JPMorgan expects the “Short Squeeze” starting next month

We are approaching a new round of growth that will crush the bearish bets of many funds, and not just in the equity sector. This is the thinking of JPMorgan quantitative analyst Marko Kolanovic, who created a one-cycle but long-term model for commodities, starting with oil.

Let's assume that, at present, one of the least appreciated sectors by investors is precisely the energy sector. Although oil has returned to hovering around $ 60, as it did before the Covid-19 crisis, at the same time, most analysts expect this to be only a temporary rise, which will run out soon. According to Marko, however, it is only the beginning of a new course.

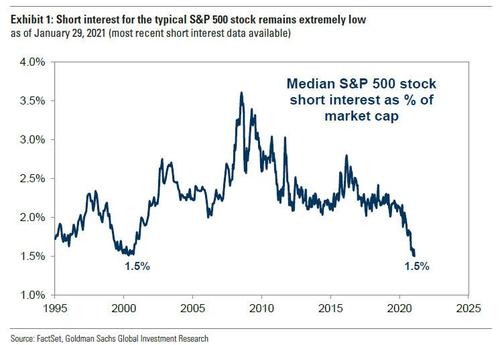

However, we premise that the arrival of small investors looking for short-lived and not very liquid assets to explode in value anyway, even with limited interventions. This resulted in a decline in risky short selling, as seen in the graph below:

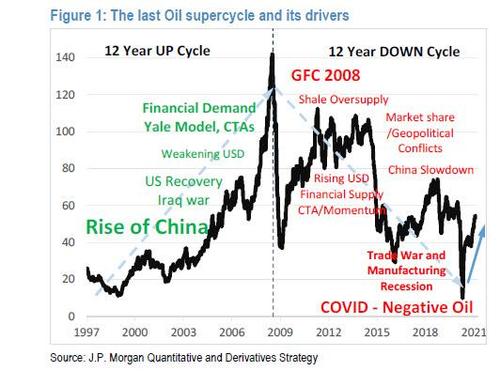

According to Marco, there is a 12 + 12 year cycle relating to oil that has reached its minimum turning point with the covid-19 crisis.

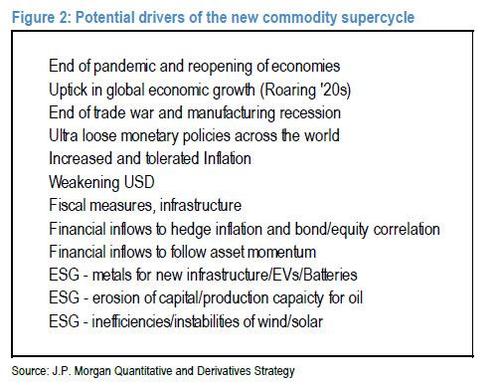

So the current rebound would not be an episodic element, but a part of a new cycle, lasting 24 years, which defines the energy and oil sector in particular. What will be the factors that will drive the growth of energy and oil values?

- End of covid-19 and reopening of economies:

- “Roaring” growth of economies;

- an end to the trade wars and the manufacturing recession;

- ultra-soft monetary policies;

- inflation tolerance;

- weakening of the dollar;

- expansive fiscal policies;

- financial inflows;

- the new sector of electric mobility;

- uncertainty in wind and solar sources;

- erosion of oil production capacity.

Many points identified by the analyst are correct and acceptable, others should lead to a countertrend, such as, for example, the identification of new energy sources, which should progressively lighten, not increase, the dependence on oil. Furthermore, it is necessary to always have an evolutionary vision of economic cycles, starting with Giambattista Vico, and therefore evaluate that the cycles never move exactly like the previous ones. However, this is a very interesting analysis and one to make due considerations.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The JPMorgan article foresees the “Short Squeeze” starting next month comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/jpmorgan-prevede-lo-short-squeeze-a-partire-dal-prossimo-mese/ on Sat, 13 Feb 2021 16:06:17 +0000.