Here is the Fed’s exit plan from QE and how it will stop buying US government bonds. How will the rates go?

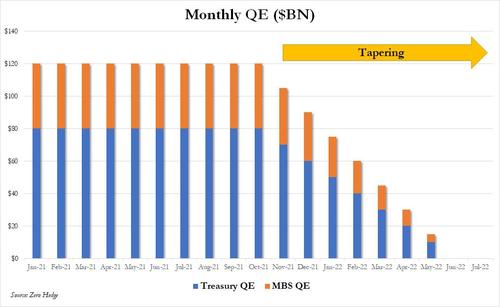

Today the Fed announced that it will come out of the government bond purchase tunnel, albeit not dryly, but rather gradually with a process that will last until at least June 2022. Here is a map that shows these steps.

All this is to be hoped that it will not lead to a too sharp shock on the prices of government bonds and, in general, on the bond market. With an economy that is slowing, a credit crunch would be the least useful thing,

Now let's talk a little bit in a technical way. The Federal Reserve took the following decisions to implement the monetary policy stance announced by the Federal Open Market Committee in its November 3, 2021 statement:

- The Board of Governors of the Federal Reserve System voted unanimously to keep the interest rate paid on reserve balances deposited with the Fed at 0.15%.

- As part of its policy decision, Open Market Desk, the operating arm at the Federal Reserve Bank of New York under orders from the Federal Open Market Committee, will now follow these guidelines:

– Engage in open market operations, if necessary, to keep the federal funds rate within a target range of 0 to 0.25 percent, ie rate guidance continues.

– Complete the System Open Market Account (SOMA) increase in holdings of $ 80 billion Treasury Securities and $ 40 billion Agency Mortgage Backed Securities (MBS) as outlined in the monthly purchase plans issued to half October.

– Increase SOMA holdings of Treasury securities by $ 70 billion and agency MBS by $ 35 billion, during the monthly purchase period beginning in mid-November.

– Increase SOMA holdings of Treasury securities by $ 60 billion and agency MBS by $ 30 billion, during the monthly purchase period beginning in mid-December.

– Increase the holdings of Treasury and agency MBS securities by additional amounts, if necessary, to support the smooth functioning of the markets for these securities.

– Conduct overnight repurchase transactions with a minimum bid rate of 0.25 percent and an aggregate, modifiable operating limit of $ 500 billion;

– Conduct overnight reverse repurchase transactions at an offer rate of 0.05 percent and with a counterparty limit of $ 160 billion per day (i.e. bank financing transactions);

– Re-auction all principal payments from Federal Reserve holdings in Treasury securities and reinvest all principal payments from Federal Reserve holdings of agency debt and agency MBS into agency MBS (i.e. how in the ECB they re-invest interest from government bonds in government bonds).

– Allow modest deviations from the declared amounts for purchases and reinvestments, if necessary for operational reasons.

– Engage in dollar and coupon exchange transactions if necessary to facilitate the settlement of Federal Reserve agency MBS transactions ”.

In a related action, the Federal Reserve System's Board of Governors voted unanimously to approve setting the primary credit rate at the existing level of 0.25 percent.

So many words, to say that, in the end, there is only in tapering as a real change in the Fed's policy. Which, however, is not cheap. we will see if, albeit more gradually, it will happen as in Australia, with a more than doubling of lending rates.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Here is the Fed's exit plan from QE and how it will stop buying US government bonds. How will the rates go? comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/ecco-il-piano-di-uscita-della-fed-dal-qe-e-come-smettera-di-comprare-titoli-di-stato-usa-come-andranno-i-tassi/ on Wed, 03 Nov 2021 21:25:10 +0000.