Investments in ESG funds are down. Obviously something is wrong

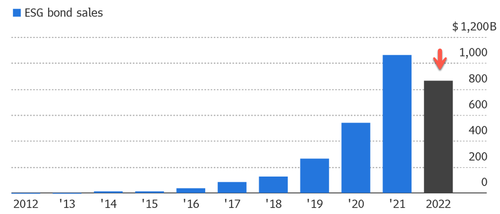

Global sell-offs of environmental, social and governance (ESG) corporate bonds fell for the first time in history as soaring interest rates, market turmoil and economic uncertainty drove investors away investors from this type of market.

Corporations and governments around the world raised $863 billion in ESG bonds in 2022, down 19% from the previous year's record $1.1 trillion, according to data from Bloomberg . This is the first drop in ESG bonds since green bonds hit Wall Street in 2007.

Total issuance is down, largely due to soaring borrowing costs among central banks as they race to tame the highest inflation in a generation. Bloomberg provides more information on the fall of ESG funds:

Social bond issuance fell 34% to about $141 billion last year, the largest drop among all issuers, as government agencies and companies reduced spending on eligible projects. Big borrowers, including states, have moved towards long-term climate goals, after the rush to raise funds for pandemic relief drives up social emissions.

Sales of sustainability bonds, the proceeds of which can be used for both social and green projects, fell 22% to $154 billion, the second largest decline. By country, the UK and the US saw the largest declines, by 52% and 39% respectively. The most scrutinized segment of the environmental, social and governance-related debt market – sustainability-linked bonds – fell 21% to $86 billion.

Green bonds, on the other hand, posted the smallest year-on-year decline, falling 11% to around $480 billion, supported by a surge in selling from China. BNP Paribas SA, the largest underwriter of green bonds in 2022, expects green debt sales to return to 2021 levels this year, mainly driven by Europe and China. According to a BNP outlook report released in November, the biggest boost will come from China, thanks to supportive local policies and the recent local taxonomy alignment.

In addition to rising funding costs, many issuers may have strengthened their balance sheets early last year, before rates rose. In addition, securities regulators from Europe to the US have increasingly focused on the ESG space to avoid scams and misleading information from issuers or asset managers who package “green” funds.

Deutsche Bank AG and its wealth management arm, DWS Group, were one such group to come under fire from regulators for going overboard with green investing in ESG products. DWS recently said it will deemphasize sales of ESG products to wealthy clients.

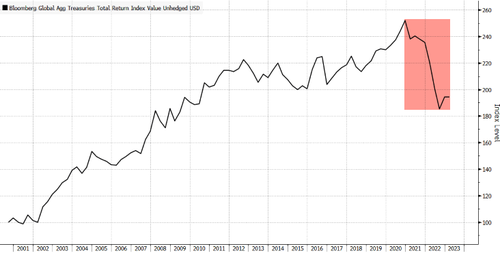

All of this is happening while global bond markets have been in a slump for more than a year.

The only thing that can lead to a recovery in the sale of ESG funds is an intervention by Central Banks with a relaxation of rates, but, at least for the next few months, this option is out of the question.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Investments in ESG funds are down. Evidently something is wrong comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/calano-gli-investimenti-nei-fondi-esg-evidentemente-qualcosa-non-va/ on Sun, 08 Jan 2023 17:28:04 +0000.