Rare earths: the production crisis in Myanmar even puts China in trouble

Metalminer's rare earth MMI (monthly metal index) recorded another strong increase month after month. Indeed, supply disruptions remain a major concern in the rare earth sector, so rare earth magnets and other materials have seen renewed bullish strength across the board in recent months.

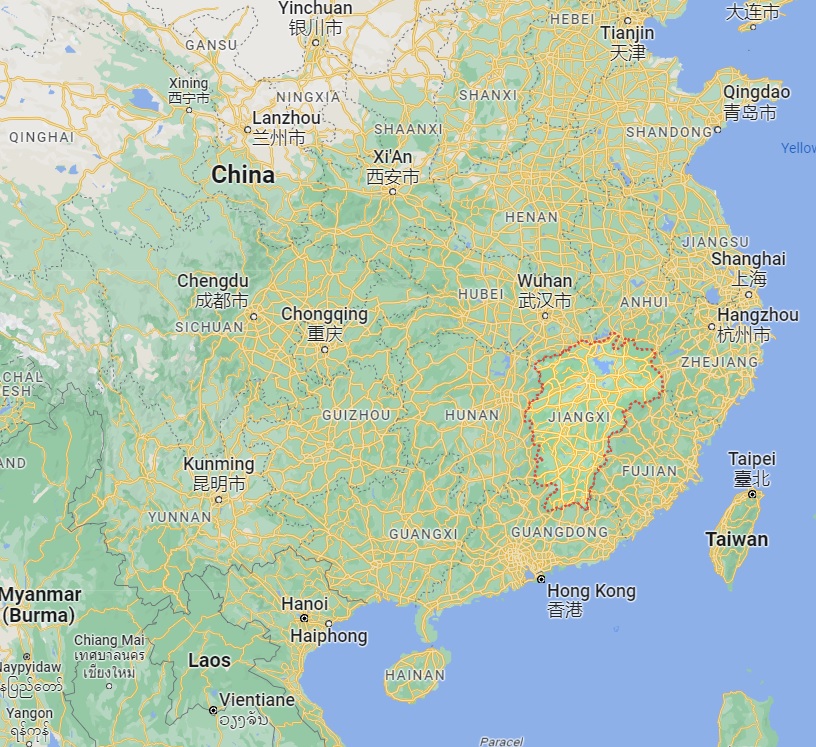

In August, market concerns emerged ahead of a planned environmental inspection in China's Jiangxi province. The China region serves as an important location for China's supplies of rare earths. On top of this, Chinese stimulus efforts have managed to boost rare earth production (although this cannot add long-term support to the index).

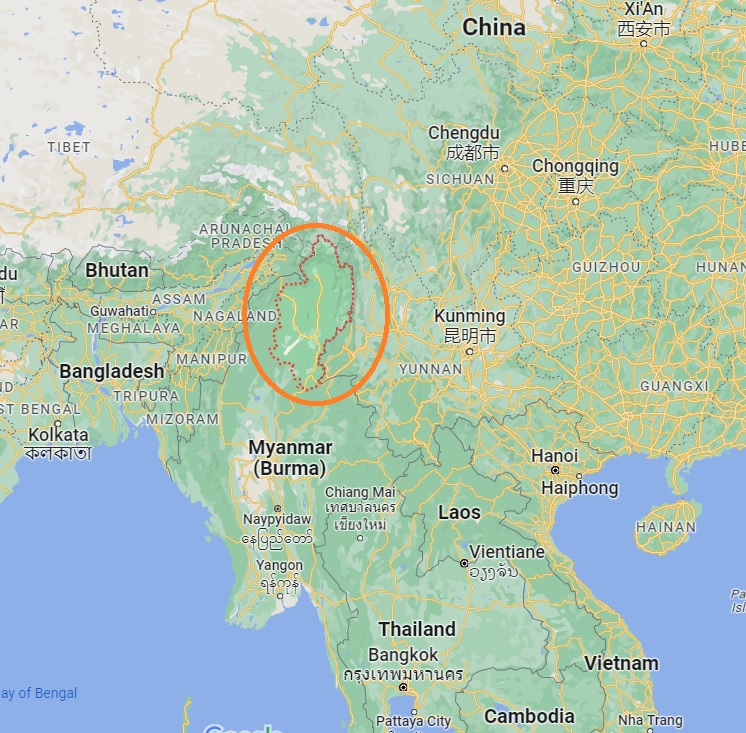

After this interruption for environmental reasons, Myanmar's Kachin State suspended mining activities. Myanmar (formerly Burma) is a leading producer of rare earths and rare earth magnets globally, and any changes in Burma's mining activity can significantly alter the market.

Thus, the suspension of mining led to inventory declines before peak consumption and caused Chinese rare earth prices to reach their highest point in more than 20 months.

As a result of all this, the index jumped 6.62%

How will the suspension of Myanmar mining affect rare earth prices globally?

From January to July 2023, Myanmar's Kachin State supplied 38% of the rare earth materials imported from China. Despite this, the Burmese state's mines closed their doors in early September to prepare for inspections. This closure has raised anxiety about supply disruptions and prompted hoarding of rare earth materials around the world.

For now, analysts predict that the recent mining restriction in Myanmar's Kachin State will have a mostly short-term impact, but, if not resolved, will also have a longer-term impact.

Short-term impact:

- Prices have already taken into account the immediate effects of the mining ban. However, rare earth prices will continue to see support from long-term supply disruption and stable demand prospects.

Fear of higher prices will also spur a surge in demand in the fourth quarter of 2023, as rare earth consumers stockpile goods for use during China's national holidays from Sept. 29 to Oct. 6.

Long-term impact:

- While the long-term effects of the mining restriction remain unknown, it could lead to a shortage of rare earth minerals, further increasing costs.

The restriction could also lead to an increase in illicit mining, which is already a significant problem due to China's control over rare earth mining in Myanmar. Over time, this could exacerbate environmental problems in the region and lead to political unrest.

Furthermore, the restriction could eventually cause harm to Myanmar's economy and mining workforce.

Changing global dynamics of rare earth trade

China's stagnant economy has had a negative impact on rare earth prices for months, even without the Burmese mining ban. Therefore, an increase in Chinese economic activity could benefit the market. However, recent forecasts indicate that China's economy will slow in 2024 due to continued domestic challenges and a lackluster real estate sector.

While China's real estate sector does not directly influence the production of rare earth magnets, a potential "domino effect" could continue to hurt prices of industrial metals that rely on Chinese imports.

China's rare earth policies have long influenced the market power and prices of rare earth metals. Private Chinese firms engaged in intense rivalry pushed down the prices of rare earths during the first two decades of their availability worldwide. China then began reducing shipments of rare earths in 2006, citing the need for resource conservation and environmental concerns, which resulted in a sharp increase in rare earth prices.

Excessive concentration in the production and refining of rare earths constitutes a global strategic threat to development, but the restart of production in areas such as North America and Australia seems slowed down by the lack of investments and the difficulty in subsequent refining. Could this further crisis be the right opportunity to overcome these constraints?

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article Rare earths: the production crisis in Myanmar puts even China in trouble comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/terre-rare-la-crisi-della-produzione-in-myanmar-mette-nei-guai-perfino-la-cina/ on Sun, 08 Oct 2023 18:34:30 +0000.