Is a new financial bubble about to burst in the US?

Is a new financial bubble about to burst in the US? This is what more and more financial analysts are asking, prompted by numerous factors that are maturing in the American market.

The American financial market is experiencing a period of peak prices and this is driving investors to growing greed, because as we explain very well in the book of Economics Explained Easy EXTRA, the closer you get to the bursting of a bubble and the greater the profits which can be achieved. Real estate is following the same fate.

In fact, the more the markets tend to grow, the more the prices of sectors of the real economy also increase. One of the main ones is precisely the real estate sector, because very often the assets lent to guarantee new loans are real estate.

How is the financial bubble in the US being created?

If I ask for loans that I will use to invest in the stock market or for any other financial or economic activity, including the purchase of new properties, offering properties I already own as collateral , when the stock market grows, the assets underlying the loan will also be positively affected by the market trend. Ditto obviously if I have reinvested in real estate or other investment assets.

Given that with the credit received I will have created greater demand, the prices of that market (including those of the properties that I had placed as collateral) will increase accordingly.

In America this is causing houses, offices and buildings to increase in value so quickly that very often the owners prefer to keep them vacant, since their value from week to week invites them to ask for ever higher rents or to resell them at a higher price than the one paid to buy them.

It thus happens that if the owner expects that the maximum value he can obtain from his properties has not yet been reached, he will tend to wait for the peak point before putting it to good use.

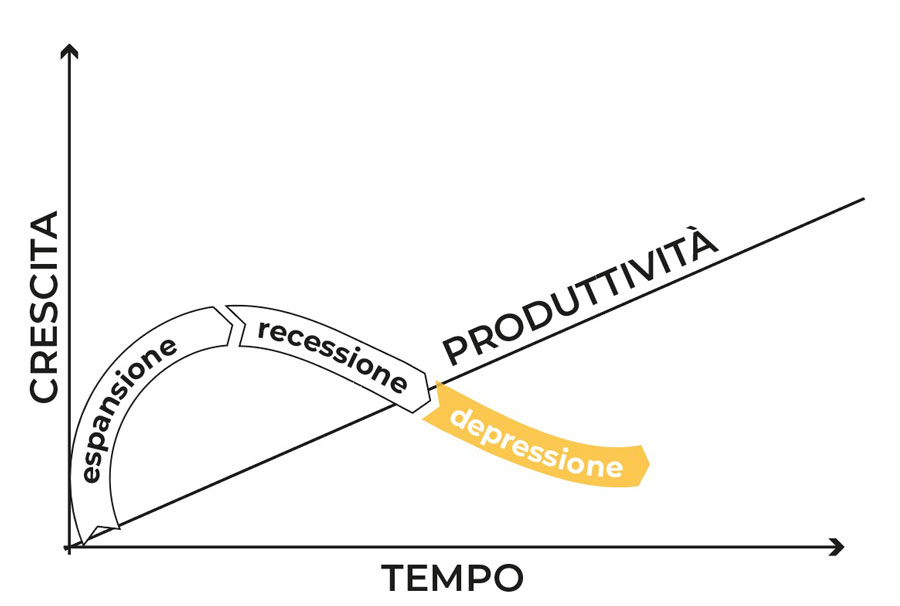

The economic cycle and its peak and valley points, from the book Easy Explained Economy EXTRA

The increasing value of real estate makes it possible for owners to obtain more and more loans, as the value of the collateral increases.

That's why loans and growth markets feed on themselves: the higher the value of the collateral, the more money I can borrow.

Higher collateral value = higher credit and vice versa.

As we explained in the chapter on economic cycles, when the value of stock exchange shares, as well as those of real estate, deviate excessively from the real fundamentals of each, it means that we are in the midst of creating a bubble.

Even more so when a market is growing strongly, increasingly greedy investors expect that there will always be someone greedier (or stupid) than them who will buy tomorrow at an even higher price. No one believes he can be the first to have the bubble burst in his face…

In the chapter dedicated to economic cycles, we focused precisely on the psychological aspects that characterize investors during the most acute phases of the cycle. This aspect is crucial if we want to be able to understand how a financial bubble is generated.

BUY THE NEW EDITION

(LAST PIECES AVAILABLE)

BUY IT NOW

BUY IT NOW

The problem of inflation

Everything is fine until inflation limits prices, which we know erodes the purchasing power and market value of everything it encounters.

Without going back again to the causes that led to the current inflation; find all the explanations in this article on inflation , it is sufficient here to understand what mechanisms it triggers at a financial level.

When central banks started raising rates, with the declared aim of fighting inflation, the cost of borrowing increased. As a result, credit started to slow down, so the market went into a crisis.

Why did it go into crisis? Well, it's very simple: because with less credit available, purchases have decreased. So at that point the most "stupid" found themselves with the match in hand.

Not only that but, more simply, given that central banks have reversed the gear that facilitated credit, now the effects are also reversed.

Obviously , if the properties cease to be in demand , because the decline in credit does not allow them to be purchased, they begin to lose value.

If the collateral loses value, then everything starts to wobble a bit, right? In fact, uncertainty begins to enter the markets and fear takes over.

After the markets pushed to invest throughout 2021, investors believed that growth could continue, despite the anomalies caused by the pandemic and the energy crisis that would sooner or later lead to credit containment levers. Just like the rate hike.

TAKE ADVANTAGE OF THE MEGA CHRISTMAS DISCOUNTS TO MAKE A USEFUL AND INTELLIGENT GIFT

TAKE ADVANTAGE OF THE MEGA CHRISTMAS DISCOUNTS TO MAKE A USEFUL AND INTELLIGENT GIFT

How does a financial bubble burst?

The first to pay the price of depreciation were cryptocurrencies, but now the turn of other collateral has come.

In all the devaluations affecting them range from -15% to -70%, depending on when they were purchased during the rise of the bubble. The most important fact is that part of these assets, acting as loan guarantees, risk causing the markets to implode. In fact, now the values of the collateral are realigning themselves to their real value, which is much lower than that generated by the bubble. That's where the panic comes from. Panic that usually, in these cases, can lead to depreciation even below the real value of the assets themselves.

This is what happens during a recession which, in particular cases, well described by the book of Economy Explained Easy EXTRA, can contribute to lead us into a depression.

business cycles, the depression – book of economics explained easy EXTRA

This happens when greed is replaced by fear thus reversing the growth cycle of the previous period. However, it is not only institutional investors who are overwhelmed, who almost always find a parachute, as happened in 2007 when the FED saved the markets by printing money out of thin air in support of them. Small domestic investors also end up in it, who are often real financial illiterates . That's what it's for studying economics on texts available to everyone: not to end up screwed in this way.

What contained the spread of the financial crisis and inflation in the United States was the strong dollar. In this the Ukrainian crisis and the resulting geopolitical changes have played a fundamental role, as we well know.

But the overall recovery of 11% of the euro against the dollar , recorded in the last two months, seems to be able to outline a new change of course and this, for all that we have said, could pave the way for the exuberance that the markets have recorded in the previous long period.

Crises in the world's largest economy are never a good omen for everyone else; starting with the European one condemned to pay for many years to come for the wrong strategic choices vis-à-vis Russia. Our main supplier of energy and relative economic tranquility.

THE ECONOMY EXPLAINED EASY – EXTRA

(LAST PIECES AVAILABLE)

BUY IT NOW

BUY IT NOW

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Is a new financial bubble about to burst in the US? comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/sta-per-scoppiare-una-nuova-bolla-finanziaria-negli-usa/ on Wed, 21 Dec 2022 11:07:59 +0000.