Japan asks the US for help to defend the Yen. Imported inflation scares Tokyo

Photo by jun rong loo on Unsplash

The Japanese yen has been depreciating against the US dollar for more than a month. A continuous slide with now over 13 sessions in which the Japanese currency continues to slide.

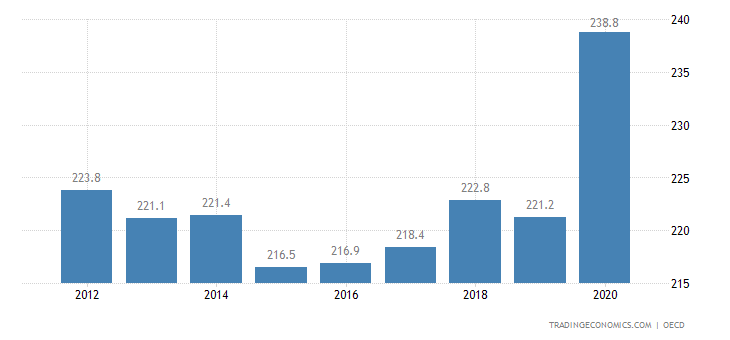

The problem for Tokyo is not, contrary to many say, the public debt, strictly in the hands of the Central Bank and expressed the Yen, but inflation: in fact, at present, Japan cannot try to strengthen the Yen by increasing rates, not so much for public debt, as for private sector debt which amounts to a high 238% of GDP

What to do then? Help Needed Among Friends: On Friday, Japanese broadcaster TBS reported that Japan and the United States are discussing the idea of coordinated currency intervention to stem further Yen declines during a bilateral meeting of financial leaders. According to Reuters , the request came after Japanese Finance Minister Shunichi Suzuki described the yen's recent declines as "abrupt" and said he agreed with US Treasury Secretary Janet Yellen on joint control of currency developments. :

" We have confirmed that the currency authorities of both countries will communicate closely, in line with the exchange rate principles agreed between G7 and G20 members ," Suzuki told reporters after meeting with Yellen in Washington DC. on the sidelines of the meetings of the International Monetary Fund.

Suzuki said he explained to Yellen that the yen's recent declines have been abrupt, but declined to comment on whether a coordinated joint intervention was in question. However, in a Washington report, TBS said Suzuki and Yellen discussed joint currency intervention during their talks.

" The US side seemed to take the idea positively ," TBS said, citing the government source.

That said, a new "Plaza Accord" is unlikely to be forthcoming. For those with little memory, the "Plaza Accord" was the agreement reached in 1985 between the USA, France, Germany, Japan and the United Kingdom for an agreed depreciation of the dollar. This is not possible, because there is no longer the Mark, the Euro is, frankly, a huge chaos. Furthermore, the US has no interest at this time in devaluing, because it must try to reduce its inflation.

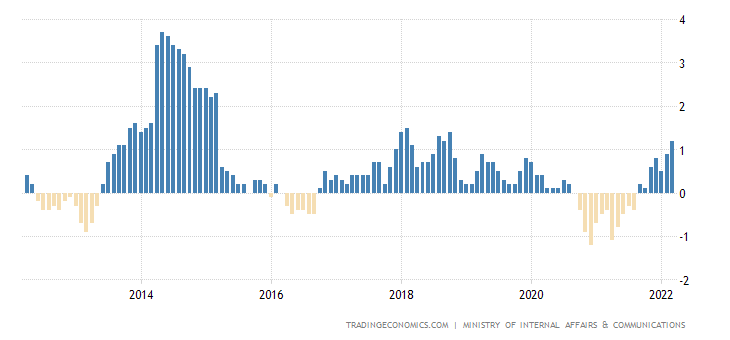

Currently, however, the Japanese devaluation panic seems a bit excessive, also because the inflationary situation appears to be under control.

It seems incredible that, afterlooking for inflation in recent years, Japan is now terrified to have found it, but the current inflation is "Bad", from rising commodity prices, not internal growth. at the same time, the PMI manufacturing forecast remains positive, and in February the contribution of industry to Japanese GDP was positive. The devaluation, combined with the rebalancing of international logistic chains, could even favor Tokyo, leading to the transfer of some productions from China, threatened by lockdowns and politics, to the more stable Japan. The problem is linked to the transition period and the instability linked to the stagflationary flare-up. The important thing is not to panic.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Japan asks for help from the US to defend the Yen. Imported inflation scares Tokyo comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/il-giappone-chiede-aiuto-agli-usa-per-difendere-lo-yen-linflazione-importata-spaventa-tokio/ on Sat, 23 Apr 2022 08:00:09 +0000.