Recession: the demand for loans in the euro area collapses to levels seen only in deep crises

After the forecast PMI indicators, today we have a very strong confirmation of how we are really entering a strong economic recession, which has not been seen for some time and which, given the sensational mistakes in economic and energy policy that are being made in Europe, risks leading to an epochal change in the internal economic structure and in its balance of power with the world economy.

Today the ECB released data on the demand for credit to the banking system and the results are making your skin crawl.

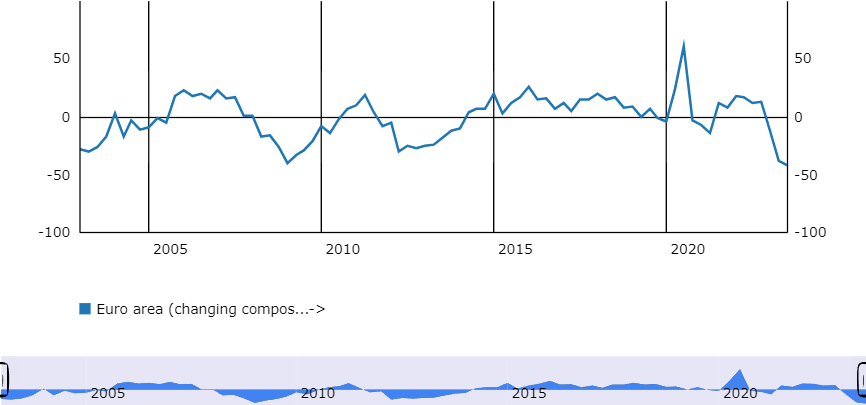

Let's start with companies : In the second quarter of 2023, this value fell to an all-time low since the survey began in 2003. The sharp decline was once again substantially stronger than expected by banks in the previous quarter, as you can see from the following chart

The increase in interest rates and the lower financing needs for fixed investments for a frozen market, were the main drivers of the reduction in the demand for loans. For the third quarter of 2023, banks expect a further sharp decline in demand for business loans, albeit much smaller than in the second quarter. Euro area banks also recorded a sharp sharp decline. The disaster is not over, on the contrary it continues.

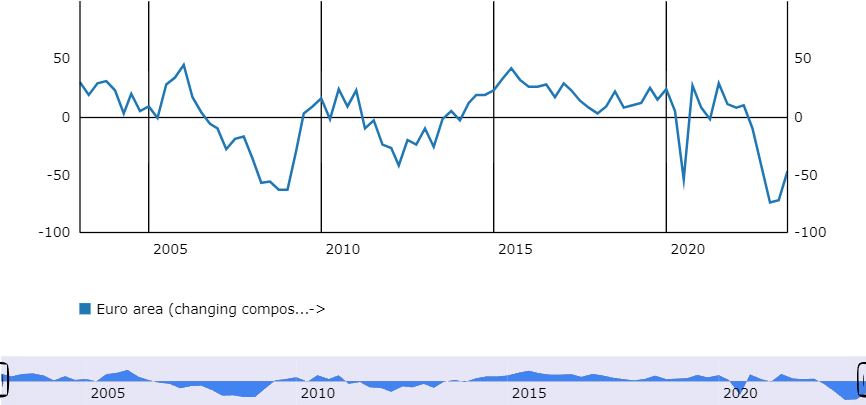

Home mortgage loans were also down this quarter, but at least less than they were in the previous quarter, as you can see

Higher interest rates, a weakening housing market outlook and low consumer confidence have all negatively contributed to demand for loans for house purchase, but this will soon be felt strongly on prices

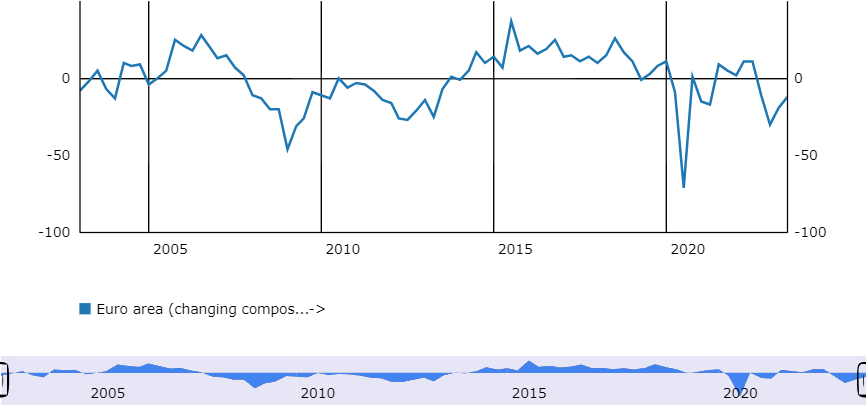

Then we have consumer loans. Also in this case we have a decrease, much less significant but also due to the very nature of these loans which are normally less important than mortgages.

Even in this case, however, the credit required drops, and we are in any case at low levels, typical of when there was a sovereign debt crisis in the euro area.

What caused this sharp drop in credit demand? There are three factors:

- a deterioration in the conditions for granting credit by banks, an element confirmed by the ECB;

- a worsening of the overall economic outlook, which discourages companies and individuals from investing or borrowing;

- an increase in the cost of borrowing, linked to the ECB's monetary policies.

What we are witnessing is the economic recession that is brewing before our eyes and preparing to explode definitively. The strength will be considerable because the drop in demand is at levels that have only been seen in moments of greatest crisis, such as, for example, during the debt crisis or that of 2009. The day after tomorrow the ECB will probably increase its interest rates, throwing more fuel on an already compromised situation.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Recession: the demand for loans in the euro area collapses to levels seen only in deep crises comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/recessione-crolla-la-domanda-di-prestiti-nellarea-euro-a-livelli-visti-sono-nelle-crisi-profonde/ on Tue, 25 Jul 2023 14:21:55 +0000.