Lagarde tries to blow up the euro again. Come on, who by dint of trying can succeed

The ECB announcement today was nothing special. Too bad that Christine Lagarde has given it her own, making harsh but expected announcements worse.

Let's see the substance, and then let's move on to the extra put in by the governor. The ECB did not raise any surprises, unlike the Bank of England and, in line with most expectations, it kept the path revealed during its December meeting.

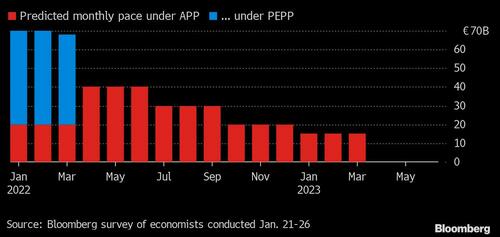

Although inflation unexpectedly hit a record high yesterday, which fueled market expectations for an initial interest rate hike in more than a decade this year, the ECB renewed its commitment to halt the pandemic stimulus. PEPP, gradually. The Governing Council reiterated that it will slow down bond buying in 2022 and completely halt asset purchases before increasing financial costs.

While the central bank keeps rates unchanged – deposit and main refinancing rates remained at -0.5% and 0%, respectively, as expected – the ECB has:

- Renewed the commitment to slow down asset purchases during the year.

- announced that confirmed net purchases under the pandemic program will end in March,

- Confirmed the plan to increase the pace of the APP to 40 billion euros in the 2nd quarter and 30 billion euros in the 3rd quarter. This is a mini program aimed at avoiding shocks due to the exit of the PEPP, dedicated above all to ItaliaM

- Reiterated that interest rates will not rise until projections show sustainable inflation at 2% and underlying price pressures are inconsistent with that target

- Repeated that the special conditions on long-term loans to banks will expire in June

Here's what the ECB's QT will look like

It would seem like good news, but then Lagarde spoke.

Sorry @ecb – this was one of the most confusing press conferences in a long time

Lagarde pedalled back previous statements in name of flexibility, refused even to say markets are wrong pricing 2 hikes this year. Wow!

But then ending on “no wage pressure” and difference to US OMG– Erik Fossing Nielsen (@ErikFossing) February 3, 2022

Faced with the possibility of two rate hikes expected by the market in 2022, it was unable to deny it. indeed it appeared uncertain and confused. In the end he made a kind of half-denial by stating the obvious, which is that there is no “Wage Pressure”, which is obvious given that Core inflation is low.

Faced with this uncertainty, the markets responded in a chaotic way …

Here are the BTPs that took 23 bp in a couple of hours …

The spread with the bund went to 150, a good result, + 7%, congratulations. Then someone comes to tell me that it depends on the instability of the government: but how, by dint of stabilizing we have killed democracy and the spread is growing anyway.

the problem is that an increase in interest rates, ie a monetary tightening, does not produce gas, it does not produce energy. Inflation at 5.1% is due to a 30% increase in energy costs, especially gas, burdening businesses and households. Putting the big hit in rising interest rates in a stagflationary situation is equivalent to throwing gasoline to put out a fire. This is a pro-cyclical move, which hurts the economy at its weakest moment. But what am I going to tell you, four Germans decide everything. Let them give a little push again, so it all blows for real.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article La Lagarde tries to blow up the euro again. Come on, who by dint of trying can succeed comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-lagarde-cerca-di-far-saltare-leuro-di-nuovo-dai-che-a-furia-di-provarci-ci-puo-riuscire/ on Fri, 04 Feb 2022 07:00:45 +0000.