NYCB still in crisis: confesses to shortcomings in internal controls and falls again

You remember New York Community Bank, the troubled bank that made a surprise decision to cut its dividend to stockpile cash (in case commercial real estate loans went bad) following mounting pressure from a major U.S. regulator and what did we tell you about here ?

NYCB disclosed that it had identified material weaknesses in internal controls related to the internal review of loans as part of an assessment, according to a regulatory filing released yesterday.

“Management has identified material weaknesses in the company's internal controls related to internal loan review, resulting from ineffective oversight, risk assessment and monitoring activities,” the bank said in the filing.

For this reason, the bank will delay its annual report and

- NYCB has determined that it is unable to file, without unreasonable effort or expense, its Annual Report on Form 10-K as of December 31, 2023. That is, it cannot file the complete financial statement report, anything more than a simple sum of the accounts, requested for informational purposes by the SEC.

- NYCB also suffered a $2.4 billion impact on its fourth quarter and fiscal year net income (loss) as GAAP accounting required a “goodwill impairment” charge for the quarter and fiscal year. fiscal year ended December 31, 2023.

Separately, New York Community Bancorp said it has named Executive Chairman Alessandro (Sandro) DiNello as president and CEO, effective immediately.

Thomas Cangemi has resigned from this role, but will remain a member of the board of directors.

“ My mandate as President and CEO, along with our Board, is to continue our transformation into a larger, more diversified commercial bank ,” said DiNello.

“ While we have faced challenges recently, we are confident in the direction of our bank and our ability to deliver long-term results for our customers, employees and shareholders.”

The company also appointed Marshall Lux as director of the board of directors, effective immediately, after Hanif Dahya stepped down from the role (in opposition to DiNello's appointment).

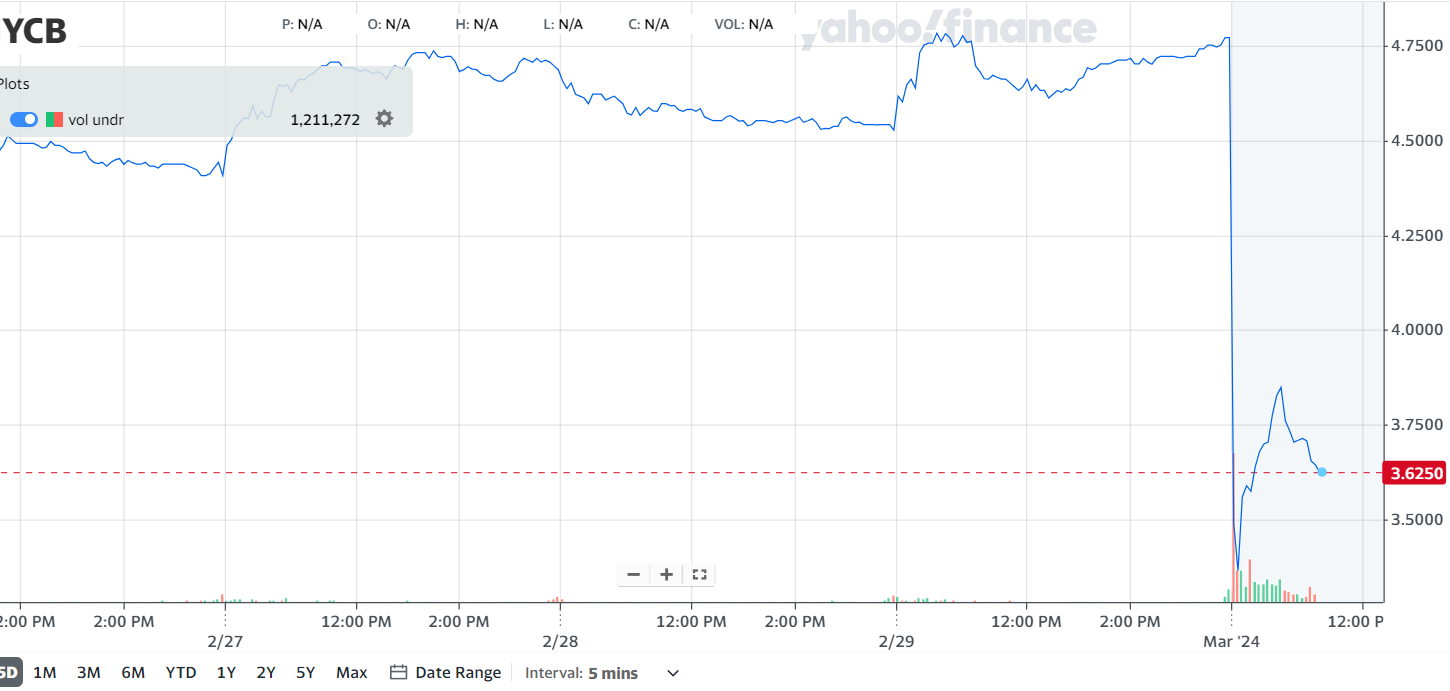

NYCB shares have fallen more than 50% since January 29, and are now down another 20%

It seems difficult to go lower than this.

Full deposit details are below:

On January 31, 2024, NYCB filed a Current Report on Form 8-K providing, pursuant to Items 2.02 and 9.01, the Company's press release announcing unaudited financial results for the fourth quarter and fiscal year ended December 31 2023 (the “Original Filing”). The full text of the press release has been included as Exhibit 99.1 in the Original Filing.

On February 29, 2024, NYCB filed with the Securities and Exchange Commission (the “SEC”) an amendment (the “Amendment”) to the original document to reflect, among other things, (a) an adjustment relating to a write-down of the goodwill in relation to the 2007 and prior transactions, as described in more detail in the document itself, (b) certain measurement period adjustments impacting the Company's bargain purchase gain arising from the acquisition of certain assets and liabilities of the former Signature Bank through a transaction facilitated by the Federal Deposit Insurance Corporation and (c) a Type 1 subsequent event adjustment (as described in more detail in the Amendment). Each of these adjustments was identified by NYCB management after the date of the Original Filing and as part of the Company's customary procedures to finalize its financial statements for inclusion in its Annual Report on Form 10-K for the fiscal year ended on December 31, 2023 (the “2023 Form 10-K”).

Separately, as part of its assessment of the Company's internal controls, management identified material weaknesses in the Company's internal controls related to internal loan review, resulting from ineffective oversight, risk assessment and monitoring activities. Although the evaluation of the Company's internal controls has not yet been completed, the Company expects to disclose in its 2023 Form 10-K that its disclosure controls and procedures and internal control over financial reporting were not effective as of December 31, 2023. The Company's remediation plan with respect to such material weaknesses is expected to be described in its 2023 Form 10-K.

The Company has worked diligently to finalize its 2023 Form 10-K; however, the Company must complete its work related to the assessment and remediation planning of the material weaknesses described above and other items included in the Amendment. Accordingly, the Company has determined that it will not be able to file, without unreasonable effort or expense, the 2023 Form 10-K by the due date.

The Company expects to file its 2023 Form 10-K within the fifteen calendar day grace period provided by Form 12b-25. The Company does not currently expect the operating data contained in the 2023 Form 10-K to differ materially from that reported in the February 29, 2024 Amendment for the full fiscal year ended December 31, 2023.

Is there anyone who trusts loan portfolio ratings after this?

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article The NYCB still in crisis: confesses to shortcomings in internal controls and falls again comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-nybc-ancora-in-crisi-confessa-mancanze-nei-controlli-interni-e-nuovamente-precipita/ on Fri, 01 Mar 2024 16:31:43 +0000.