Retail speculation sinks the Yen, but the government threatens to react

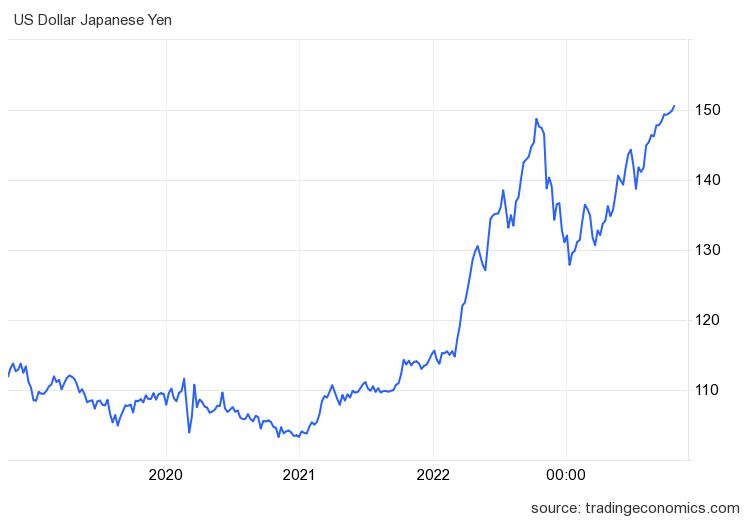

The Japanese yen has weakened beyond the critical level of 150 per dollar, and this is starting to create some concern, especially since the causes of this situation are to be found in speculation and not in the real economy. Let's see the graph that shows how the level has not been seen recently

Salaried workers flicking through their phones on the subway are now a common sight in Tokyo, but not everyone plays Pokemon Go: many use trading apps, aggressively buying and selling Yen to profit from short-term swings.

Retail currency traders are experiencing make-or-break days as rumors grow that the Bank of Japan is moving closer to raising its interest rates to record lows, with some betting on a move as early as next week. This is amplifying volatility in fast-paced currency markets by taking advantage of intraday movements, moving away from the previous focus on interest rate differentials.

Obviously the Japanese government does not like this speculation, and this raises fears that the government may intervene in the foreign exchange markets to support its currency. The yen's decline also prompted Japanese Finance Minister Shunichi Suzuki to warn speculators, saying authorities were closely watching currency movements "with a sense of urgency." However, Suzuki made no direct comment on the potential for intervention.

The basic problem is related to the contradiction between US and Japanese interest rates, but Tokyo is not wrong. The yen has weakened sharply this year as the Bank of Japan has continued to commit to ultra-loose monetary policy even as other major central banks have embarked on an aggressive tightening campaign to fight inflation.

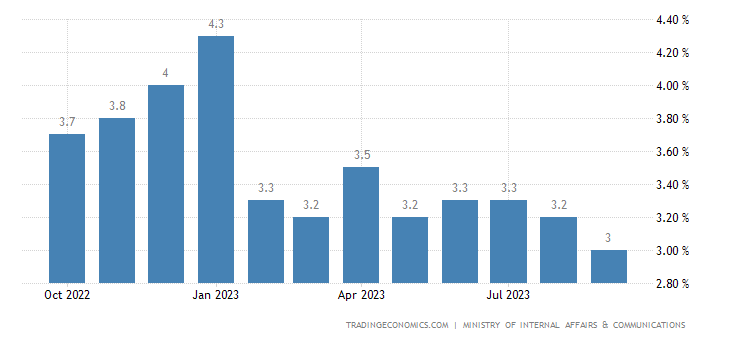

On the data front, Japan's headline inflation rate fell to a one-year low of 3% in September, while the core inflation rate slowed to 2.8% at a 13-month low but remained above of the central bank's 2% target for the eighteenth consecutive year. However, the data are not worrying and do not justify a major change in economic policy. Here is inflation:

Then there is the problem of international politics: the extremely confusing and threatening situation in Ukraine and the Middle East strengthens the position of the US dollar, which has always been the safe haven currency, but the international situation is becoming complex.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article Retail speculation sinks the Yen, but the government threatens to react comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-speculazione-retail-affonda-lo-yen-ma-il-governo-minaccia-di-reagire/ on Thu, 26 Oct 2023 09:00:51 +0000.