In Argentina, the scarcity of USD pushes the adoption of the Yuan

The suicide of the US dollar as an international trade currency also passes, if not above all, from the recent monetary tightening which has made its possession difficult and expensive, especially in countries with weaker economies, such as Argentina.

It has become so hard to find U.S. dollars in Argentina that Whirlpool, the American appliance giant, is considering paying in Chinese yuan to import the components it needs to run a new factory. And she is not alone in making these assessments .

Across the South American country, the dwindling availability of US dollars is leading companies to embrace a currency that has otherwise played a peripheral role in international trade. The trend highlights both Argentina's dire financial woes and China's ambitions vis-à-vis the yuan.

"The central bank has no dollars, so it needs the emergency aid that China is offering," said Marcelo Elizondo, a business economist in Buenos Aires. "For Argentina, the currency link with China represents an emergency, but for China it is a leverage point to exploit a geopolitical opportunity."

The supremacy of the dollar in global trade is being eroded by the fragmentation, especially in developing countries, caused by the rivalry between the United States and China. Russia's economic isolation following its invasion of Ukraine has also opened up non-dollar trade routes to avoid sanctions. Neighboring Brazil, for example, also intends to use more yuan, a policy decision by President Luiz Inacio Lula da Silva to seek alternatives to the dollar.

In Argentina, however, the yuan offers a quick and short-term solution to keep factory assembly lines going, while long-term planning is challenged by rising inflation and zigzagging politics.

China recently allowed Argentina to use more than half of an $18 billion currency swap line to shore up trade between the two nations. The two nations have shared a bilateral swap agreement since 2009, designed as a kind of insurance policy to bolster foreign reserves during liquidity crises.

"The only option left is to access the yuan from the Chinese swap line," said Maria Castiglioni, director of Buenos Aires-based consulting firm C&T Asesores.

More than 500 Argentine companies have asked to pay for imports in yuan, including electronics, auto parts and textile makers, as well as oil and mining firms, according to the country's customs agency. Obviously, the yuan goes, preferably, to pay for supplies from Chinese companies, increasing Beijing's exports and the economic ties between the two countries.

According to the central bank, officials also authorized the payment of imports in Chinese currency amounting to $2.9 billion. In the first 10 days of June, transactions in yuan on the Argentine foreign exchange market totaled approximately $285 million, double the figure for all of May.

In addition, the share of yuan transactions in Argentina's foreign exchange market recently hit a daily record of 28%, up from 5% last month, according to data from Mercado Abierto Electrónico, one of the country's major stock exchanges.

Whirlpool, the Michigan-based appliance maker, is among Argentine companies considering using the yuan instead of the dollar. The company invested $52 million in its factory outside Buenos Aires last year to make washing machines and other products.

Now that imports are struggling due to the tightening dollar and after shortages briefly put production on hold in recent months, the company is considering paying some inputs in yuan to ensure a steady supply of parts. basic electronics.

“We have had to stop the factory at times and this is not good for business, productivity or quality,” said Juan Carlos Puente, president of Whirlpool Latin America, adding that the company plans to export about 70% of its production in Argentina. "We are working to understand how to exploit this new flow route to be able to continue to import materials," he said, acknowledging that changing currency "is not easy."

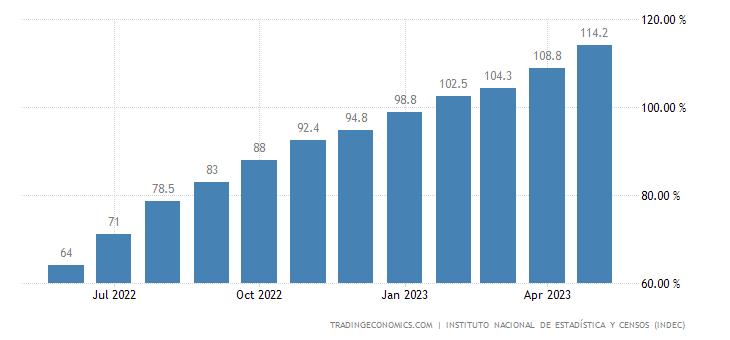

If it goes ahead with the plan, Whirlpool will join the ranks of Argentine firms like Mirgor and Newsan, which paid for $630 million in imports between May and August using yuan, according to Argentina's customs agency. More firms are lining up for the yuan as the central bank forces firms to find dollar financing abroad before waiting months to tap into the local foreign exchange market. Meanwhile, inflation reigns supreme, with a rate of 114% in May

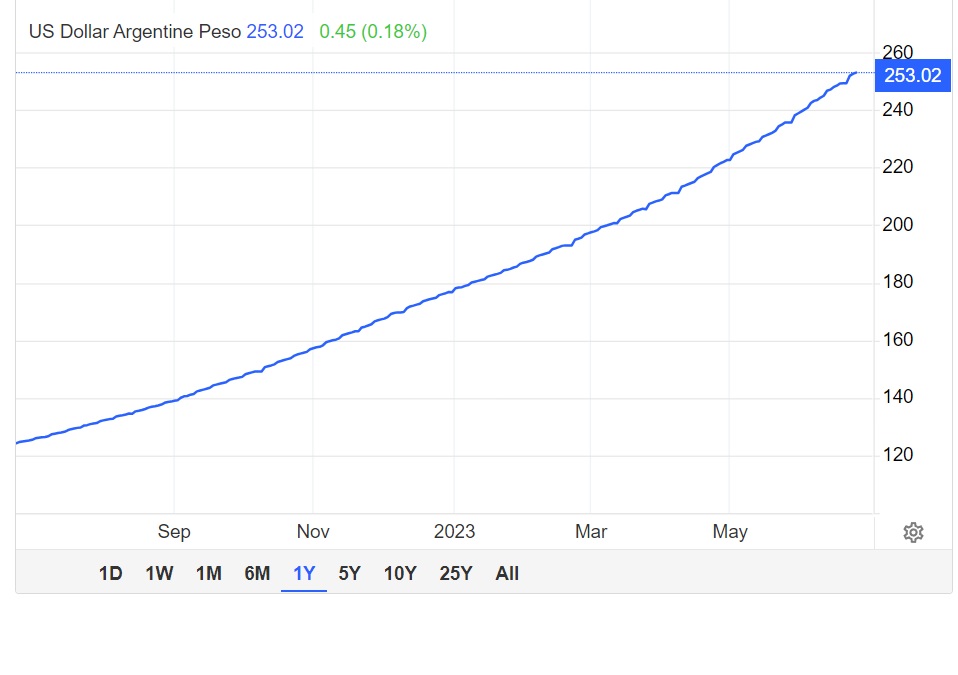

And the Argentine Peso depreciated powerfully compared to the USD in one year, going from 120 ARS per Dollar to 260..

China has promoted the yuan as an alternative to the dollar among other measures to broaden its role in the global financial system, including the gradual opening of China's financial markets and the exit of the authorities from regular currency interventions.

Over the years, the People's Bank of China has signed currency swap agreements with some 40 countries and has steadily expanded its cross-border yuan payments network, known as CIPS.

Argentina's rush to pay the bills in yuan comes as government officials negotiate with the International Monetary Fund to get more cash upfront from the country's $44 billion aid program. Argentina is failing to meet any of the IMF's key targets after a record drought destroyed an estimated $20 billion worth of agricultural exports, exacerbating the dollar shortage. So for a while there won't be any funding in Dollars, and the Yuan will dominate.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article In Argentina the scarcity of USD pushes the adoption of the Yuan comes from Scenari Economics .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/in-argentina-la-scarsita-di-usd-spinge-alladozione-dello-yuan/ on Sat, 24 Jun 2023 07:00:24 +0000.