Monetary sovereignty is unwelcome to the strong powers. The 1941 Panama case

by Davide Gionco

Most people don't realize the importance of monetary sovereignty for a nation. This is because the mass media never talk about it and, in fact, no one protested when Italy ceded monetary sovereignty to the Central Bank of Europe and many do not even today protest that the lack of monetary sovereignty causes Italy to be unemployed and impoverished.

One way to realize how fundamental monetary sovereignty is in governing a nation's economy is to study history .

We have already dealt in other articles with the imperial policies of France in Africa , conducted by imposing the use of the CFA franc, on many of its former colonies, which for this reason continue to be de facto colonies.

Another historical case of "imperial deprivation" of a nation's monetary sovereignty is the case of the Republic of Panama.

Panama had gained independence from Spain in 1821, but remained united with Colombia until 1903, when the USA, which had decided to build the Panama Canal to create a rapid naval link between the Atlantic and the Pacific, sent the ship from the Nashville war against Colombia, they conquered Panamanian territory and sponsored the birth of the newborn Republic of Panama, which was established in 1904, starting as a de facto colony of the USA.

The status of colony was guaranteed, first of all, by the adoption of the new currency called balboa , strictly having an exchange rate 1: 1 with the dollar. As it happens, the same thing happens in the CFA Franc area, which has a fixed exchange rate with the euro (first with the French franc) and in the eurozone (where the same currency is used, so the exchange rate is by definition 1: 1 ).

In 1904 the Banco Nacional de Panamá was also established with the function of issuing only metal coins in Balboa.

This while as banknotes the use of the US dollar was immediately imposed, issued in the US by the Federal Reserve (FED).

The Banco Nacional de Panamá was not, right from the start, a real central bank, but rather a branch of the FED, as well as the manager of the mint for the minting of metal coins, it being clear that the currency "of substance" (banknotes and scriptural currency) was issued only by the Fed or American banks.

To date, Panama is one of the (only) 10 countries in the world to lack a real central bank:

Source: https://en.wikipedia.org/wiki/List_of_central_banks

After 36 years of “colonial” republican life, in 1940 the Panamanian people elected by a large majority Arnulfo Arias Madrid , a doctor who graduated from Harvard, as new president.

Arias was known for his nationalist thinking, which did not like the presence of foreign powers and exalted national values. During his first year of government he promulgated a new constitution, the Social Security Fund, a whole series of nationalizations and, above all, he established the Central Bank of Panama, which immediately began to issue banknotes denominated in Balboa.

The new central bank was authorized to issue 6 million balboa, which began on October 2, 1941.

After only 7 days of printing the banknotes, on the following 9 October 1941, President Arias was overthrown by a military coup sponsored by the United States and was replaced by one of his ministers, a certain Ricardo Adolfo De La Guardia, who immediately demonstrated the most faithful ally of the Americans, interrupting the printing of banknotes in balboa, making them withdraw as much as possible and making them burn.

This is the historically shortest life span of a sovereign currency.

Only 7,000 banknotes were saved, making Panamanian balboa notes issued between 2 and 9 October 1941 among the rarest in numismatics.

The De La Guardia government was also the first Latin American government to declare war on Germany, Italy and Japan.

The rush of the Americans to end the experience of monetary sovereignty and a government-controlled central bank in Panama demonstrates that it is a fundamental power that an imperialist system cannot allow to remain in the possession of a people with its own rulers.

The founder of the Rothschild banking empire, Mayer Amschel Rotschild (1744-1812), stated:

" Let me issue and control a nation's currency and I don't care who makes its laws ."

And this is precisely what the Americans were interested in when they carried out the coup in Panama in 1941: to have control of the issuance of money in Panama, so that they could rule above the law.

Which is the same thing that the French do, through the Banque de France , which control the issuance of CFA francs in Africa.

Which is the same thing that the international financial powers do, through the European Central Bank , which control the issuance of euros in Europe. With the only difference that in this case it is not possible to attribute a nationality to the imperial power.

Also for these reasons, in 2002 the American President George Bush included the following countries in the Axis of Evil list : Iraq, Iran and North Korea. To which the American "hawk" John Bolton , who has held prominent positions in the American government over the years, also added Cuba, Libya and Syria.

These were countries whose central bank was not tied to the Western financial system, the one that has achieved for some decades that central banks, such as the Fed or the ECB, are "independent" from political power and, therefore, removed from any form of democratic and popular control, it being clear that financial lobbies have a thousand ways to condition them and interfere with their choices.

Of the countries on the 2002 list, Iraq and Libya suffered the American armed attack (as in Panama in 1941), after which the central banks of these countries were included in the globalized "western" financial system.

North Korea has managed to withstand the tremendous pressure, but only because it is supported by China, because it is a dictatorship (no possibility of financing a political opposition) and because it has nuclear weapons.

Cuba has been saved for the time being, but the hard American embargo against a nation that does not have the slightest chance of constituting a danger to the US remains. Of course it is also a dictatorship, because the US would find no obstacles in manipulating a democracy.

We know the history of Syria's last years. Years of war and a dictatorship (so they tell us) that was able to resist thanks to the support of Russia.

Finally, Iran, which continually suffers American and Israeli pressure, with repeated threats of war.

In the years following 2002, Venezuela was also included in the list of "bad guys" and we all know how Venezuela is treated in the media and American attempts to carry out a coup in that country.

This is the history of world finance of the last century (at least): weapons impose control over central banks and the issuance of money; control over the issuance of money makes it possible to exercise power above the laws, almost always without using weapons, since the money created out of thin air by central banks allows you to buy, flatter, bribe or (possibly) eliminate any possible opponent to this system of power.

For those interested, here is a list of US "interventions" to impose its political-financial power around the world.

Why is control of a country's central bank critical to exercising power?

The fundamental reason is that the central bank has the power to finance or not to finance the government. A government without funding cannot adequately serve its people. And whoever decides how much the government can be financed also has the power to set conditions for financing or to decide how this money will be destined for the benefit of some and not the people.

A second reason is that the central bank regulates the banking sector, which in turn has the power to create credit money, which allows the economy of a country to be lifted or depressed depending on the constraints placed by the central bank.

The armed interventions of the US in most cases did not lead to the imposition of the use of the dollar, as in Panama, but to the imposition of a currency at a 1: 1 fixed exchange rate with the dollar, which eliminates the risks exchange rate for commodity importers from those countries and for merchandise exporters in those countries. That is, the impossibility for the governments of those countries to adjust the exchange rate to the needs of their country's economy.

In other cases the Americans (or the French), through control over the central bank, have imposed policies of destruction of the internal production system (which is what has been happening in Italy for a few decades), which subsequently forced those countries rich to raw materials to borrow in dollars, generating a priceless debt, fueled by high interests, which turns into an instrument of domination and power over those states.

Since Italy joined the single euro currency, subject to the governance of the European Central Bank, an organism totally outside the political-democratic control of the Italian people, it has inserted itself into the mechanisms underlying the control by the Italian people. strong powers of the world over the internal policies of most countries.

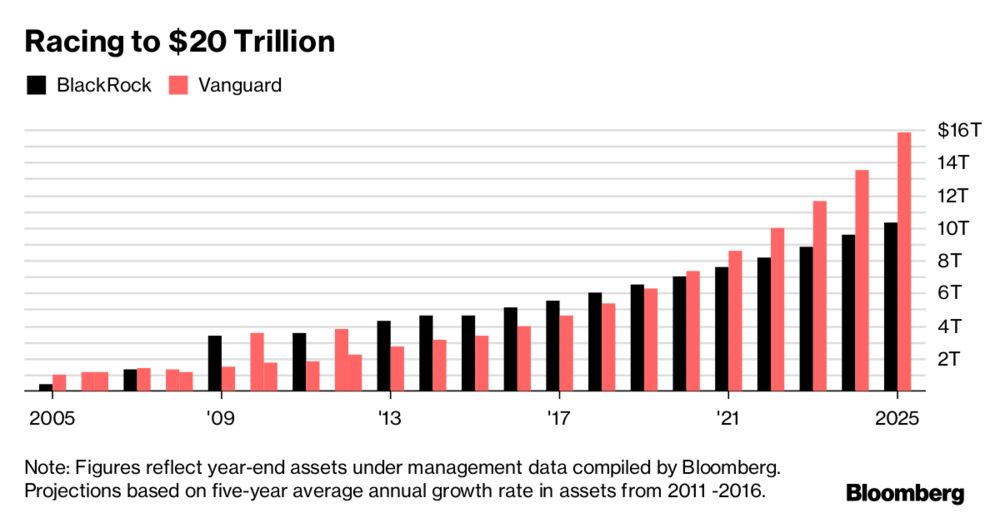

In this case, power is not represented by a well-defined foreign nation, but by those who, by controlling the ECB, determine its choices to their own advantage, such as the Mutual Funds companies , such as Blackrock or Vanguard, which today govern by made the economies of most of the world, two companies that, alone, have a portfolio of the order of 15 trillion, equal to 15'000 billion dollars, equal to about 10 times the annual GDP of a country like Italy .

Until the Italians become aware of these mechanisms and do not support political forces that really intend to free Italy from this system of power linked to the single European currency, it is essentially impossible to hope for an economic recovery of Italy, because the decisions that count will be taken by those who have an interest in plundering Italy to favor the big names in international finance.

Italy is not doing badly because Italians "don't want to work" (as public opinion in certain northern European countries think), but because it made the mistake of giving up its monetary sovereignty.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Monetary sovereignty is unwelcome to the strong powers. The 1941 case of Panama comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-sovranita-monetaria-e-sgradita-ai-poteri-forti-il-caso-di-panama-del-1941/ on Sat, 28 Nov 2020 10:30:50 +0000.