If this continues, the Bank of Japan will buy all the debt within the year

In 2015, the IMF was the first to reckon with the endless monetization of Japanese debt and warned that under a “realistic rebalancing scenario” the BoJ would need to reduce JGB purchases in 2017 or 2018, “given the collateral needs of banks, the asset-liability management constraints of insurers and the asset allocation targets announced by major pension funds”. ”

Needless to say, the BOJ has not curtailed its QE, which began in 2001 and continued for more than two decades in various stages. Indeed, as the BOJ bought more and more debt, outgoing BOJ Governor Kuroda crossed a historic rubicon last June as the BOJ became the owner of more than 50% of all Japanese bonds, effectively destroying the JGB bond market. , where it was the fringe trader who set the prices, leading to bizarre results like a record four days in a row without a single trade!

Today we are in 2023, about 5 years after the initial IMF deadline, and Japan is holding on to the skin of its teeth, especially after Kuroda's December surprise, with his "YCC tweak", opened a gap in credibility of the Japanese central bank and it is now clear that control of the yield curve cannot be maintained.

According to Bloomberg's Garfield Reynolds, the trillion yen problem is that Tokyo will continue to spread rates and currency market turmoil until some sort of solution is found.

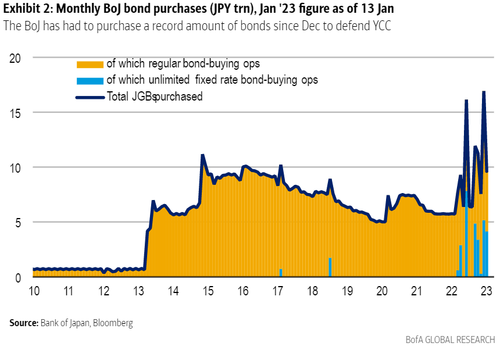

Meanwhile, the utterly appalling and frantic pace of JGB's recent purchases — some 12 trillion yen in just four days — surpasses any single month of purchases to date.

BOJ is on pace to do $300BN in QE this month https://t.co/VldlKLcbkw

— zerohedge (@zerohedge) January 13, 2023

The central bank's market share probably jumped a full percentage point in January to 53%, and the month is only half over. According to Garfield's calculations, if the BOJ continues like this, there are approximately 33 weeks before there are no more privately owned JGBs.

Assuming the government does indeed increase its lending, that would add a few more weeks, but the idea that the BOJ could buy up the entire local bond market by the end of 2023 is not an idea policymakers would be particularly eager to contemplate. . but it seems around the corner.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article If this goes on, the Bank Of Japan will buy all the debt within the year comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/se-va-aavanti-cosi-la-bank-of-japan-si-compre-tutto-il-debito-entro-lanno/ on Wed, 18 Jan 2023 07:00:49 +0000.