If interest rates on government bonds fall, this is a very bad sign

In recent weeks there has been a sharp decline in government bond rates after these, as inflation rose, had reached a maximum between the end of April and the beginning of March:

A sudden drop, despite inflation expectations not particularly calmed down. Many saw this as a good sign, linked to the fact that the Fed is believed to be able to regulate interest rates on government bonds. In reality, the American Central Bank has also engaged in absorbing a lot of liquidity from the banking system through Reverse Repo operations, so the Fed's function has been, more than anything else, to regulate the market.

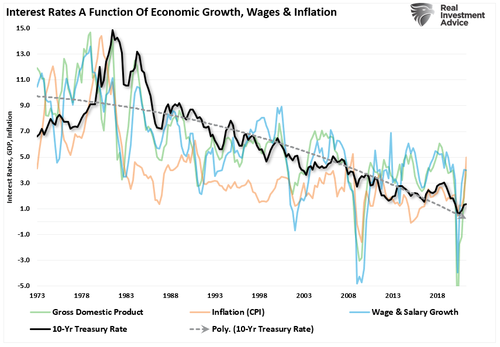

In reality, the lowering of rates essentially shows a worsening of the economic growth prospects. As you can see from the following chart, interest rates show a correlation with growth, wage trends and inflation.

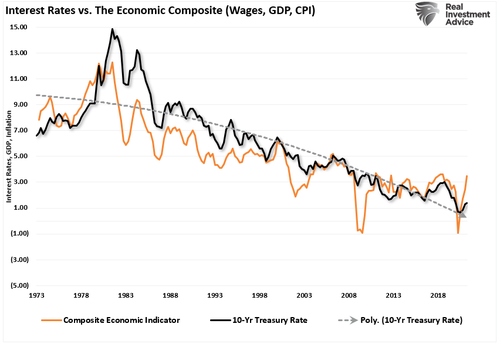

This graph also shows a very similar trend:

Rates fall because there is an expectation of lower economic growth, accompanied by a lower expectation of wage mobility and therefore of inflation. Rates also fall also because there is a worse prospect of remuneration with the stock market, a direct competitor of US government bonds. So there is little to be satisfied with the drop in 10-year T-bond rates: this is a sign of a worsening economic outlook. Post covid-19 growth already seems to be stalling and reaching a moment of tiredness. The next few months will prove decisive for understanding the trend in 2022.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article If interest rates on government bonds fall it is a bad signal comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/se-i-tassi-di-interesse-dei-titoli-di-stato-scendono-e-un-pessimo-segnale/ on Sat, 10 Jul 2021 16:30:53 +0000.