Powell: We are unlikely to raise interest rates again. Afraid of breaking the toy?

The winds are clearly changing and the US Central Bank must take note of it too . The Fed is proceeding cautiously and policymakers will make decisions about the extent to further tighten monetary policy and how long policy will remain tight based on the totality of incoming data, the evolving outlook and the balance of risks, he said Fed Chairman Powell at the Economic Club of New York.

The Fed chair added that restrictive policy is putting downward pressure on economic activity and inflation. However, further evidence of persistently above-trend growth, or that labor market tension is no longer easing, could put further progress on inflation at risk and could justify further tightening of monetary policy.

Powell also noted that inflation is still too high and that a sustainable return to the 2% inflation target will likely require a period of below-trend growth and a further softening of labor market conditions. A tenuous way of saying that it will take a recession to bring about a reduction in inflation, but it remains to be seen who will start it. Or does the Governor of the FED already see it underway?

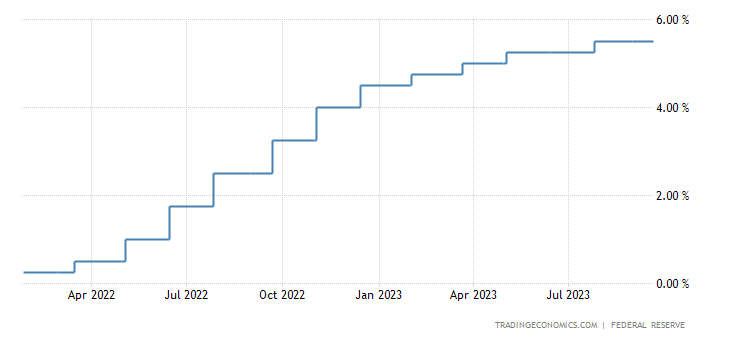

At its September 2023 meeting, the Fed maintained its target range for the federal funds rate at a 22-year high of 5.25%-5.5%. Here is the relevant graph

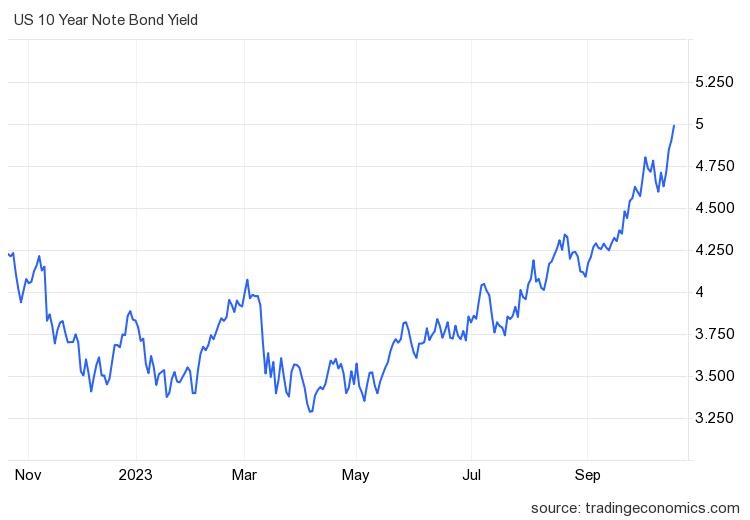

On the one hand, Powell couldn't have said anything different a year after the elections, and, at the same time, the market didn't take the bait this time and US ten-year bonds are now at 5%

The fact that the announcement of the stop did not lead to a reduction in interest rates shows that, in reality, the matter is no longer of much interest to the markets who no longer believe in it. Interests start to move automatically. We'll see how long it takes before a crash.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The Powell article: we are unlikely to raise interest rates again. Afraid of breaking the toy? comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/powell-difficilmente-aumenteremo-ancora-i-tassi-di-interesse-paura-di-rompere-il-giocattolo/ on Fri, 20 Oct 2023 06:00:39 +0000.