Price of uranium skyrocketing in the face of booming demand and shortage of supply

The price of Yellowcake, the uranium concentrate used in nuclear generation, has reached its highest level in 15 years, driven by soaring demand as a crucial energy source for a “green future”. Additionally, global supply disruptions are pushing prices further higher.

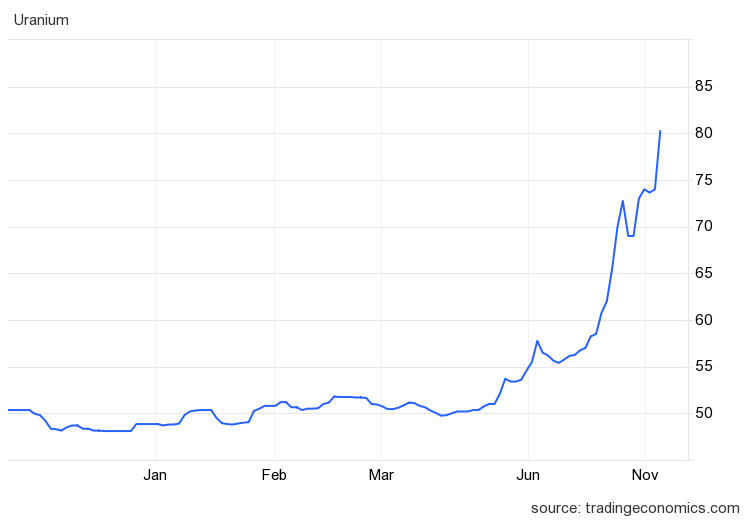

Nymex futures that track physical uranium ore market contracts topped $80.25 per pound (454 grams) on Monday, the highest level since February 2008. Since we first recommended uranium stocks in December 2020, in a note titled “Buy Uranium: Is This the Start of the Next ESG “Craze,” uranium ore prices jumped 173%. Here is the relevant graph from Tradingconomics:

Here is what a long-term view looks like, which shows how these prices had only been exceeded before the great financial crisis and the Fukushima accident:

Prices have also surpassed the level last seen since Japan's Fukushima reactor disaster put nuclear power on probation around the world – and in Germany, sentenced it to death – various factors, including which the decarbonisation of electricity networks, have relaunched the nuclear industry.

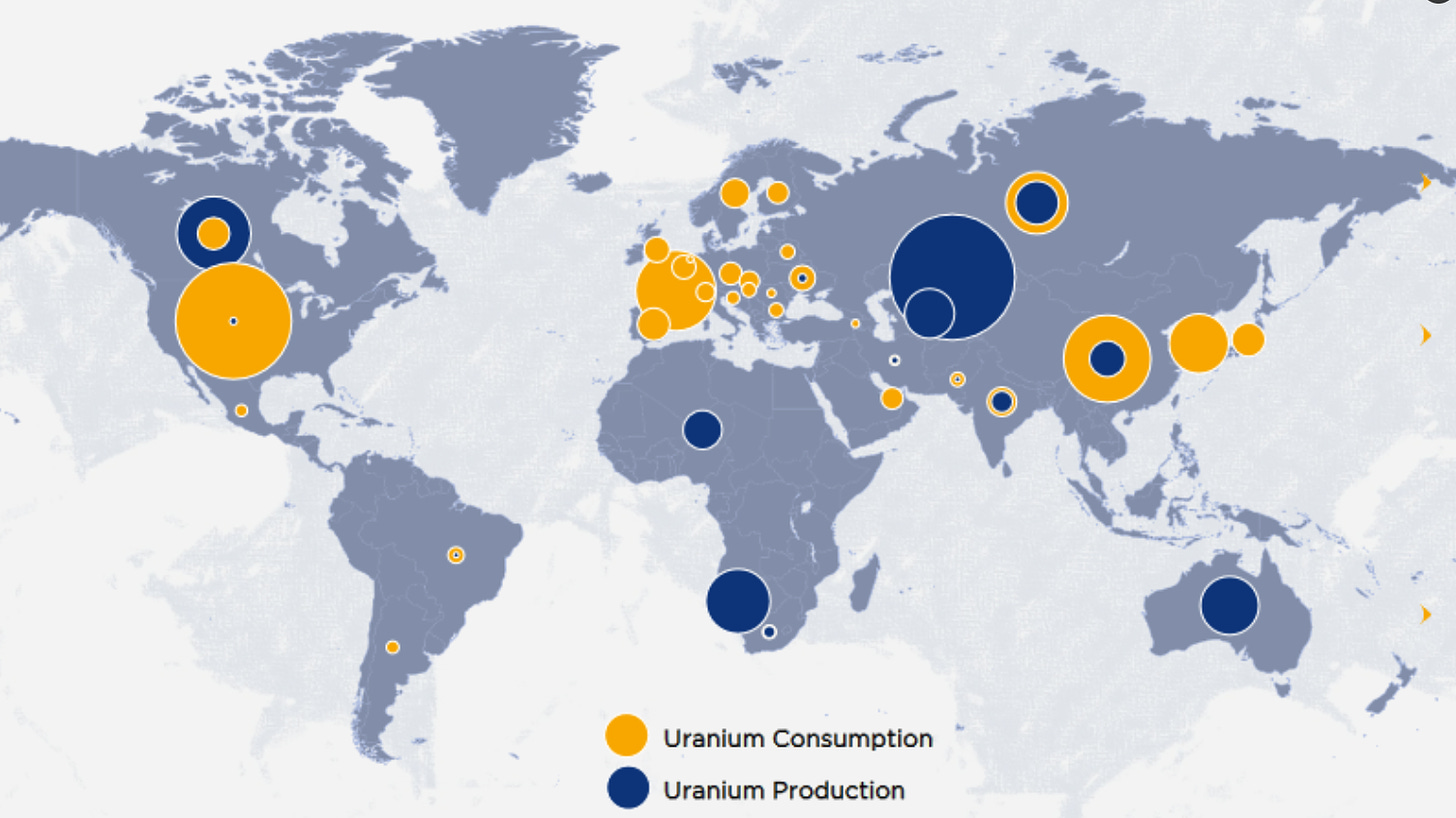

While the International Energy Agency says that to reach “net zero” goals – global nuclear generation capacity must double from 2020 levels by 2050 – demand for Yellowcake is skyrocketing at a time when Western governments are sanctioning Russia, which currently accounts for about 8% of the world's uranium reserves. This means that the West must develop new sources of supply.

According to Colin Hamilton, managing director for commodities research at BMO Capital Markets, “utility trading continues to grow” and “there is very little available production available to meet unhedged utility requirements” .

Bloomberg pointed out that major mining company Cameco Corp. has revised down production targets due to various supply chain challenges in Canada, while a coup in Niger has disrupted shipments to Europe.

As for uranium stocks, Terra Capital's Matthew Langsford toldBloomberg , “[Uranium] stocks could see a dramatic rally: 50%, 100%, maybe more.”

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article Skyrocketing uranium prices amid booming demand and limited supply comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/prezzo-delluranio-alle-stelle-a-fronte-del-boom-della-domanda-e-della-scarsita-dellofferta/ on Wed, 22 Nov 2023 17:23:30 +0000.