyde Russell.

Imports into Asia are set to increase to 22.67 million tonnes in November from 21.18 million tonnes in October, with China leading imports and rising. Japan's LNG imports are estimated to be stable this month compared to last month, while India's imports are expected to decline starting in October as last month's higher prices may have discouraged price-sensitive Indian buyers from buying more LNG for November.

Related: UAMPS cancels planned NuScale reactor

European LNG imports are also rising and are expected to reach their highest level since May this month, according to Kpler data.

Against a backdrop of expected higher demand at the start of the heating season, LNG imports into northwestern Europe are expected to increase by 30% in November compared to October, according to preliminary estimates from LSEG.

“Heating demand is increasing and there are forecasts of colder weather,” Wayne Bryan, head of European gas at LSEG, told Montel in late October.

Despite higher LNG demand and arrivals in both Europe and Asia, the average spot LNG price for December delivery in Northeast Asia last week fell 3% from the previous week to $16.50 per million British thermal units (MMBtu), according to industry estimates. sources cited by Reuters .

The spot price of LNG in Asia has fallen for three consecutive weeks now due to warmer weather and high inventories. Furthermore, according to recent Chinese customs data reported by Reuters, Chinese energy giants are reselling more cargoes to the rest of Asia this year than last, in a bid to make trade gains and balance gas supply. The greater volume of LNG resold to other buyers in Asia also provides a buffer against supply disruptions and concerns, including from Australia and new U.S. sanctions on Russia's Arctic LNG 2 project.

The calm before the storm?

The LNG market appears calmer than usual for November, when heating demand is generally rising in both Europe and Asia.

However, no one can predict how cold this winter will be in the Northern Hemisphere. Last winter was fortunately warmer than usual in Europe, just as the continent was looking to import larger volumes of LNG despite soaring prices to replace the lost gas supply via the Russian pipeline.

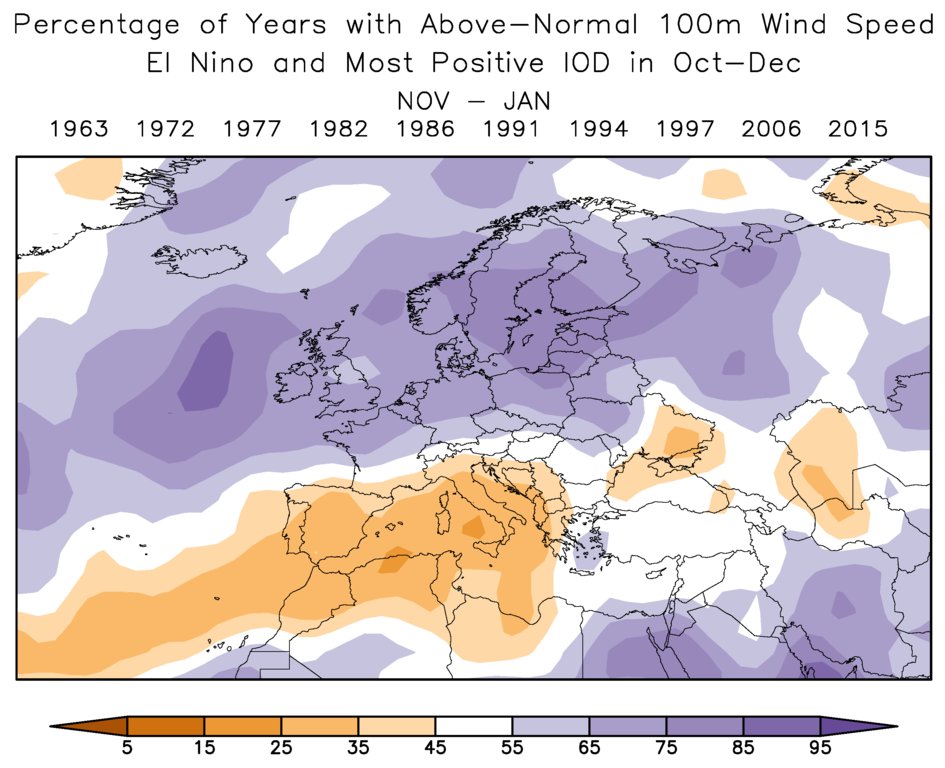

There is no guarantee that this winter will be as warmer than usual, and the weather will be the driving force behind the LNG market and prices. The most recent forecasts, linked to the El Niño phenomenon, are consistent with a colder and drier winter in the Nordic and North Eastern European countries, while it should be humid but mild in the Mediterranean area. Now the Nordic countries are little or not at all dependent on natural gas, but the situation is different for Germany, Austria and Poland. A more intense cold spell could lead to stockouts in those areas. Here's what the weather forecast looks like for next winter

Time is one of the greatest unknowns, and everyone knows it well.

Last month, Vitol Group CEO Russel Hardy said some of the European demand for natural gas lost due to the energy crisis and record prices may never return.

“For gas, demand has collapsed in Europe, with double-digit percentage reductions. We expect some of the lost demand to be permanent,” Hardy told the Energy Intelligence Forum.

Even with structurally lower gas demand, Europe and its major economies are not out of the woods yet, and a cold winter could reveal supply vulnerabilities.

Gas supply disruptions continue to pose a risk for Germany, the CEO of the country's largest utility, RWE, said last month .

“We have no buffer in the gas system,” RWE CEO Markus Krebber told German magazine WirtschaftsWoche , adding that Europe's largest economy must accelerate the construction of gas import infrastructure to avoid future shortages.

Sustained colder-than-normal temperatures and unplanned outages at LNG export facilities are the main risks to a sufficient supply of gas this winter, the U.S. Energy Information Administration said last week.

“Relatively full natural gas supplies in the United States and Europe, as well as expanding global liquefied natural gas (LNG) export and import capacity, have increased the likelihood that supply will be sufficient to meet demand in the global natural market.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article Gas in Europe: winter could bring bad surprises comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/gas-in-europa-linverno-potrebbe-portare-pessime-sorprese/ on Wed, 15 Nov 2023 18:00:30 +0000.