Inflation: signals from Germany and France will make the economic situation more dramatic

The inflation signals coming from Germany and France will have negative conditions on the European economy that are much more dramatic than their slight adjustment.

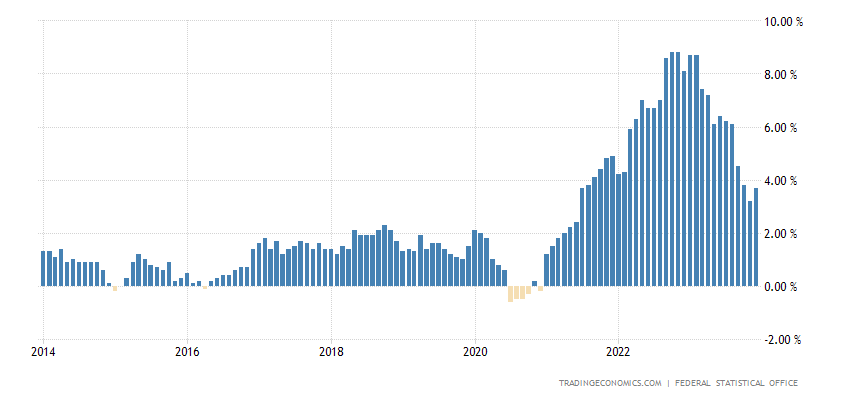

Let's start with Germany : Consumer price inflation in Germany rose to 3.7% year-on-year in December 2023, up from the previous month's more than two-year low of 3.2% and aligning with the market consensus, according to a preliminary estimate.

The upward pressure came from a 4.1% surge in energy prices (compared to -4.5% in November), driven by base effects related to the so-called “December emergency aid” . Under this program, the federal government covered monthly household gas and heating deductions in December 2022, which did not happen in December 2023, leading to this increase linked not to the market, but to fiscal policies of the government.

Meanwhile, food inflation slowed further to 4.5% (compared to 5.5% in November) and the growth rate of services prices reduced to 3.2% (compared to 3.4% in November). November). Core inflation, which excludes volatile items such as food and energy, fell to 3.5%, hitting its lowest point since July 2022, so wage dynamics are collapsing. On a monthly basis, consumer prices rose 0.1% after falling 0.4% in November. For all of 2023, the average inflation rate reached 5.9%.

Here is the relevant graph:

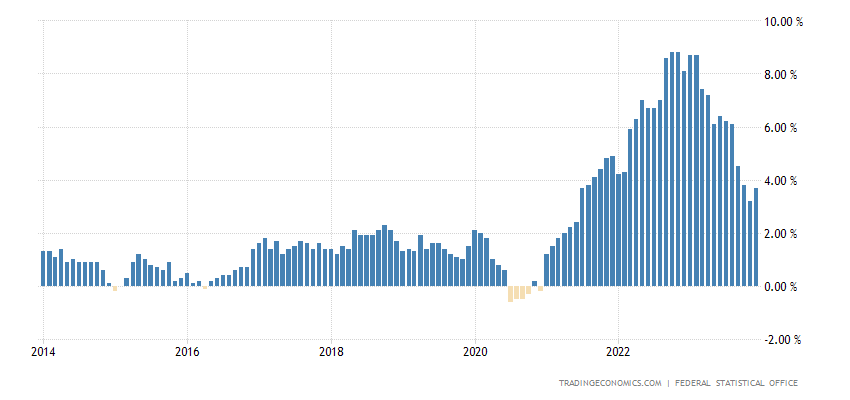

Now for France: consumer price inflation in France rose to 3.7% year-on-year in December 2023 from 3.5% in the previous month, exactly like Germany and slightly below expectations of the market by 3.8%, according to a preliminary estimate.

This surge in inflation is mainly due to the increase in energy prices (5.6% against 3.1% in November ) and services (3.1% against 2.8%). By contrast, prices for manufacturing products increased at a slower pace (1.4% vs 1.9%), while inflation remained stable for tobacco (9.8%).

Meanwhile, food inflation continued to decline, hitting a 17-month low of 7.1% (up from 7.7%). On a monthly basis, consumer prices rose 0.1%, reversing the 0.2% decline seen in November. Additionally, the harmonized CPI increased 4.1% year-on-year, compared to 3.9% in the previous month.

Here is the French graph:

The consequences of these slight inflationary adjustments will be serious because they will push the arguments of the ECB hawks, who are against drops in rates, even if it is clear that:

- the causes of inflation are either external, energy, or linked to the end of one-off fiscal policies;

- there is no wage dynamic, indeed manufacturing prices are falling, indicating a less than brilliant economy.

You will hear the German, Austrian and Dutch hawks who will still call for toughness on interest rates and this will lead to a further worsening of the European economic trend.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article Inflation: the signals from Germany and France will make the economic situation more dramatic comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/inflazione-i-segnali-da-germania-e-francia-renderanno-la-situazione-economica-piu-drammatica/ on Thu, 04 Jan 2024 14:48:11 +0000.