JP Morgan: Ethereum 2.0 will send tens of billions into the crypto industry

JP Morgan has produced an interesting document regarding the future forecasts for the cryptocurrency sector, especially in light of the introduction of Staking in Ethereum, at a time when the public's eyes are still centered on Bitcoin.

Analysts Ken Worthingon and Samantha Trent analyzed the development of staking and the virtual currencies that rely on it. These professionals conclude that the pledging process behind staking, with the associated interest income, will become increasingly attractive as a source of income for both institutional and retail investors, and that once ethereum merges into ethereum 2.0, JPM estimates that staking, which is currently a $ 9 billion business for the crypto economy, "will grow to $ 20 billion following the Ethereum merger and could rise to $ 40 billion by 2025 if the proof-of -stake were to grow to the dominant protocol ”(at which point the duo expects Coinbase to get a $ 500 million st revenue execution rate).

Now the PoS is becoming even more popular as a “Green” response to the PoW, that is to the protocol that underlies the issuance of Bitcoin and which, being accused of being highly energy-intensive, is considered non-ecological. The PoS, on the other hand, ie Proof of Stake, is instead based on "Freezing" a part of crypto, leaving it as a pledge for mining, so it does not involve an increase in the use of energy. Staking is an essential part of maintaining the integrity of the cryptocurrency ecosystem for proof-of-stake tokens. To record cryptocurrency transactions, the blockchain must be updated and validated. Two protocols are used for this validation, proof-of-work (the current dominant blockchain validation protocol, used by Bitcoin and currently by Ethereum) and proof-of-stake (the emerging and fastest growing protocol that is the core staking). Both PoS and PoW protocols incentivize blockchain validation by issuing rewards (generally in kind), with Bitcoin miners rewarded in Bitcoin and Ethereum 2.0 rewarded in Ethereum 2.0, for example.

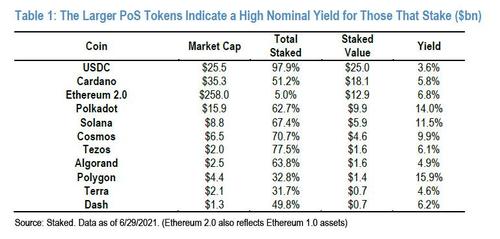

Below is a list of the major currencies that use PoS algorithms.

Staking in cryptocurrencies such as SOL or BNB lead to returns ranging from 4% up to 15.9% per year, according to staking data. Cryptocurrency exchange Winklevoss Gemini currently advertises investors the ability to earn annual returns of up to 7.4% while maintaining their stablecoin.

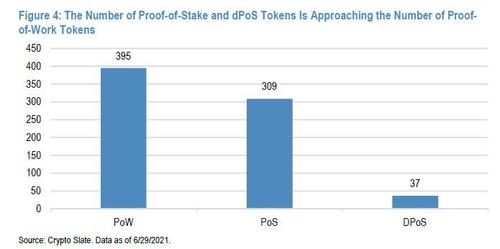

The report also states that as cryptocurrency volatility declines, the ability to achieve a positive real return will be an important factor in helping the market become more mainstream. That's why JPM predicts that the number of tokens using the proof-of-stake protocol will continue to grow faster than the number of tokens using the proof-of-work protocol. Here, the greater the number of PoS tokens, the greater the market capitalization associated with PoS, the greater the investment income opportunity for token holders in the staking process and for companies facilitating staking.

PoS are currently still a minority, but growing.

The JPM report states:

Individuals or institutions are incentivized to stake their cryptocurrencies to passively earn in the network. Nominal returns can be high from staking and depend on both token design and stake rates in staking pools. While not the main attraction for individual or corporate participants in crypto markets right now, in our view, the return earned through staking can mitigate the opportunity cost of owning cryptocurrencies compared to other investments in other asset classes such as US dollars. US Treasuries or money market funds in which investments generate a positive nominal return. Indeed, in the current zero-interest environment, we see returns as an incentive to invest.

Basically Staking cryptocurrencies are riskier, but much more profitable, so they can help build balanced portfolios when weighed with safe assets like government bonds. A clear invitation to diversification, also by investing in the Virtual Currency sector.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article JP Morgan: Ethereum 2.0 will send tens of billions to the crypto industry comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/jp-morgan-ethereum-2-0-mandera-decine-di-miliardi-nellindustria-cripto/ on Tue, 06 Jul 2021 14:37:06 +0000.