In 2023 the banking crisis destroyed more assets than in 2008. Which bank will be next to blow?

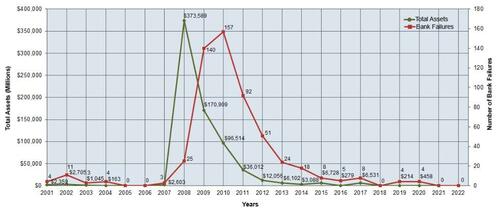

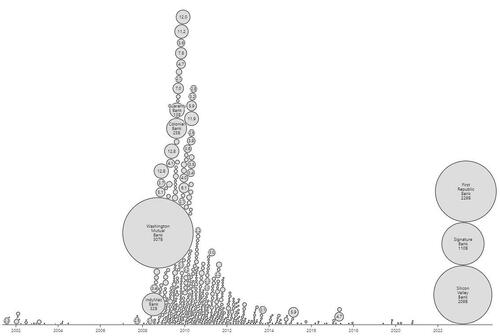

Collectively, the big three US banks that failed in 2023 had more assets than all 25 banks that collapsed in 2008. 2008 saw the peak in asset bank failures ($373.6 billion with “only” 25 failures). , while 2010 saw the peak in terms of the number of failed banks (157 against 25 in 2008). So far, in 2023, 3 banks with total assets of $548.5 billion have failed .

Even including the $170.9 billion in assets of failed banks in 2009, 2023 is still worse than the two years of the "great financial crisis" combined, and it's only been four months old.

There are still eight months to go until the end of the year and many other banks are currently teetering on the brink. The executives of these banks tell us not to worry, but obviously the executives of the First Republic only gave similar assurances last week. Personally, I had heard that First Republic would have enough reserves to keep going for months. But it was a lie, and now First Republic is a goner. The following is from the official statement released by the FDIC when it took over the bank…

First Republic Bank of San Francisco, California, was shut down today by the California Department of Financial Innovation and Protection, which appointed the Federal Deposit Insurance Corporation (FDIC) as bankruptcy trustee. To protect depositors, the FDIC is entering into a buy and borrow agreement with JPMorgan Chase Bank, National Association, Columbus, Ohio, to assume all deposits and substantially all assets of First Republic Bank.

JPMorgan Chase Bank, National Association has filed an offer for all of First Republic Bank's deposits. As part of the transaction, First Republic Bank's 84 offices in eight states will reopen today as branches of JPMorgan Chase Bank, National Association, during normal business hours. All First Republic Bank depositors will become JPMorgan Chase Bank, National Association depositors and will have full access to all of their deposits.

The government had no intention of allowing anyone to take over the assets of the First Republic. JPMorgan Chase was one of the institutions invited to bid, and came out as the big winner…

JPMorgan is getting about $92 billion in deposits in the deal, which includes the $30 billion it invested alongside other big banks in First Republic last month. The bank will also take on $173 billion in loans and $30 billion in securities. The Federal Deposit Insurance Corporation has agreed to absorb most of the mortgage and commercial loan losses JPMorgan is receiving and has given it a $50 billion line of credit.

In addition to providing JPMorgan Chase with a $50 billion credit facility, the FDIC will incur a loss of approximately $13 billion. So he's definitely one of the big losers of this deal…

The FDIC estimates the cost to the Deposit Insurance Fund to be approximately $13 billion. This is an estimate and the final cost will be determined when the FDIC ends receivership. It goes without saying that the biggest losers of all are the First Republic shareholders, all of whom have been delisted. Likewise holders of subordinated bonds, 4.65% yielding stuff issued in 2017, were wiped out. Is 4.65% a real risk premium?

We are only a third of the way to 2023. What will happen in the next few months?

And as Charlie Munger recently observed, many of our banks are absolutely overflowing with poor quality loans right now, and the US housing market appears to be in trouble.

Charlie Munger believes the US commercial real estate market is in trouble. We know that above all CRE, commercial credits, are in great difficulty. Meanwhile, the KRE ETF, which comes to represent the US regional banking sector, has lost 39% in six months, and continues to fall. Now the question should be: what's next. For example Comerica has lost 47% in the last 6 months and recently had to ask for a loan of three billion.

Therefore Comerica has little liquidity, but cannot turn to the market to recapitalize itself. The perfect situation to go into crisis.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article In 2023 the banking crisis destroyed more assets than in 2008. Which bank will be next to blow up? comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/quale-sara-la-prossima-banca-usa-a-fallite/ on Thu, 04 May 2023 06:00:47 +0000.