Italy and the Eurozone: inflation remains high. How come Japan….

Inflation revived slightly in April, both in Italy and in the Eurozone, confirming that interest rate policy alone does not help to overcome the inflationary problem.

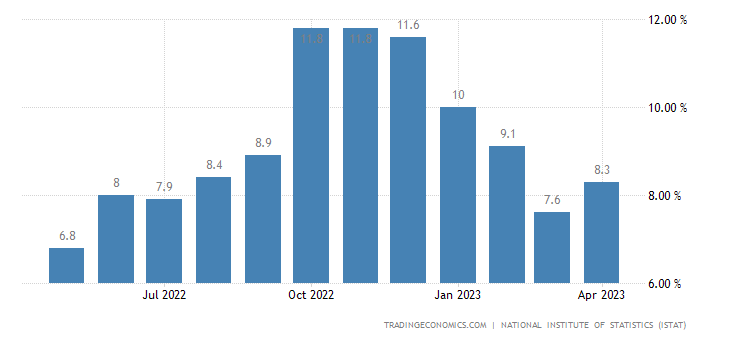

Italy's annual inflation rate rose to 8.3% in April 2023 , recovering a one-year low of 7.6% hit in the previous month, and slightly above expectations as prices they grew at a faster pace for unregulated energy (26.7% against 18.9% in March). On the other hand, prices fell further for regulated energy (-26.4% against -20.3%). In addition, inflation decreased for cultural and recreational services (6.7% vs 6.3%), other miscellaneous services (2.9% vs 2.5%), processed food (14.7% vs 15, 3%), unprocessed foods (8.4% vs 9.1%) and housing services (3.2% vs 3.2%). Meanwhile, the annual core inflation rate, which excludes energy and unprocessed food, remained unchanged at a record high of 6.3%, confirming that the inflation momentum is external. . On a monthly basis, consumer prices increased by 0.5%, erasing the 0.4% decline seen in March.

The situation is no different in the Eurozone. The euro area consumer price inflation rate increased slightly to 7.0% in April 2023, from a 13-month low of 6.9% in March, according to a preliminary estimate. The rate remained significantly above the European Central Bank's target of 2.0%, and although the core index fell to 5.6%, it remained close to the previous month's all-time high of 5.7%. This suggests that the bloc's central bank is likely to continue its efforts to fight inflation. Energy prices rebounded by 2.5% (versus -0.9% in March) and the cost of services increased faster by 5.2% (versus 5.1% in March). On the other hand, inflation slowed for food, alcohol and tobacco products (13.6% against 15.5%) and for non-energy industrial goods (6.2% against 6.6%). Month-on-month, consumer prices rose 0.7%, the third consecutive month of increases.

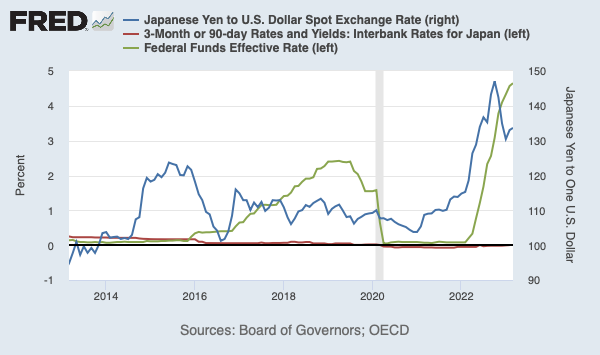

The inflationary dynamics can be easily explained by the increase in energy prices, especially oil, which took place during the month of April. Wages have not grown further, as can be seen from the "Core" infaction, in the strict Italian sense. Yet the only cure imagined in the euro area is monetary, with the increase in interest rates, a solution that has not caused a decisive containment of inflation, at least so far: how can the interest rate of the ECB limit global energy prices? On the contrary, this choice puts the banking system in difficulty, due to the devaluation of the assets, and the debtors, who have to disburse higher amounts on floating rate debts. Yet Japan, which hasn't raised rates, is holding inflation better even revaluing against the USD.

Amazing that no one thinks our treatment is wrong. Meanwhile, without wage dynamics, inflation impoverishes Italians and Europeans.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Italy and the Eurozone: inflation remains high. How come Japan…. comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/italia-e-eurozona-resta-alta-linflazione-come-mai-il-giappone/ on Tue, 02 May 2023 13:15:22 +0000.