Inflation: in the end it also arrived in Japan: what will the Bank of Japan do?

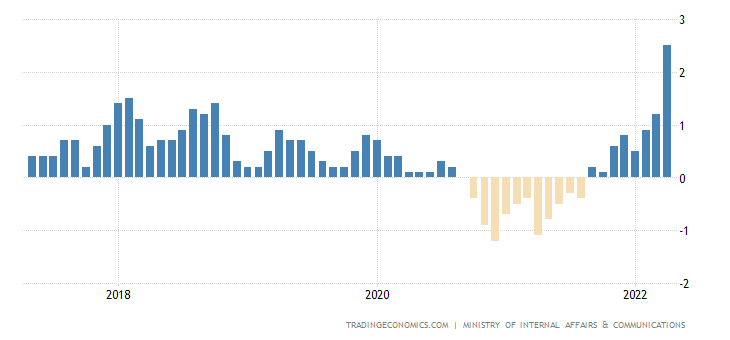

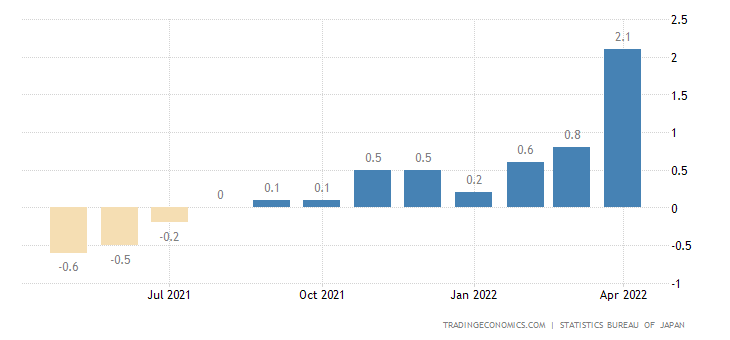

Eventually, inflation also spread to Japan, where it hadn't been seen for some years . Consumer prices in Japan rose 2.5% yoy in April 2022, the highest since October 2014, following a 1.2% rise a month earlier. The latest figure also marked the eighth consecutive month of annual inflation, with food prices rising at the fastest pace in 7 years (4% versus 3.4% in March). Further upward pressures also came from the cost of fuel, electricity and water (15.7% versus 16.4%), clothing and footwear (0.8% versus 0.7%), culture and leisure (1.3% against 1.3%), housing (0.4% against 0.3%). %), mobile (2.3% vs 0.4%), education (0.9% vs 1.4%) and various (1.2% vs 1%). At the same time, the cost of transportation fell 0.2%, much less than the 7% decline in March. Meanwhile, the prices of medical care have further decreased (-0.7% vs -0.4%). Core consumer prices rose 2.1% yoy, the eighth consecutive month of increases and the highest since March 2015, in line with forecasts and beating the BoJ's 2% target for the first time in seven years. On a monthly basis, consumer prices increased by 0.4% in April, at the same pace as the previous two months.

Japan's leading consumer price index, which excludes fresh food but includes fuel costs, as opposed to other countries, jumped 2.1% in April 2022 from the previous year. hitting its high in more than seven years and surpassing the Bank of Japan's 2% target, led by a weak yen and rising costs of energy and other commodities. Core inflation also rose for eight consecutive months and accelerated from a 0.8% rise in March.

Japan's leading consumer price index, which excludes fresh food but includes fuel costs, as opposed to other countries, jumped 2.1% in April 2022 from the previous year. hitting its high in more than seven years and surpassing the Bank of Japan's 2% target, led by a weak yen and rising costs of energy and other commodities. Core inflation also rose for eight consecutive months and accelerated from a 0.8% rise in March.

This indicator is important because it is the one followed by the Bank of Japan to guide monetary policy. Again the BoJ swept away inflationary pressures and said they are only "transitional" issues.

"There is no need to tighten monetary policy in response to a transient trend, as opposed to a sustained one," BoJ chief Haruhiko Kuroda told a nervous parliament in April.

The yen has devalued all year (except for a rebound in recent days), hence some of those inflationary pressures, as the yen's exchange rate slump against the dollar causes imported commodities and commodities , including food and energy raw materials, much more expensive.

The yen plummeted against the dollar as the BoJ refuses to change its negative benchmark rate and yield curve control, even as the Fed is now grappling with inflation and US yields have risen. Given the BoJ's recklessness, the yen paid the price and the BoJ thus helped import inflation.

However, the BOJ had to do something about this devaluation and rising inflation, and it was doing it by slowing down government bond purchases. But then he had to take them back, and also in a massive way

The BOJ had to resume purchases under its “Interest Rate Control Policy”, which cannot exceed 0.25%. However, this makes it even more difficult to defend the Yen, and the devaluation of the Yen could import even more inflation.

A big problem for the BOJ.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Inflation: in the end it also arrived in Japan: what will the Bank of Japan do? comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/inflazione-alla-fine-e-arrivata-anche-in-giappone-che-fara-la-bank-of-japan/ on Sat, 21 May 2022 07:00:04 +0000.