Morgan Stanley sees two (tiny) trend reversals at the Macro level

Chetan Ahya , an economist at Morgan Stanley, was recently asked what was the major macroeconomic change he was witnessing. His answer was somewhat surprising, because he did not mention structural changes in the supply chain, but focused on the distribution of income among people and the distribution of wealth between profits and wages.

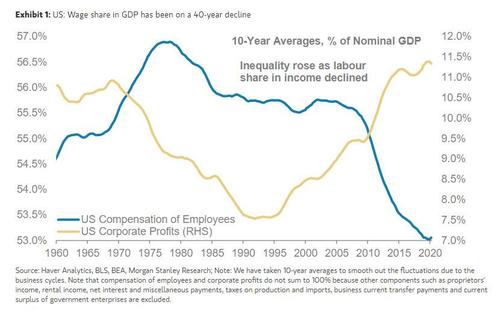

To give the context, the share of corporate profits in GDP has been increasing over the last 40 years, while the share of wages has decreased, at least until Covid-19. At the same time, income inequality has increased significantly and intergenerational mobility has decreased. While these trends are global in nature, the United States has undoubtedly been at the forefront.

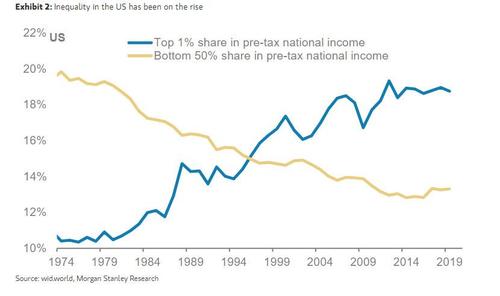

Now let's see how the income distribution between the richest one percent and the poorest 50 percent in the US is behaving:

2020 saw, for the first time, a tiny, very light, barely noticeable turnaround in the distribution of wealth. An almost imperceptible movement, but still present.

As the burden of the COVID-19 recession fell more heavily on low-income families, policy makers were pressured to action to prevent the already dramatic inequality from worsening, according to Ahya.

They did so, at a macro level, or explicitly in a high-pressure economy, that is, with sustained growth, trying to involve even the poorest families in income growth, again according to the Morgan Stanley economist. Additionally, the Federal Reserve has reformulated both sides of its dual mandate, essentially creating space to lower unemployment rates to ensure that gains in the labor market can be shared more widely among low-income groups, at least in the US. . The ECB, the only bank in the world, does not have a double mandate, and this over time will lead to a strong revaluation of the Euro.

The wage dynamics have also been adjusted, according to Ahya:

For the first time, there has been a tiny increase in the wage share and a small decrease in the profit share. This phenomenon was linked, in the USA, to an improvement in social treatment and to the first case of antitrust fight against “BigTech”, according to Ahya, the main responsible for the trend in the distribution of the gross margin between profits and work. However, this has not yet occurred in Europe, because aid has been much less consistent. Furthermore, the danger of this policy is the possibility of a restart of inflation and a dangerous acceleration in the speed of the economic cycle. But William Vickrey, the Nobel Prize in Economics, seems to have some reason …

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The Morgan Stanley article sees two (tiny) trend reversals at the Macro level comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/morgan-stanley-vede-due-minuscole-inversioni-di-tendenza-a-livello-macro/ on Mon, 14 Jun 2021 08:00:44 +0000.