New IMF forecasts: Europe bad, USA super

The United States is heating up. Chinese growth is slowing. Eurozone economic activity is at historic lows. Germany sinks like a stone, Italy floats.

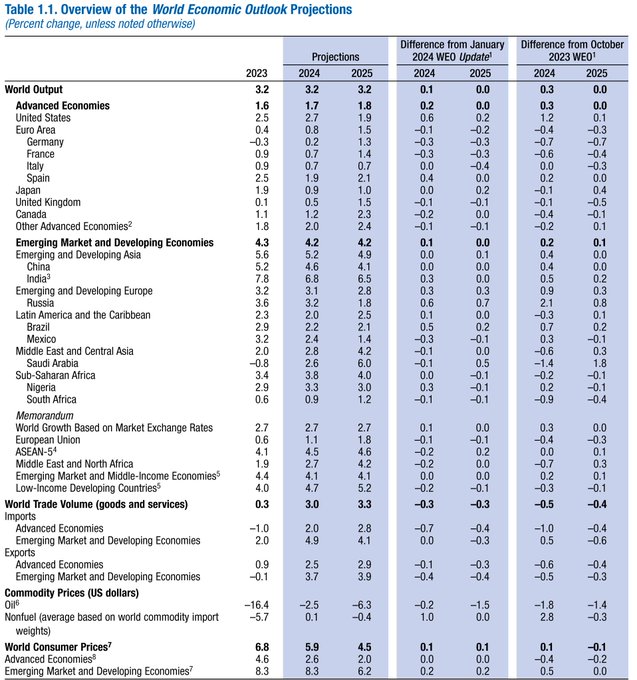

This is the picture painted by the International Monetary Fund (IMF) when it published its new global outlook on Tuesday. For the current year, the IMF has revised its global growth forecast slightly upwards (+0.1 points), bringing it to 3.1%. The forecast is unchanged for next year (3%).

It is especially in the United States that the Fund corrects its trajectory. In 2024, growth is expected to reach 2.7%, not 2.1% as forecast at the beginning of the year. “The US's strong recent performance reflects strong productivity and employment growth, but also strong demand in an economy that remains overheated,” Pierre-Olivier Gourinchas, the IMF's chief economist, commented in his blog. As a result, the Federal Reserve's easing of monetary policy may be slower than initially expected.

For the Fund, the Fed's rate hikes had a moderate effect on economic activity. The increase in the share of fixed-rate mortgages and the reduction in household debt after the 2008 global financial crisis have probably limited the effect of rising rates on consumption. Added to this is budget spending, the long-term trend of which is "particularly worrying", warns the Fund. This is a brake on the disinflation process underway in the United States.

Chinese slowdown

If the United States roars, China whispers. Although growth in the first quarter was stronger than expected (5.3%), “the Chinese economy continues to be affected by the slowdown in the real estate sector. Credit booms and recessions never resolve quickly, and this is no exception,” explains Pierre-Olivier Gourinchas. According to the Fund, China's GDP growth will not exceed 4.6% this year and 4.1% next year. Domestic demand remains sluggish.

Weak domestic consumption could lead to an increase in Chinese exports and therefore trade surpluses. “The risk is that this will further exacerbate trade tensions in an already tense geopolitical environment,” fears the chief economist.

During his meeting with German Chancellor Olaf Scholz in Beijing on Tuesday, Chinese leader Xi Jinping stressed that China's exports of clean technologies have helped the world fight inflation, with electric cars and solar panels at rock-bottom prices. But they have also ruined the European solar panel industry and are ruining the car industry. China is the real winner of the Green challenge, because it has used it to demolish other industrial countries.

The eurozone is struggling

The Eurozone, meanwhile, is in trouble. The Fund has revised its forecasts downwards. Growth in the Eurozone will be 0.8% this year, rather than the 0.9% hoped for at the start of the year. Germany is credited with a paltry 0.2% and France with 0.7%, Italy with 0.7%.

The economist expects European growth to rebound, “but from very low levels, because past shocks (Covid pandemic, rising energy prices) and restrictive monetary policy will weigh on activity.”

So the IMF takes a wrong turn which shows that someone forgot to read the latest data. There is talk of "high wage growth" and "persistent inflation", but this is only, and partial, in services, while there is no growth in goods, while there is no growth in real wages. The ECB could finally decide on the real European economic situations and

Alarm on public finances

Overall, while inflationary trends are encouraging, the IMF notes that progress has stalled since the beginning of the year. Falling energy prices and falling commodity prices eased the pressure. But oil prices have risen due to geopolitical tensions.

There is also the risk that international conflicts will fuel uncertainty and inflation, cutting growth prospects.

Obviously the institution then calls for orders to reduce debt and expenses before the financial markets intervene, etc. The same old story of austerity, spending cuts, etc. which, frankly, after the experiments of Gracia and many other countries, has become tiring.

The IMF recipes have so far failed to revive any country, and it is understandable why some countries try to organize supranational financial institutions other than the IMF. Among other things, the USA, the successful example, is doing the opposite of this predicate.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article New IMF forecasts: Europe bad, super USA comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/nuove-previsioni-del-fmi-male-leuropa-super-usa/ on Wed, 17 Apr 2024 05:15:22 +0000.