Namibia: large oil discovery by GALP, while price growth stops

Shares of Portuguese integrated energy operator Galp Energia jumped more than 20% in the first trading session on Monday, after the company announced that the first phase of its exploration in the Mopane field , offshore Namibia, could contain at least 10 billion barrels of oil. Galp says it conducted test operations on the Mopane-1X well in January and the Mopane-2X well in March, with “significant columns of light oil discovered in high-grade reservoir sands.” The Mopane field is located in the Orange Basin, where Shell Plc and TotalEnergies have made several oil and gas discoveries. Galp produced an average of just over 122,000 barrels of oil equivalent per day in 2023.

According to Galp, flows achieved during testing reached the maximum allowable limit of 14,000 barrels per day , “potentially positioning Mopane as an important commercial discovery.” Citi is optimistic about Galp's discovery, saying the test results are close to a best-case scenario, and called the discovery "totally transformative" for the company.

From one perspective, the Galp discovery is comparable to the more than 11 billion barrels of recoverable oil and gas contained in Guyana's Stabroek block, a 26,800-square-kilometer area owned by U.S. oil majors Exxon Mobil Corp. and Hess Corpì, as well as the Chinese CNOOC Ltd. However, Chevron Corp. could end up participating in Guyana's valuable resource if it pulls off its $53 billion merger with Hess. Exxon is the block's largest operator with a 45% stake, while Hess and CNOOC own 30% and 25%, respectively.

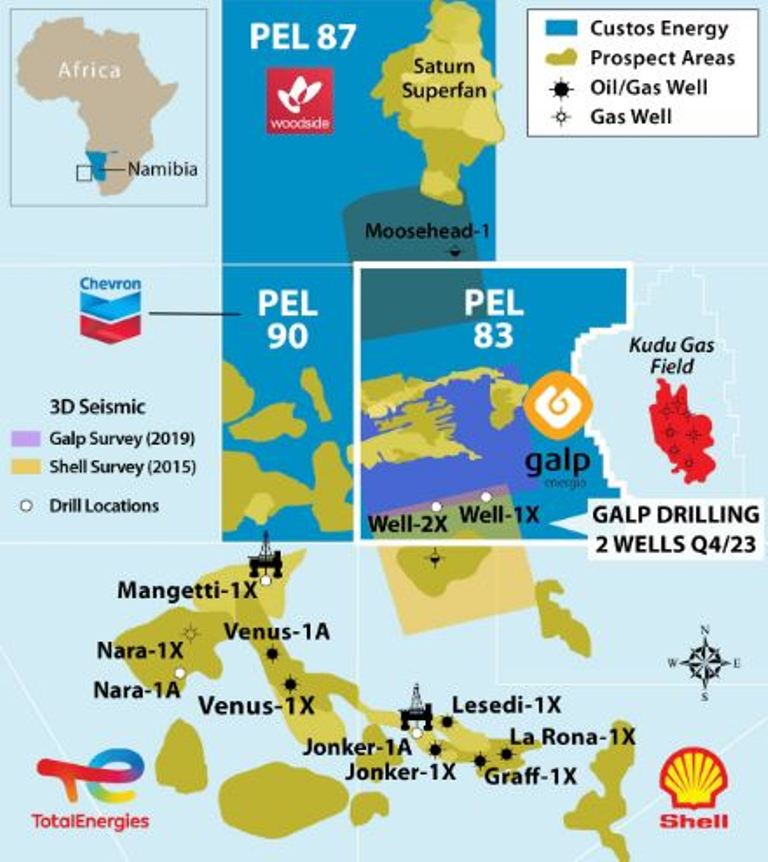

Galp has launched the sale of half of its 80% interest in Petroleum Exploration License 83 (PEL 83), which covers nearly 10,000 square kilometers in the Orange Basin. Namibia's national oil company NAMCOR and independent exploration group Custos each hold a 10% stake.

Galp plans to hand over control of the project's development to the potential buyer, who is likely to be a major international energy company with strong project management experience. Galp has hired Bank of America to manage the sale process, with proceeds that could be in the billions of dollars.

The Mopane discovery – one of the largest made in the nascent basin following successful exploration campaigns by rivals TotalEnergies and Shell – could help revive the southern African country's oil industry. In recent years, Namibia has attracted huge interest from international oil companies looking to grow their production based on demand.

Despite the ongoing clean energy transition, most energy analysts have predicted that oil demand will continue to grow for years, if not decades. The US Energy Information Administration (EIA) is the most optimistic about long-term oil demand and has predicted that peak demand will not come until 2050, while the OPEC Secretariat sees it coming in 2045.

Meanwhile, Standard Chartered has predicted that global oil demand will reach 110.2 mb/d in 2030 and increase further to 113.5 mb/d in 2035.

According to StanChart, a long-term structural peak is very unlikely to be reached within 10 years , despite the high probability of cyclical downturns over the period. StanChart argued that the current gap in demand sentiment creates significant investment uncertainty, which is likely to push prices higher in the long term.

This does not mean, however, that the price of oil will continue to grow as has happened in recent weeks: the oil price rally continued to lose momentum, with crude oil futures recording their second consecutive weekly loss, marked by large swings with geopolitical risk perceptions rising and falling in the Middle East. Tradition Energy's Gary Cunningham told MarketWatch that oil's rally has stalled because "there has been no increase in risk for high-producing countries in the region," with Saudi Arabia, the United Arab Emirates and Iraq remaining out of the conflict. “In reality, only Iran's barrels are at risk, and that would only happen if broader hostilities broke out,” he added. Which, fortunately, seems unlikely to happen.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article Namibia: large oil discovery by GALP, while price growth stops comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/namibia-grande-scoperta-petrolifera-di-galp-mentre-si-ferma-la-crescita-dei-prezzi/ on Tue, 23 Apr 2024 08:00:55 +0000.