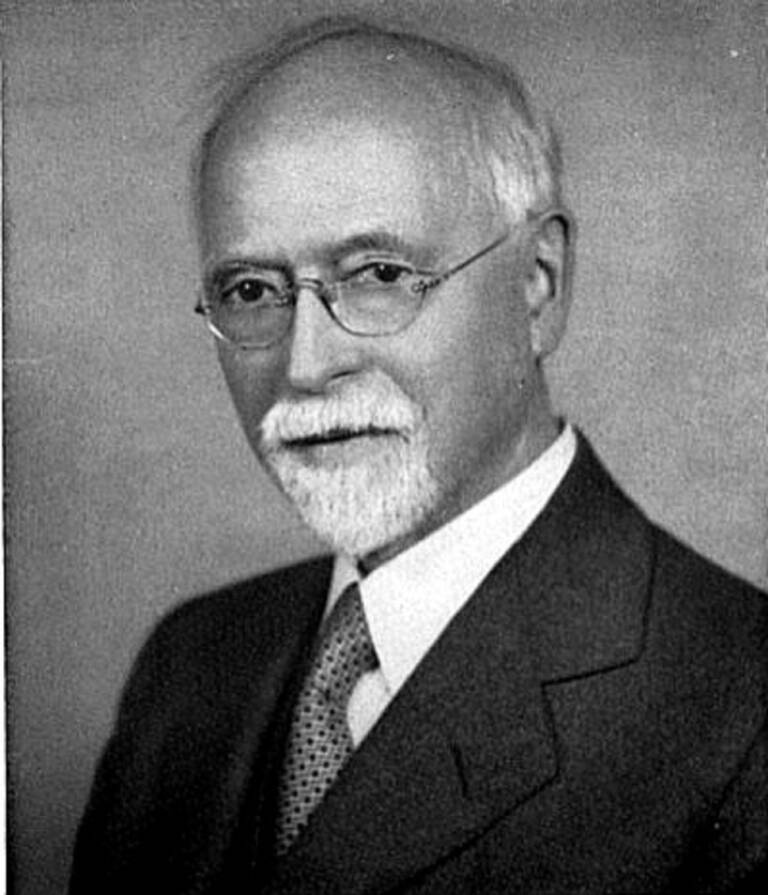

Irving Fisher: The great economist who screwed up with an economic forecast

Irving Fisher is the example of even a good economist, who dares to make forecasts on real markets, ruining his own fame. Yet he is considered, above all by monetarists, one of the founding fathers of the study of the American economy, praised by both Tobin and Freidman.

Irving Fisher was born on February 27, 1867 in Saugerties, New York, USA. From a young age he showed a marked intelligence and a passion for studies. He graduated from Yale University in 1888, where he studied mathematics and economic theory. His dissertation, titled “Mathematical Investigations in the Theory of Value and Prices,” immediately underlines his unique approach to economics, based on the rigorous application of mathematics to economic issues.

Fisher quickly became a prominent figure in academia. In 1892 he was appointed professor of political economy at Yale University, where he would teach for most of his career. His influence began to grow, and in 1918 he became the first president of the American Economic Association.

But Fisher's best-known contribution to economics was probably his theory of inflation, the so-called "Quantity Theory of Money," which we'll tell you about shortly. . In 1911, he published “The Purchasing Power of Money,” a book that introduced the “Fisher Equation”; considered the basis of monetarist theory.

Just days before the Wall Street stock crash, he claimed that "stocks have risen to a new permanent plateau." We will also talk about this later.

Throughout his career, Fisher also developed the concept of the "consumer price index" (CPI), an important measure of inflation still used today to assess changes in the prices of goods and services over time. The CPI is a crucial tool for financial analysts like you, as it provides a clear overview of inflation trends, which in turn can have a significant impact on investment decisions.

Personally, Irving Fisher also faced significant challenges. In his youth he was ill with tuberculosis, like his father and for three years he had to be treated in a sanatorium. He was an extreme health fan, against smoking, alcohol, and he was also in favor of prohibition, and not eating meat. Son of his era, he was in favor of extreme surgical and medical practices in an attempt to cure his schizophrenic wife. In short, he was a pain in the ass who trusted doctors. He lived to be 80 years old, eleven less than Winston Churchill who drank, smoked and ate meat…

The quantity theory of money, inflation and the real yield

Fisher's theory of capital and interest is based on two fundamental principles: the principle of impatience and the principle of expediency. The impatience principle states that people would rather consume today than tomorrow unless there is an incentive to postpone consumption. This incentive is the interest rate, which represents the premium people receive for lending their money or the cost they have to pay to borrow the money. Interest is the price of time.

The principle of expediency states that people allocate their capital among different possible uses based on the expected return of each. The expected return depends on the interest rate and the risk associated with each investment.

According to Fisher, capital is the sum of present assets that can produce a future stream of income. Capital can be divided into two categories: consumer goods and capital goods. Consumer goods are those that directly satisfy people's needs or wants, such as food, clothing, entertainment, etc. Capital goods are those used to produce other goods, such as machines, factories, land, etc. Fisher argues that the value of capital depends on the present value of the future income it generates. Present value is the present value of a future sum discounted at the interest rate.

Fisher also introduced the concept of the real interest rate, which is the inflation-adjusted nominal interest rate. Inflation is the percentage change in the general price level over time. The real interest rate measures the actual gain or loss in purchasing power of money lent or borrowed. Fisher formulated the following relationship between the nominal interest rate (i), the real interest rate (r), and the inflation rate (p):

i = r + p

This formula is known as the Fisher equation and underpins the analysis of monetary policy.

Fisher's theory of capital and interest has had a great impact on economic science and economic practice. Fisher provided a rationale for the behavior of economic agents and helped clarify the role of money, inflation and credit in the economy. Fisher also anticipated some of the ideas of modern macroeconomics, such as the consumption function, liquidity preference, and long-run money neutrality.

Another fundamental equation for understanding Fisher's thought, contained in his "The purchasing Power of Money" is the following

MV = PQ

The equation M V = P Q is a simple but powerful expression of the relationship between the quantity of money in circulation (M), its velocity of circulation (V), the general price level (P) and the quantity of goods and services traded in the economy (Q).

First, let's look at the left side of the equation: M*V. This represents the total monetary value of transactions in the economy. M represents the amount of money in circulation, i.e. the liquidity available at any given time. V represents the rate at which this money changes hands through transactions. For example, if people spend money faster, V will be high. Conversely, if they keep the money in bank accounts and don't spend it, V will be low.

Now, let's move to the right side of the equation: P*Q. Here, P represents the general price level, i.e. how much a representative "basket" of goods and services costs in the economy. Q represents the quantity of goods and services produced and traded in the economy.

The quantity theory of money holds that the equation must be in equilibrium. In other words, the value of the transactions (M V) must equal the value of the goods and services exchanged (P Q). This implies that there must be a proportional relationship between the quantity of money in circulation and the general level of prices and the quantity of goods and services produced.

One of the most important implications of this theory is that an increase in the quantity of money in circulation (M) should, in theory, lead to an increase in prices (P), provided that the velocity of money circulation (V) and the production of goods and services (Q) remain constant. This is known as the monetary effect, which suggests that inflation is mainly caused by an excess of money over the supply of goods and services in the economy.

The problem is that, empirically, this equation has not always occurred, or the importance of the value V, the speed of circulation of the currency, has simply always been underestimated. If the issued currency is not spent, but is hoarded or destroyed in speculative bubbles, then there will be no effect on the PQ side, i.e. on the price.

To give a practical example, the years of European QE, the one following Draghi's "Whatever it takes", saw a boom in the quantity of money, but an unresponsive inflation value. The excess money has simply been hoarded, causing V to collapse, or has ended up in purely financial speculation with minimal spillover into the economy, practically disappearing.

Irving Fisher acknowledged that his equation was crude, but that hasn't stopped many economists from screaming infaction every time the money stock has increased. .

Fisher's Misfortune: The Crisis of 1929

When the summer of 1929 drew to a close, the famous economist d expressed himself in the pages of the New York Times about Wall Street, the market was experiencing a certain nervousness which, in any case, did not portend an imminent crisis. Stock prices had risen throughout the year; investors had speculated with borrowed money, assuming the good times would continue. This was the all-time bull market and those who had gambled wanted to be reassured that their money was safe.

Fisher gave them an alibi to continue their speculation, confidently predicting: "Stock markets have reached what appears to be a permanent high." That day was less than two months away from the Wall Street Crash of October 1929. It was the worst stock market downturn in history.

The crisis erupted on Thursday 24 October, when the market fell by 11%. Black Thursday was followed by a 13% drop on Black Monday and a further 12% drop on Black Tuesday. By early November Fisher was bankrupt and the stock market was in a downward spiral that would only bottom out in June 1932 when companies listed on the New York Stock Exchange had lost 90% of their value and the world had completely changed .

The Great Crash was followed by the Great Depression, the biggest setback to the global economy since the dawn of the modern industrial age in the mid-18th century. Within three years of Fisher's ill-advised prediction, a quarter of America's working population was unemployed and desperate. As the economist JK Galbraith put it: "Some people were hungry in 1930 and 1931 and 1932. Others were tortured by the fear that they might go hungry."

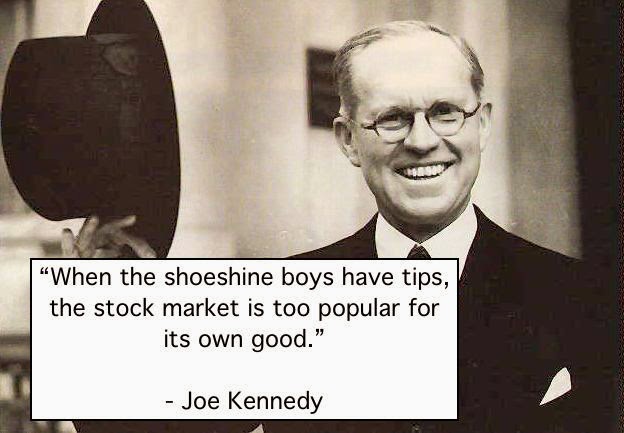

Yet someone had understood that the market could not grow forever, Joseph Kennedy, the father of the future president John F. Kennedy (and grandfather of the current candidate Robert F. Kennedy Junior ..) gave up his entire portfolio and kept liquid before the collapse, to then return in the following months, on assets whose value had collapsed, realizing a profit of 10 times the invested capital.

By the way, a famous phrase is attributed to him:

“When your shoe shiner has stock tips, then the stock market is too popular to do.”

Irving Fisher was personally affected by it and his fame was severely tarnished.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Irving Fisher: the great economist who went broke with an economic forecast comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/irving-fisher-il-grande-economista-che-si-rovino-con-una-previsione-economica/ on Sun, 03 Sep 2023 12:52:17 +0000.