Rates on US securities at the highest since 2007. New construction at its lowest. Inflation is scary

In the USA, the news of the unexpected inflationary peak in Canada has prompted the call for a new increase in interest rates which, in turn, has pushed up US government bond yields:

The US 10-year Treasury yield rose further to 4.35%, sitting at levels last seen in September 2007, as evidence of economic resilience supports bets of a more aggressive Federal Reserve ahead of policy decision of tomorrow.

Added to the Canadian data, the surge in rental costs coincided with the unsustainable increase in core rates, which are kept under close observation by central bankers. Earlier data showed that US consumer and producer prices rose above expectations, dispelling earlier hopes of disinflation, while jobless claims data from the previous two weeks solidified the tightness of the labor market.

The Federal Reserve is expected to keep the refinance funds interest rate unchanged tomorrow, but markets will be paying close attention to the FOMC's Summary of Economic Projections to gauge a possible rate hike in November.

Here is the trend in rates

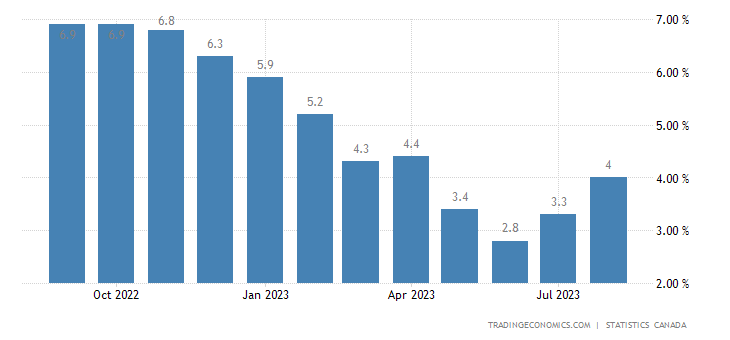

Here is the Canadian inflation, which scared the Americans and led to the increase in the US 10-year yield. The market did not expect an increase of this kind, to this level. The cause is linked to oil prices, which increased due to the production squeeze wanted by OPEC+

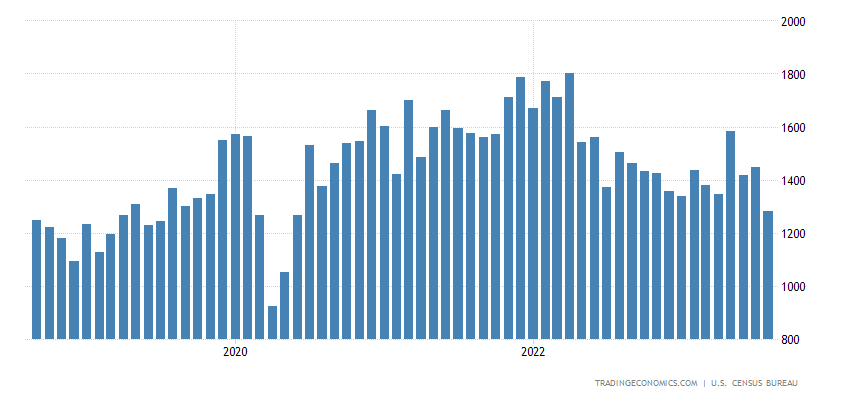

Rising interest rates are taking their toll on the US housing market and new construction is coming to a halt.

US housing starts fell 11.3 % month-over-month to a seasonally adjusted annualized rate of 1.283 million in August 2023, the lowest level since June 2020 and well below forecasts of 1.44 million.

Tighter financial conditions, soaring mortgage rates and high home prices continue to weigh on buyer affordability.

New construction of single-family homes fell by 4.3% to 941 thousand units, while for buildings with five or more units it fell by 26.3% to 334 thousand. The largest decline was recorded in the West (-28.9% to 281K), followed by the Midwest (-7.5% to 160K) and the South (-4.9% to 745K), while starts increased by '1% in the Northeast (at 97K). Here is the relevant graph

so now real estate activity is completely emerging from the bubble, indeed it is returning to the level it had just after the outbreak of Covid, when many construction sites were still closed.

The post-covid bubble has now burst, but external factors, such as the price of oil, are pushing inflation further upwards, and this suggests further rate increases. This increases the interest rate on government bonds, but generally leads to an increase in interest on all economic activities and therefore to a decline in the activity itself.

If employment data were more up-to-date and not always revised ex post, we probably wouldn't see them as so positive.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article Rates on US bonds at the highest since 2007. New construction at its lowest. Inflation is scary comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/i-tassi-sui-titoli-usa-al-massimo-dal-2007-ai-minimi-le-nuove-costruzioni-linflazione-fa-paura/ on Tue, 19 Sep 2023 15:08:56 +0000.