OPS: THE BUNDEBANK THINKS ABOUT CAPITAL CHECKS….

The always good Musso highlighted a research by the Bundesbank, a "Discussion paper" on a very delicate topic: "The controls of capital flows: cases, uses and consequences ". A discussion paper is a scientific research, in this case economic, which should be the basis for a discussion among experts on possible economic measures to be taken to solve a given problem, in this case excessive capital movements. The result of the research is, in itself, rather obvious: in fact it is stated that if there are controls on the movement of capital it is obvious that these move less, as discovered by the research, both incoming and outgoing.

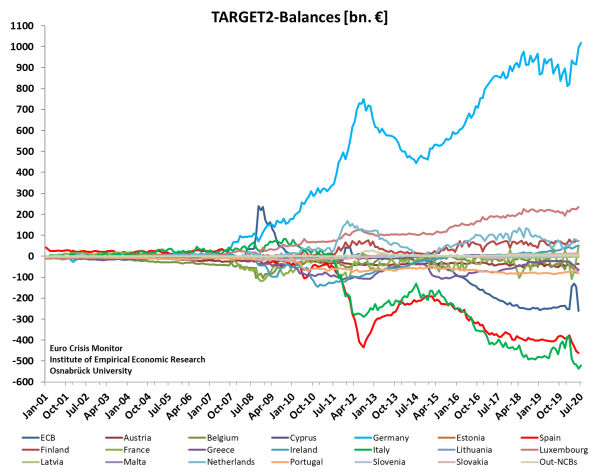

The interesting fact, on the other hand, is the research itself: a central bank opens a discussion on the need to impose controls on financial movements in a Europe where the only, true, liberalized movement with the Euro has been that of capital … If you think this is a simple philosophical discussion you have to put it into perspective with the growing nervousness of the Bundesbank and many German economists regarding the Target 2 balances resulting from the continuous inflow of capital into Germany.

the positive balance of BUBA through Target 2 is now over 1000 billion euros. We know that it is not a real credit, but a monetary balance of the flows transited through the central bank, but the bad construction of the Union means that this money is part of the assets of the BuBa which, to offset the liabilities, must create monetary base. In short, the fears of the Germans are as follows:

- for the most deluded of never being able to collect the "Credit" of Target 2, which will never be collected, let's face it, even in the event of the euro closing. In that case it will likely become a claim on the other CBs or reserves in their future currencies;

- that the continued construction of a monetary base deemed excessive, and in the heterodirect case, comes to prevent any restrictive monetary operation that some economists and the BuBa deem necessary to cool the excessive growth in the value of assets;

Being in the single currency means that, if capital flows freely, the monetary base can also move from one area to another. Even if T2 did not exist (it would be enough to change the system to record interbank movements), however, there would be, albeit to a lesser extent, an inflow of capital to Germany. This oversupply translates into low rates, negative yields for government bonds, oversupply of credit and possible speculative property bubbles in the first place, but also equity: suffice it to note that while the Italian and French stock exchanges are sailing at 20% in less than the Pre Covid, the German one has almost reached and passed the period before the epidemic. But 11% of the decline in GDP indicates that there are also problems in Berlin.

If I introduce capital controls and stop the flow, I can make, at least in pure theory, a restrictive policy WITHOUT detaching myself, at least immediately, from the ECB rate policy. I cool the industry (you can no longer freely export intra-EU without a counterpart of purchases) and the lower monetary supply will lower rates. In short, Von Hayek wins, avoids the bubbles and makes the Germans all a little poorer and austere. Of course, the control in the movement of capital, like its mirror version, that is the restriction of Target 2, leads to the end of the Euro, because a euro in Berlin will no longer be worth as a euro in Rome or a euro in Paris, but it will not be the end for anyone. I propose a reflection: it is often said that Italy pays slightly higher interest rates because it discounts the risk of devaluation in the case of Eurobreak. Isn't it that Germany has negative rates because it discounts the risk of revaluation, in the same eventuality? I leave you to this reasoning.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article OPS: THE BUNDEBANK THINKS ABOUT CAPITAL CHECKS…. comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/ops-la-bundebank-pensa-ai-controlli-di-capitali/ on Thu, 27 Aug 2020 16:26:03 +0000.