Is the US Entering Stagflation?

Today the data on US GDP growth and the trend of the PCE price index came out, and they did not go particularly well, in fact they give some worrying signals.

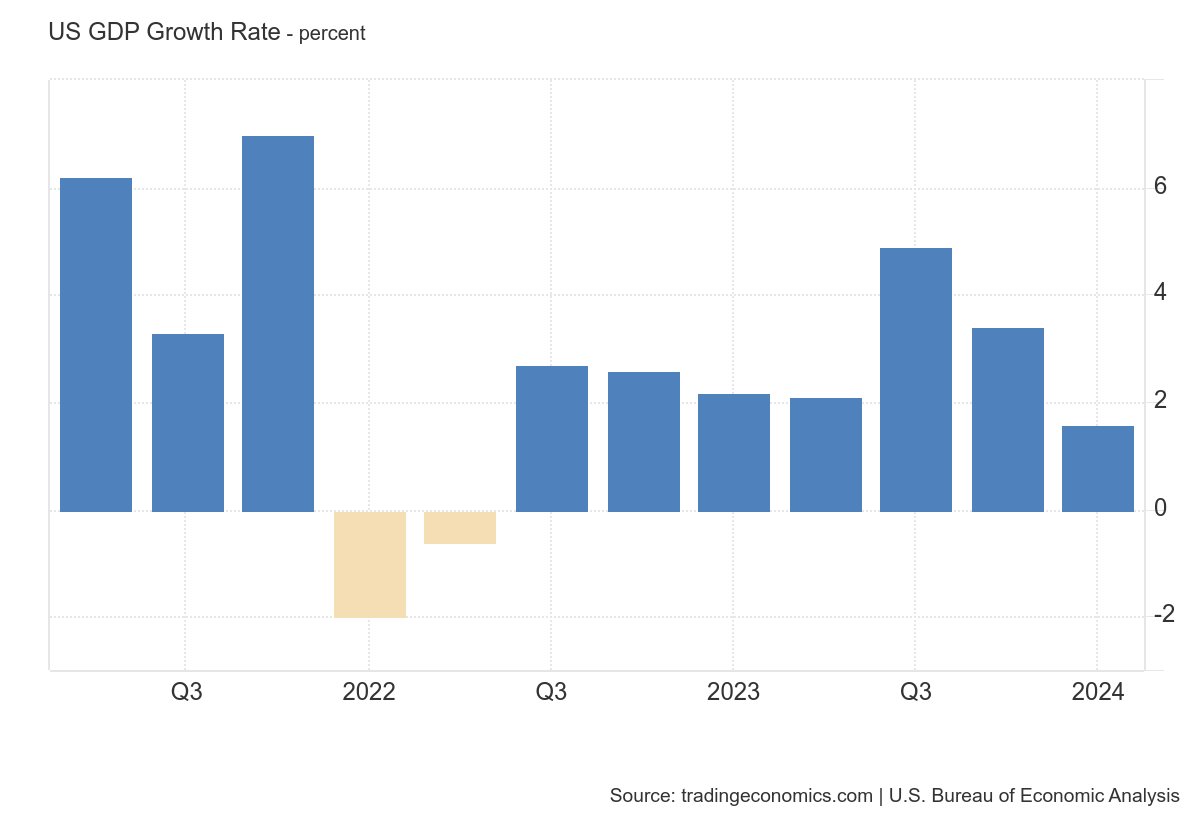

Let's start with GDP : The U.S. economy expanded an annualized 1.6% in the first quarter of 2024, up from 3.4% in the previous quarter and below forecasts of 2.5%. Far below, a very bad signal.

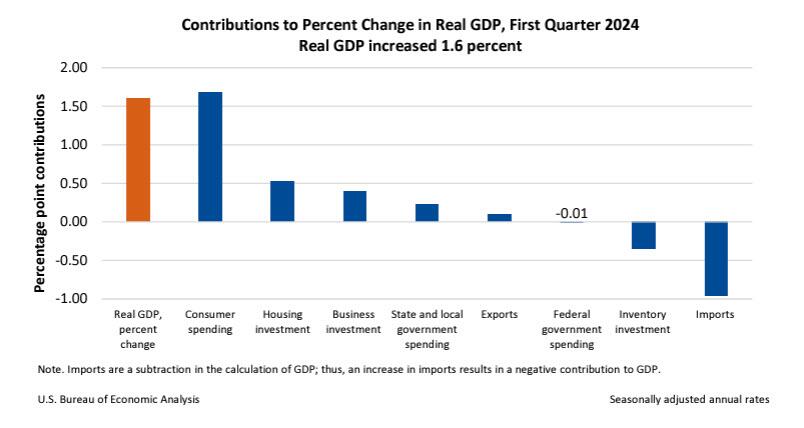

This is the lowest growth since the contraction in the first half of 2022, according to the advance estimate. There was a slowdown in consumption spending (2.5% vs 3.3%), mainly due to a drop in the consumption of goods (-0.4% vs 3%), while spending on services was increased more rapidly (4% vs 3.4%).

Non-residential investments also decreased (2.9% vs. 3.7%), due to structures (-0.1% vs. 10.9%), while investments in equipment rebounded (2.1% vs. – 1.1%) and those in intellectual property products (5.4% vs 4.3%) accelerated.

Looking further, public spending increased much less (1.2% vs 4.6%), and exports slowed sharply (0.9% vs 5.1%) while imports surged (7, 2% vs 2.2%). Meanwhile, private stocks subtracted 0.35 pp from growth (vs -0.47 pp). On the other hand, residential investment jumped at a double-digit pace (13.9% vs 2.8%).

Here is a graph of GDP

Growth was therefore mainly driven by internal consumption, while the public spending component was negative, and the trade balance was also negative.

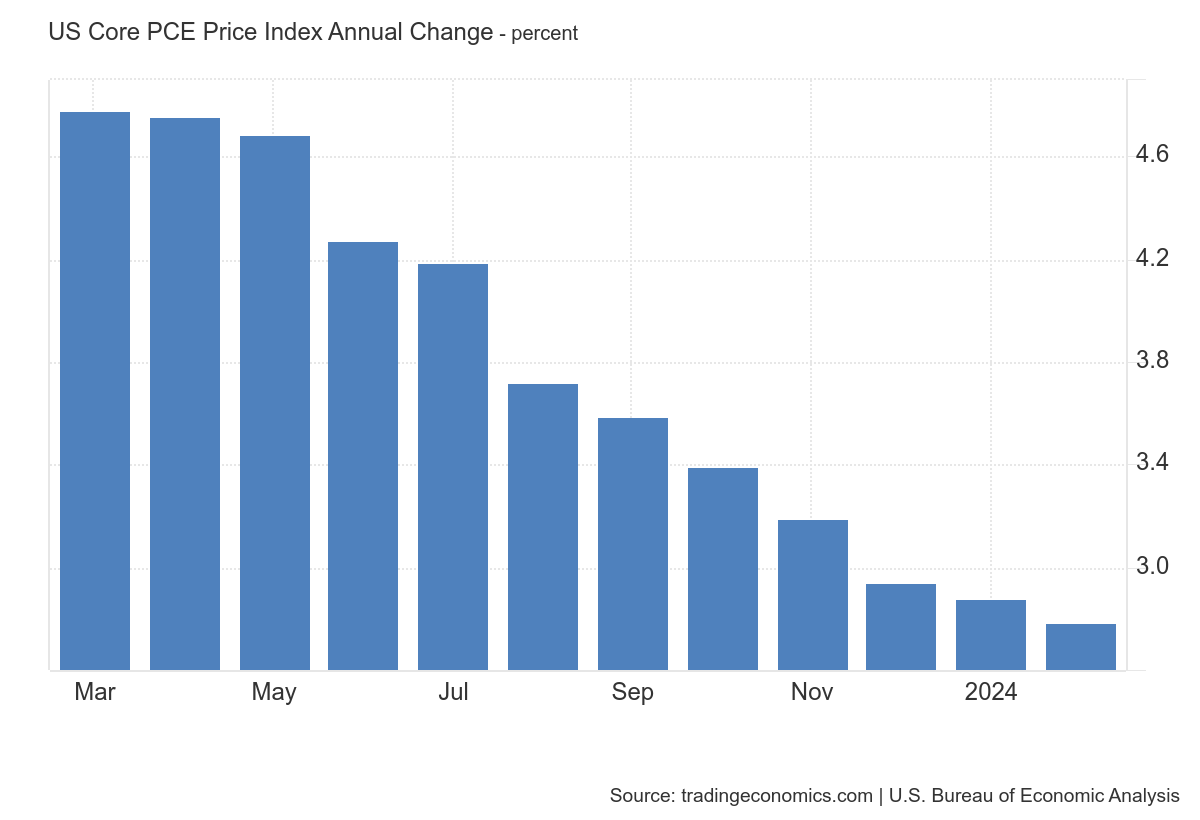

At the same time, however, there are some data that are not exactly exciting from the point of view of the PCE Index, the index of personal expenses, which is taken into strong consideration by the Fed in defining its monetary policy and interest rates.

This indicator has been declining, but the decline is very slow in the core component, excluding energy and fresh food products.

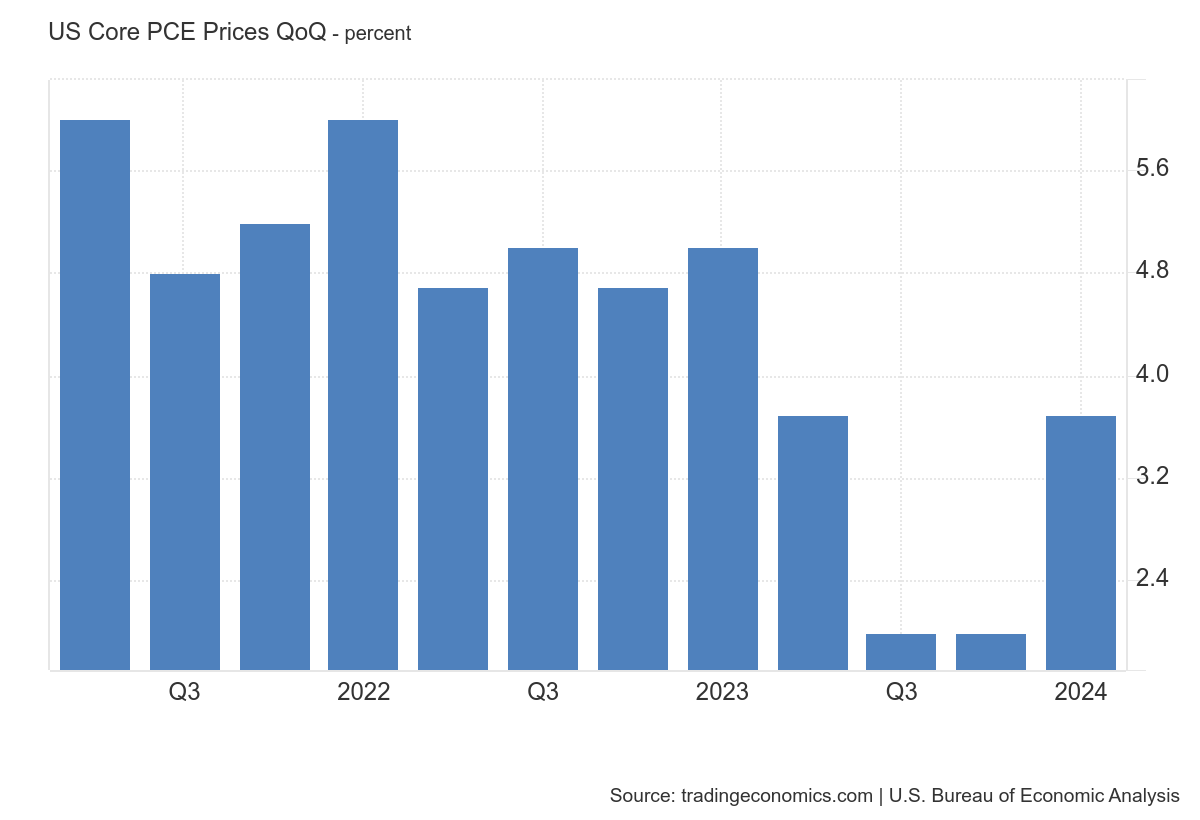

If we evaluate the data quarter on quarter we even have a rebound in the PCE core

The risk is that on the one hand the Fed does not deem the inflationary decline sufficient to lower rates, on the other that the present increase in prices cuts disposable income, compressing growth and therefore consumption. Given that inflation is very high on services, much more than on goods, the result will be a progressive compression of consumption themselves.

The potential risk is that of going into stagflation with high inflation and low growth, especially if the growth in demand for labor does not increase, causing incomes to rise. But this must happen, and soon

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article Is the US Entering Stagflation? comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/gli-usa-stanno-entrando-in-stagflazione/ on Fri, 26 Apr 2024 05:15:38 +0000.