Real estate: more mortgages and falling values. The UK’s recipe for disaster

There are two conflicting pieces of news creating quite a conundrum in the UK: falling prices and rising mortgages. Where this contrast leads we will see at the end.

Here's the first: British house prices fell 3.8% year-on-year in July, the biggest drop since July 2009, mortgage lender Nationwide said on Tuesday. The data is consistent with the forecasts of industry experts and economists.

Home prices fell 0.2% month-on-month, Nationwide said.

The survey is in line with other housing market indicators that point to soft activity caused by rising interest rates that have pushed mortgage rates above 6% for homebuyers and existing borrowers looking to refinance. .

Robert Gardner, chief economist at Nationwide, said the typical first-time buyer with a 20% deposit would see mortgage payments, at current rates, represent 43% of their salary, up from 32% a year ago. .

"This challenging affordability picture helps explain why housing market activity has been subdued in recent months," Gardner said.

And here's the news at odds with the previous one: UK mortgage approvals rose to their highest level since October 2022, the Guardian reported last month, amid signs of a scramble to secure mortgage deals sooner. of the expected hike in interest rates.

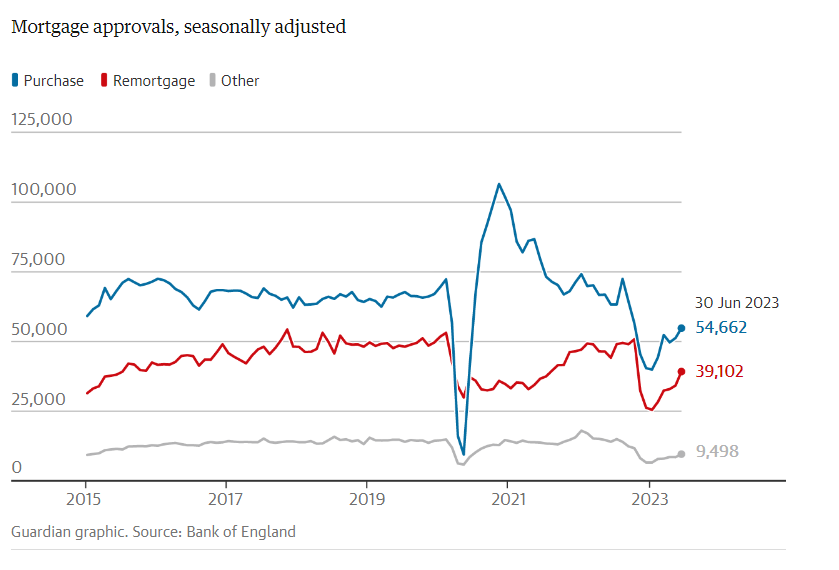

New data from the Bank of England revealed a surprise surge in mortgage demand, rising from 51,100 in May to 54,700 in June, refuting financial market expectations for a decline to 49,000.

The Bank said there was also an increase in remortgaging activity, which rose by 5,000 to 39,100 between May and June. Here is a graph showing this particular activity

So the British ran to take out new mortgages because they expect more interest increases. However, these mortgages are based on current values: as has already happened, successive increases in interest by the Bank of England will lead to further declines in property values. It is a pity that the latest mortgages have been made on current values, in the event of increases in interest rates they risk being based on excessive values and which do not guarantee the debt itself.

So more rate hikes will drive property values down in the face of a heavily leveraged market. An extremely dangerous mix that could pave the way for a banking crisis. However, the English banks seem more interesting in de-banking than the Farages.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Real estate: more mortgages and falling values. The UK's recipe for disaster comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/immobili-piu-mutui-e-valori-che-calano-la-ricetta-del-regno-unito-verso-il-disastro/ on Tue, 01 Aug 2023 09:58:42 +0000.