JAPANESE YEN: A ROAD TO STRENGTHENING (despite the debt and deficit)

As the always excellent analyst Robin Brooks notes, the yen is strengthening against the dollar.

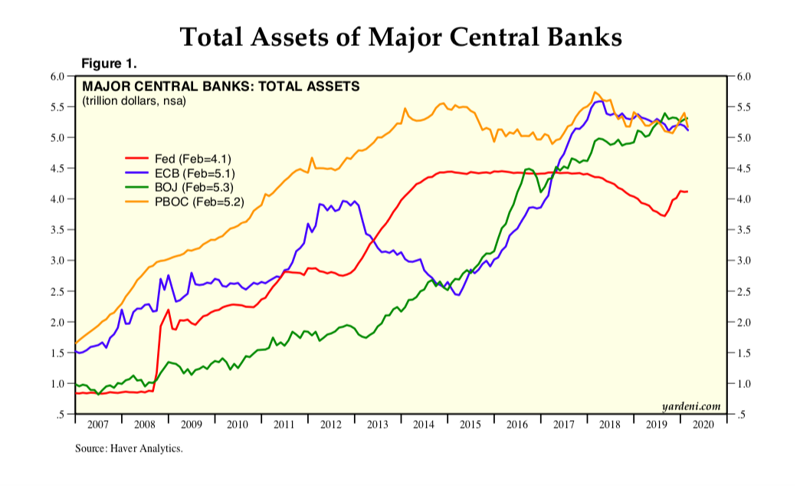

What happens ? Is the Bank Of Japan not trying to give enough monetary stimulus? It would not be said at all, given that Japan's anti-covid monetary stimulus was impressive in an absolute sense, similar to that of other central institutions:

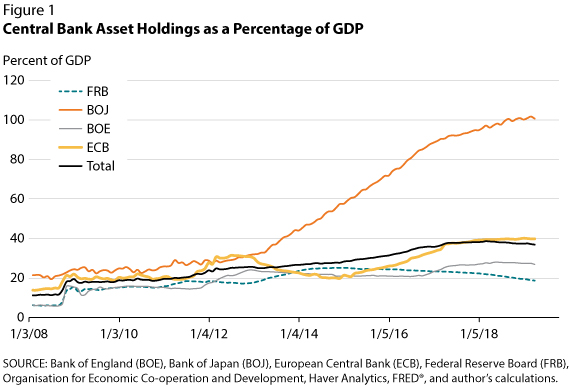

In terms of GDP, the growth of the BoJ's assets was even more impressive:

Surely the revaluation of the Yen against the dollar is therefore not due to a timid monetary policy, and the BoJ has done its duty as an expansion of the monetary base. The BoJ's surplus is now equal to the country's GDP.

Why then does the yen revalue? Politically, the new Prime Minister Yoshihide Suga continues in the line of his predecessor Abe and is an expression of the Liberal Democratic Party, a man of the Japanese political apparatus, and therefore the end of the "Abenomics" is not to be expected, but the reality the main problem derives the Bank of Japan's interest rate time curve control policy (YCC, Yield Curve Control)

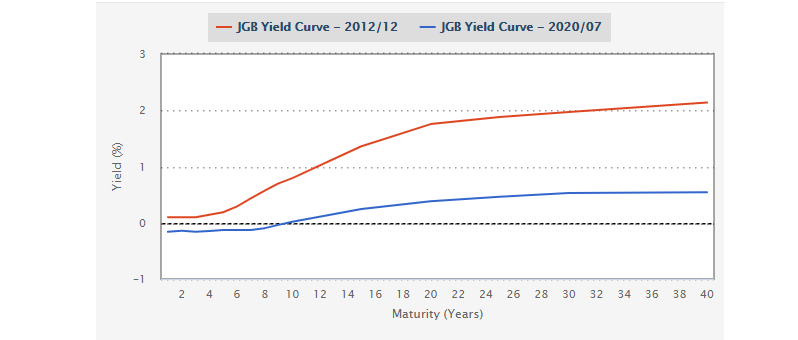

The BoJ has given a yield target of 0 for 10-year government bonds and -0.1% for shorter ones. These objectives want to avoid both positive rates, therefore difficulties in refinancing the public debt (Japan has no one who chokes it), and excessively negative rates and therefore such as to put the credit sector and mega banks into crisis. All this happens through a careful purchase of purchases on the basis of their maturity, obtaining that the time curve behaves exactly as the central bank wants.

this is an example of how the Japanese rate curve has evolved.

However, controlling the rate curve also has strong contraindications: in fact, if the target is forward rates, the central bank loses control of how many securities to buy over various maturities. This is what is happening now. in the face of the inflationary prospects of the Fed, the BOJ finds itself blocked by the policy of controlling the interest rate curve, it cannot follow the Fed and therefore cannot try to make the dollar follow the yen. The result is the revaluation of the Yen, even against the wishes of the BoJ and, above all, of the Japanese government which risks seeing exports affected.

Ultimately it is a matter of monetary policy priorities. You can also try to balance the various objectives to follow, but, sooner or later, if these become conflicting, you find yourself in the need to choose. In the coming weeks, also according to the result of the US elections, we will see if the BoJ will change its lines of action.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article JAPANESE YEN: A ROAD TO STRENGTHENING (despite the debt and the deficit) comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/yen-giapponese-una-strada-verso-il-rafforzamento-nonostante-il-debito-ed-il-deficit/ on Sat, 19 Sep 2020 11:52:29 +0000.