Lithium: the exploitation of new deposits can lead to significant reductions in costs

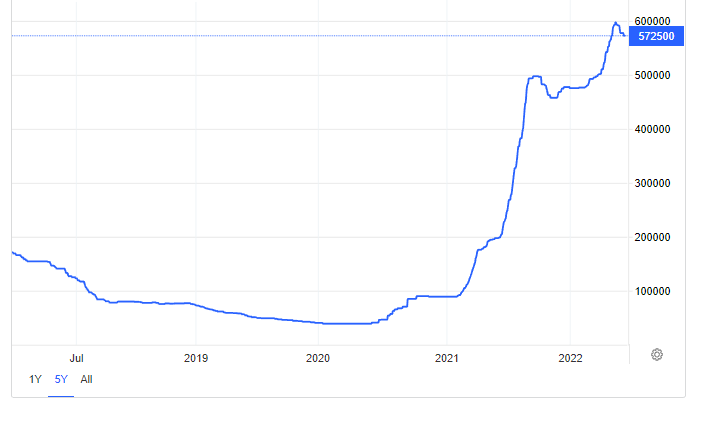

Lithium prices have become one of the red flags of the energy transition, as they have soared relentlessly for more than a year and many expect supply of the battery metal to contract further in the future.

However, at least one EV maker says they have enough lithium for now, in rare positive news for the industry. China's BYD, a leading electric vehicle maker, said it expects a lithium surplus next year as new mines come on stream. In an interview with Bloomberg, Stella Li, executive vice president of BYD, said current lithium prices are "unreasonable" and added that new supplies should solve the problem.

Lithium prices have gained a staggering 1,200% in the past year, thanks to an expected surge in demand from the EV manufacturing industry, as the electrification of transportation is a major focus of the transition, as well as a means to reach net zero. Here is an explanatory graph of the price trend.

The price hike comes as EV makers grapple with rising prices of other raw materials, as well as ongoing pandemic-related supply chain issues that continue to plague industries global.

Ultimately, feedstock cost inflation led to the first hike in lithium batteries since 2010, BloombergNEF reported earlier this week . Bloomberg's Transitions Research division said batteries had become 7% more expensive since last year, topping $151 per kWh.

Additionally, BloombergNEF expects prices to remain at these high levels for another year, delaying the EV revolution on which the transition depends. After that, though, it looks like prices will go down, and they'll go down substantially.

Goldman Sachs analysts share expectations from BYD's Li and expect lithium supply to match demand over the next year, driving prices sharply lower.

According to them, as reported by the Motley Fool , lithium carbonate prices could fall from more than $59,000 per ton this year to just $11,000 per ton in 2024, while lithium hydroxide could fall from $67,240 per ton in this year to $12,500 per ton in 2024.

The investment bank said it expects demand for the battery metal to rise to 1.3 million tons of lithium carbonate equivalent by 2025, but supply will expand to 1.7 million tons over the same period.

One of the new mines slated to come online soon is Grota do Cirilo, Brazil, a project by Canada's Sigma Lithium that expects to start production by April 2023. By the following year, the mine is expected to produce 100,000 tons of carbonate of lithium equivalent per year.

“With the advent of electric mobility and all this enthusiasm for lithium, the world needs new sources,” Daniel Jimenez of the consultancy iLiMarkets told the FT this week. “Anyone who makes lithium over the next three years is going to get abnormally high margins.”

Indeed, these are good times for lithium miners, but they could be better times for lithium buyers, but this free ride could end soon: In October, Argentine media reported that the country and its fellow lithium producers, Bolivia and Chile, they were discussing the creation of some sort of OPEC, but for lithium.

The three countries, which host most of the Lithium Triangle and, therefore, nearly 60% of the world's lithium resources, have talked of a pricing and production deal that would give them control over the product. However, to have real power, such a grouping would have to include China, which is the leader in lithium refining.

However, until this bundling becomes a fact, if it ever becomes a fact, the future of lithium prices looks set for a correction that has cost EV makers a further delay in their plans for world conquest.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Lithium: the exploitation of new deposits can lead to significant reductions in costs comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/litio-lo-sfruttamento-di-nuovi-giacimenti-possono-portare-a-forti-riduzioni-nei-costi/ on Fri, 09 Dec 2022 08:00:14 +0000.