Inflation down in Italy and the Eurozone. Whose credit is it?

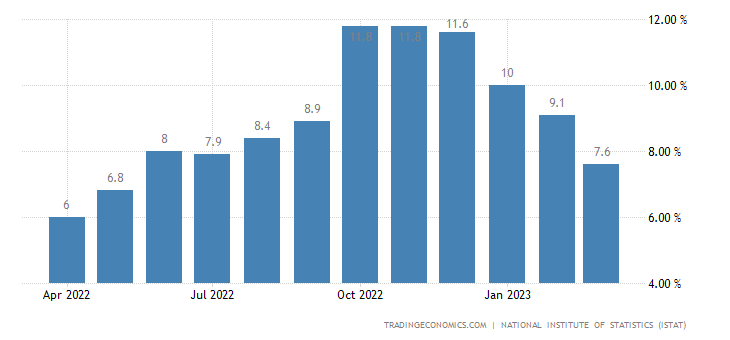

Inflation finally seems to be coming down both in Italy and in the Eurozone, but whose credit is it? Let's start from Italy. Italy's annual inflation rate fell to 7.6% in March 2023 from 9.1% the previous month, the lowest since May 2022, and revised downwards from the preliminary estimate of 7.7%. The sharp deceleration was largely due to falling energy prices, as the base year now includes the initial economic impact of the Russian invasion of Ukraine. Inflation slowed down for unregulated energy (18.9% against 40.8% in February), while deflation increased for regulated energy (-20.3% against -16.4%). On the other hand, the CPI continued to accelerate for Unprocessed Food (9.1% vs 8.7%), Housing Services (3.5% vs 3.3%) and Recreation and Cultural Services (6 .3% vs 6.1%). The annual core inflation rate, which excludes energy and unprocessed food, remained unchanged at a record high of 6.3%. Month-on-month, consumer prices fell 0.4%, revised upwards from a 0.3% drop, for the first monthly drop in 11 months. Here is the related graph:

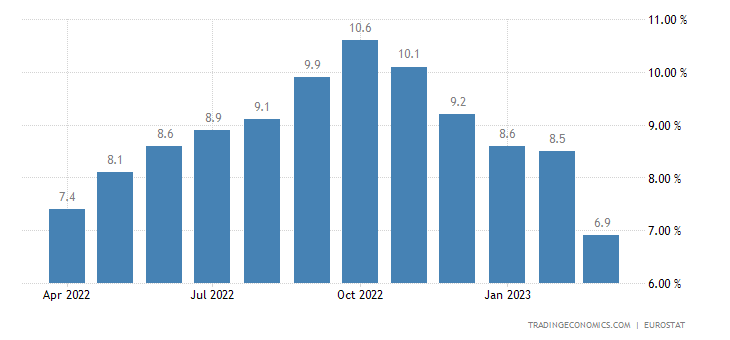

And let's move on to the Eurozone: the consumer price inflation rate in the Eurozone fell to 6.9% year-on-year in March 2023, the lowest level since February 2022 and slightly below 7.1% expected by the market, according to a preliminary estimate. However, the reading remained well above the European Central Bank's target of 2.0% and the core index, which excludes volatile items such as food and energy, hit a new record of 5.7%, putting pressure on policy makers for further rate hikes. The cost of energy decreased for the first time in two years (-0.9% against 13.7% in February), while the prices of non-energy industrial goods increased at a slower pace (6.6% against 6.8%). Conversely, inflation accelerated both for food, alcohol and tobacco (15.4% against 15.0%) and for services (5.0% against 4.8%). On a month-on-month basis, consumer prices rose 0.9% in March, following a 0.8% gain in February. Here is the related graph:

Whose credit is the drop in inflation? Of the ECB? No, the credit goes to the drop in energy prices, which in turn is linked to the drop in the use of energy itself (gas and electricity) by Italian and European companies. It is clear by reading the decline in industrial activity in Italy: it was energy-intensive productions such as the paper and chemical sectors that collapsed. Prices have risen so much that they have crushed demand . And the ECB rates? Those have hit other sectors, like real estate and construction, and we'll soon see the effects on the credit system, much more so than we've seen before.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Inflation down in Italy and the Eurozone. Whose credit is it? comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/inflazione-in-calo-in-italia-e-euro-zona-di-chi-e-il-merito/ on Tue, 18 Apr 2023 09:00:58 +0000.