John Maynard Keynes: A Brief Guide to the Most Influential Economist of the 20th Century

Who was Keynes, often mentioned, apropos or inappropriately, in discussions of an economic nature? Without wanting to force you to read an economics book, we want to provide you with some basic information.

Who is John Maynard Keynes

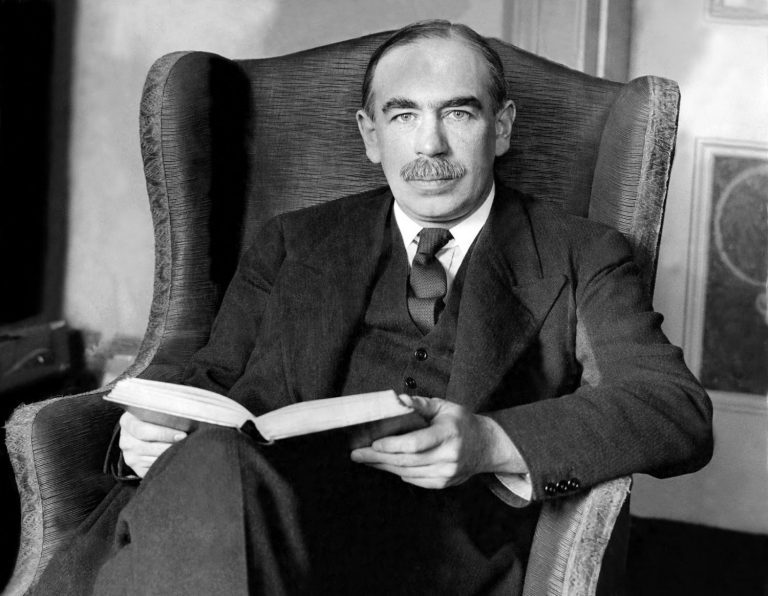

John Maynard Keynes (1883-1946) was one of the most influential economists and philosophers of the 20th century, known for developing Keynesian economic theory and for participating in the major international conferences of his time.

Keynes was born in Cambridge to an intellectual family. He studied mathematics at Eton and at King's College, Cambridge, where he came into contact with the philosophy of Alfred North Whitehead and Bertrand Russell . He also took an interest in politics, literature and art, and became a member of the Bloomsbury Group , a circle of artists and writers which included Virginia Woolf, Lytton Strachey and Duncan Grant, with whom Keynes had a homosexual relationship.

During World War I , Keynes worked as an official in the British Treasury and was sent to the Versailles peace conference in 1919. Here he opposed the harsh conditions imposed on Germany, which he believed were unjust and harmful to the stability of Europe. He wrote a critical book on the treaty, entitled The Economic Consequences of the Peace, which was very successful and made him famous.

In the 1920s, Keynes devoted himself to academic, financial and cultural activity. He was a professor of economics at Cambridge, director of the Bank of England, editor of the Economic Journal and patron of various artists and writers. In 1925 he married Lydia Lopokova, a Russian dancer with the Ballets Russes, with whom he had a happy marriage. Keynes was bisexual and had been in several same-sex relationships prior to marriage.

In 1936 he published his most famous work, The General Theory of Employment, Interest and Money , in which he elaborated a new economic theory based on the importance of aggregate demand and the role of the state in intervening in the economy to ensure full employment and price stability.

Despite the alleged homosexual experiences in his youth, Keynes happily marries. John Maynard Keynes' wife was Lydia Lopokova, a very talented Russian ballet dancer. They met in 1918 and married in 1925. Lydia was best known for her work with Serge Diaghilev's Ballets Russes and had a successful career in the dance world. Though they came from very different worlds, their marriage was passionate and loving.

Lydia supported Keynes in his academic and business pursuits, and often helped him relax with her lively spirit and passion for art. Their relationship was characterized by deep affection and mutual respect, contributing to the personal and professional lives of both. Lydia Lopokova became an important figure in the intellectual circle of the time and left a lasting imprint on history alongside the well-known economist.

During World War II, Keynes resumed his role as an adviser to the Treasury and negotiated loans with the United States to finance the British war effort. Furthermore, he participated in the Bretton Woods conference in 1944, where he proposed an international monetary system based on a universal currency called the bancor. However, his project was rejected in favor of the US dollar-based one.

Keynes died in 1946 at Tilton, his country house in Sussex, of a heart attack. He was buried in the churchyard of St Peter's in Firle. His intellectual legacy is still today the subject of study and debate among economists and philosophers.

John Maynard Keynes and his role during, and after, the Great War

Keynes dropped out of Cambridge University to work at the Treasury in 1915. He worked every day to support the war effort during the First World War. This annoyed the pacifist members of the Bloomsbury Group of which Keynes was a member. Lytton Strachey, a member of the group and a close friend of his, sent him a letter in 1916 questioning him as to why he still worked at the Treasury. Keynes almost immediately gained a reputation as one of the most able and able men in the Treasury and for this he was sent to the Versailles conference as adviser to the British Government 1

Keynes objected to the harsh conditions imposed on Germany, which he believed were unjust and harmful to the stability of Europe. He wrote a critical book on the treaty, entitled The Economic Consequences of the Peace, which was very successful and made him famous. In the book, Keynes argued that war reparations from Germany were unsustainable and would lead to poverty, unemployment, inflation, political and social instability, and possibly another war. Instead, Keynes proposed a peace based on economic cooperation, on the cancellation of war debts, on the reduction of trade barriers, on the creation of a European Union and a common currency 3 .

Keynes resigned from the Treasury in June 1919, in protest against the treaty. He wrote a letter to Lloyd George, the British prime minister, in which he expressed his disappointment and concern: ' Here I can no longer do any good. Even in these anguished last few weeks, I have continued to hope that you will find a way to make the treaty a just and convenient document. But now it's too late, evidently. The battle is lost .' He was trogically right, as Hitler's rise to power taught.

Keynes returned to Cambridge, where he resumed his academic and financial activities. He continued to write essays and articles in which he criticized the Treaty of Versailles and proposed alternative solutions for the reconstruction of Europe. He was also involved in various humanitarian and cultural initiatives to help the countries affected by the war, especially Austria and Germany 5 .

Keynes was one of the first to foresee the negative consequences of the Treaty of Versailles and to propose a different vision of the international order based on cooperation and not on competition. His ideas were largely ignored or rejected by the governments of the day, but influenced many later intellectuals and politicians. His book The Economic Consequences of Peace is considered a masterpiece of economic and political literature of the 20th century

Keynes and the Great Crisis of 1929

Keynes thought that the great crisis of 1929 was caused by a fall in aggregate demand, i.e. the sum of consumer spending, investment spending, government spending and net export spending. This fall was due to various factors, including financial speculation, industrial overproduction, trade protectionism, price and wage rigidity, households' propensity to save and investors' preference for liquidity. Keynes believed that in a crisis situation, the market was unable to reach equilibrium on its own, due to the lack of incentives to consume and invest. In this case, it was necessary for the state to intervene with an expansionary fiscal policy, in which it increased public spending and/or reduced taxes, to stimulate aggregate demand and create jobs. This effect was magnified by the so-called Keynesian multiplier, which stated that an increase in government spending generated a larger increase in income and spending in the economy.

Keynes acted to be able to minimize its consequences both in theory and in practice. On a theoretical level, he wrote numerous essays and articles in which he criticized liberal economic theories and proposed his alternative ideas. On a practical level, he came into contact with US President Franklin D. Roosevelt, who had initiated the New Deal, a program of economic and social reforms based on state intervention in the economy. Keynes appreciated the New Deal and studied it as an example of applying his theory. Keynes was also involved in various humanitarian and cultural initiatives to help crisis-hit countries, especially Austria and Germany.

Keynes also played a major role in the United Kingdom's abandonment of the Gold Standard in 1931 . The Gold Standard was an international monetary system based on the value of gold, requiring countries to maintain a fixed parity between their currencies and gold. Keynes believed that the gold standard was an obstacle to economic recovery because it limited the ability of countries to expand the money supply and adjust exchange rates to economic conditions. Keynes argued that the United Kingdom should abandon the Gold Standard and let the pound float freely, in order to follow an expansionary monetary policy and favor exports. Keynes influenced public opinion and politicians with his writings and lectures, and contributed to the British government's eventual decision to withdraw from the Gold Standard.

Here is a speech, circulated in the newsreels of the time, in which Keynes defended the exit from the gold standard.

The choice to abandon the gold standard for an expansive policy saved British industry and made it ready for the test of the Second World War.

Keynes' economic theory

Keynes' contribution to economic theory is based on the belief that the private sector does not always produce the most efficient results for the economy as a whole, and that therefore a certain degree of government intervention is needed to influence aggregate demand, in particularly in times of crisis or recession.

Keynes introduces the concept of aggregate demand . Aggregate demand is the sum of consumer spending, investment spending, government spending, and net export spending. Aggregate demand determines the level of output and employment in the economy.

- If aggregate demand is less than the productive capacity of the economy, underemployment and deflation arise.

- If aggregate demand exceeds the productive capacity of the economy, overemployment and inflation result.

Keynesian theory argues that in a situation of underemployment, the market is not able to reach equilibrium on its own, due to the rigidity of prices and wages, the propensity to save of households and the preference for liquidity of investors. In this case, it is necessary for the State to intervene with an expansionary fiscal policy, in which it increases public spending and/or reduces taxes, to stimulate aggregate demand and create jobs. This effect is magnified by the so-called Keynesian multiplier, which states that an increase in government spending generates a larger increase in income and spending in the economy.

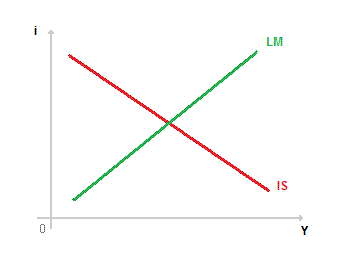

The Keynesian theory connects with the IS-LM model, which is a way to graphically represent the general macroeconomic equilibrium in a closed economy, ie without foreign trade. The IS-LM model consists of two curves: the IS (Investment-Saving) curve and the LM (Liquidity preference-Money supply) curve.

The IS curve shows the inverse relationship between the interest rate and output in the goods market, where aggregate demand equals aggregate supply. The IS curve shifts to the right when one of the components of aggregate demand (consumption, investment, government spending, or net exports) increases.

The LM curve shows the positive relationship between the interest rate and output in the money market, where the demand for money equals the money supply. The LM curve shifts to the right as the money supply increases or liquidity preference decreases.

The intersection between the two curves indicates the level of production and the interest rate which ensure simultaneous equilibrium in the two markets. The IS-LM model makes it possible to analyze the effects of fiscal and monetary policies on the economy.

According to the IS-LM model, an expansionary fiscal policy (increase in public spending or reduce taxes) causes a rightward shift of the IS curve and an increase in the level of output and the interest rate. This effect can be partially or fully compensated by a restrictive monetary policy (reduction of the money supply or increase in liquidity preference), which causes a leftward shift of the LM curve and a reduction in the level of output and the interest rate .

Conversely, an expansionary monetary policy (increase in the money supply or decrease in liquidity preference) causes a rightward shift of the LM curve and an increase in the level of output and a decrease in the interest rate. This effect can be partially or totally offset by a restrictive fiscal policy (reduction of public expenditure or increase in taxes), which causes a leftward shift of the IS curve and a reduction in the level of production and an increase in the interest rate.

Keynes and the Second World War

Keynes resumed his role as an adviser to the Treasury during World War II and was involved in various financial and monetary matters. In particular, he negotiated with the United States the loans needed to finance the British war effort, which were conditional on the United Kingdom giving up the Gold Standard and accepting the dollar as an international reserve currency. Keynes objected to these terms, which he believed were unfavorable to Britain and Europe, but had to accept them in order to obtain the funds.

Keynes also attended the Bretton Woods conference in 1944, where the creation of a new international monetary system after the war was discussed. Keynes proposed a system based on a universal currency called the bancor, which would be issued by an international institution called the Clearing Union. The bancor would have had a fixed value in relation to gold and would have been used for commercial transactions between countries. The system would have required countries with trade surpluses or deficits to adjust their economic policies to achieve equilibrium. Keynes believed that his system was more fair and stable than the dollar-based one.

However, Keynes' project was rejected in favor of the American one, proposed by Harry Dexter White, which envisaged the creation of the International Monetary Fund (IMF) and the World Bank. The American system relied on the dollar as the international reserve currency, which was convertible into gold at a fixed rate. Other countries had to maintain fixed exchange rates against the dollar and could obtain loans from the IMF in case of difficulty. The American system favored the United States and countries with trade surpluses, while penalizing countries with trade deficits.

Keynes reluctantly agreed to the compromise and helped draft the final agreements. However, he was dissatisfied with the result and feared that the American system was unstable and unfair. Keynes died in 1946, before the system went into effect. His intellectual legacy is still today the subject of study and debate among economists and politicians.

Criticisms of Keynesian economics

Keynesian economics has received numerous criticisms from other schools of economic thought, which have questioned its effectiveness, coherence and sustainability. Among the main criticisms, we can mention the following:

- The monetarist critique: This critique was formulated by the Chicago School, whose main exponent was Milton Friedman . Monetarists argue that the recurring imbalances of the economic system have predominantly monetary causes, so that the most suitable instrument to guarantee stability is constituted by the maneuvers put in place by the central banks to regulate the quantity of means of payment in circulation (monetary policy). Monetary policy is also considered preferable to fiscal policy in terms of timeliness, as maneuvers on revenue and public expenditure are implemented through rather lengthy and complex legislative and administrative procedures.

- The critique of public choice: This critique was formulated by James M. Buchanan and his school of public choice. Supporters of public choice observe that in a representative democracy, political bodies must respond to the demands of their constituents and are generally reluctant to make fiscal policy choices that may appear unpopular or cause social tensions. Functional finance interventions are implemented easily (and sometimes lightly) when it comes to expanding public spending or lightening the pressure of taxes, while there are many hesitations in the face of the need for restrictive measures.

- The critique of the new classical macroeconomics: This critique was formulated by Robert Lucas and his school of the new classical macroeconomics. The new classics challenge the effectiveness of fiscal policy based on the concept of rational expectations, according to which economic agents are able to foresee the consequences of government actions and adjust their behavior accordingly. In particular, economic agents anticipate that a deficit-financed increase in government spending will have to be offset in the future by a tax increase or a reduction in spending. Therefore, they increase their savings to meet the future tax burden, canceling the multiplier effect of public spending. In reality, this criticism often overestimates the forecasting capacity of agents and their rationality.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article John Maynard Keynes: A Brief Guide to the Most Influential Economist of the 20th Century comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/john-maynard-keynes-una-breve-guida-alleconomista-piu-influente-del-xx-secolo/ on Sat, 26 Aug 2023 13:35:04 +0000.