Real estate investments: are we facing a new bubble in Japan?

The bursting of Japan's asset bubble in the early 1990s was one of the most severe financial shocks experienced by a large economy. Not only did it consign the country to decades of little or no growth, the famous "Lost Decade", but it ingrained a devastating deflationary mentality among consumers and businesses that proved difficult to overcome and still characterizes a Japan with expansionary monetary policy .

Even today, the Bank of Japan (BOJ) persists with the ultra-loose monetary policy introduced a decade ago to banish deflation and boost growth, even as the consumer price indicator – which excludes the impact of energy and of fresh food – reached 4.1% in April, the highest since 1981.

For the BOJ, premature policy tightening could jeopardize years of efforts to drive up prices. The lasting effects of the stagnation are still evident. Even after Japanese companies agreed to the largest wage hike in decades, real wages fell 3% in April, perpetuating the decline in real spending power.

In another sign that Japan has yet to fully recover from the bursting of the asset bubble, the Nikkei 225 is still about 15% below its 1989 peak. And this is even after surging 20% since inception. of April.

Yet, in a crucial but overlooked corner of the market, prices are on the rise again. In February, the average asking price for a 70-square-meter second-hand apartment in Tokyo's 23 boroughs hit a record high of nearly 70 million yen ($492,000), surpassing the level reached at the start of the bubble.

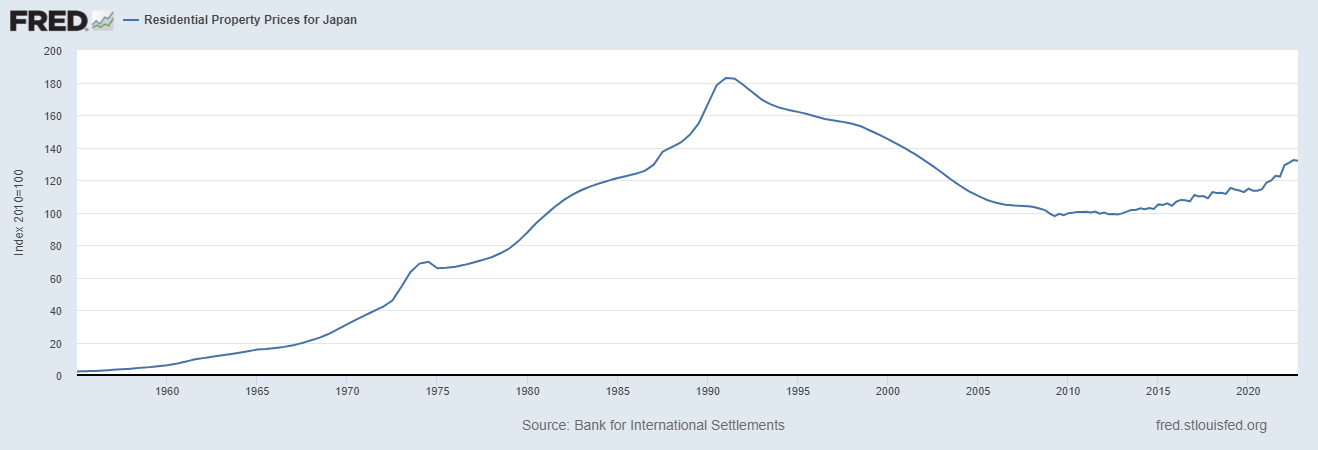

The price has jumped 76% over the past decade. In Tokyo's six central wards, the average price is just over 100 million yen, up 93 percent since 2013. Tokyo also saw the world's fourth-fastest growth rate in luxury home prices last year , with an increase in values of 22.8%. According to the index compiled by Knight Frank, the growth rate was higher than that of Miami, the hottest city, and recorded the fastest growth rate in the Asia-Pacific region. Here is a FED chart with historical average Japanese real estate values.

At first glance, the situation looks positive. As in 1981, a 70 m2 apartment in Tokyo costs 21 years of average salary for a worker, although this is mainly due to wage deflation, but there is also a positive increase in demand.

Furthermore, the key factors driving the demand for apartments in Tokyo – the rise of high-income dual-income households and the entry of more women into the workforce, a tax system that favors home ownership, the shortage of land for residential development and rising construction and labor costs – will continue to support rising prices.

However, the major factor driving prices is Japan's contested super-expansionary monetary policy overseas: the BOJ's unprecedented monetary easing has pushed mortgage rates down to very low levels. Fixed-rate loans stand at 1-2%, while variable-rate mortgages – which account for about three-quarters of outstanding loans – can be secured at a price of less than 0.4%.

Low rates have greatly increased affordability. The interest payment on a 10-year fixed-rate mortgage for a 700-square-foot apartment in Tokyo is equivalent to 32% of the starting salary of a top-tier company, compared with 150% at the peak of the bubble, Koll notes. In addition, lower borrowing costs are supporting institutional investment in Tokyo's mature multi-family housing market. While yields on multifamily assets have fallen sharply over the past decade, "Japan is one of the very few markets that offers a positive spread over financing costs," said Koji Naito, director of capital markets research at JLL in Tokyo. .

The blessing and curse of insanely low mortgage rates in Japan

This accentuates the central role played by years of cheap money in supporting the country's housing market and the prices of other assets. Valuations appear dangerously high only if one believes that the BOJ will normalize rates more sharply than expected and, more importantly, that the exit from ultra-loose policy will prove messy. The risk of a soft monetary policy lies in the exit from the policy itself, not from its permanence, and this is being observed precisely in Europe.

Global investors have grappled with this risk for some time. If the future path of inflation is critical, concerns about financial stability are more important. Even a relatively small increase in interest rates could inflict severe pain on borrowers, given that rates have been low for a long time and the share of variable-rate mortgages high. “The borrowers are effectively holding the BOJ hostage,” said Zoe Ward, founder and chief executive officer of Japan Property Central in Tokyo.

Despite this, the situation in Tokyo and Japan is much safer than in various other expanding realities in the world, especially in the East, where several cities now offer prices that are beyond the reach of middle-class professionals. According to data from Knight Frank, one million dollars can buy 60 square meters of prestigious residential properties in the Japanese capital, compared to 21 square meters in Hong Kong and 33-34 in Singapore, London and New York.

So the Japanese real estate market moves on a razor's edge and appears to be highly dependent on the monetary policy of the BoJ, but, if nothing else, it moves and is even still within the reach of a middle class that has not completely disappeared. This guarantees greater solidity, also considering that inflation is also decreasing in Japan and in any case we are at levels far removed from Europe, so it is very difficult for the central bank to intervene by raising rates. But things can always change in the future.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Real estate investments: are we facing a new bubble in Japan? comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/investimenti-immobiliari-siamo-di-fronte-ad-una-nuova-bolla-in-giappone/ on Tue, 20 Jun 2023 08:00:14 +0000.