Russia and Liquefied Natural Gan: despite efforts, production goals are far away

Russian oil production has remained strong despite sanctions imposed by Western countries in the wake of Russia's invasion of Ukraine. The country's gas and liquefied natural gas (LNG) industries , however, have suffered due to limited pipeline infrastructure and dependence on Western companies.

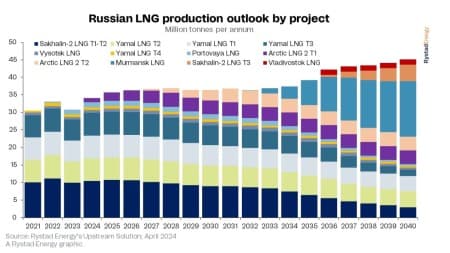

Rystad Energy expects Russian gas piped to China to increase thanks to new infrastructure, but the outlook for Russian LNG is less rosy. The Kremlin has set out an ambitious plan to bring 100 million tons of LNG capacity into operation by 2030, but expert forecasts show the country will miss this target by as much as 60 million tons.

Despite the difficult outlook, Russia's planned LNG projects will move forward despite sanctions and challenges in securing ships and long-term contracts, thanks to government funding and research and development support and incentives, as well as tax breaks. However, due to the challenging environment, Russian LNG production is highly unlikely to reach government targets, with our forecast calling for only 36.3 million tonnes of production by 2026.

In 2021, the Russian Ministry of Energy published a forecast that predicted the country's LNG production would rise to 140 million tonnes per year (tpa) by 2035, in a high scenario, or 80 million of tpa in a more conservative perspective. Last year, the ministry disclosed its plan to increase LNG exports by 33% between 2022 and 2026, to 44 million tonnes per year. In its conservative scenario, this increase is expected to reach only 18%, with a target of 39 million tonnes per year.

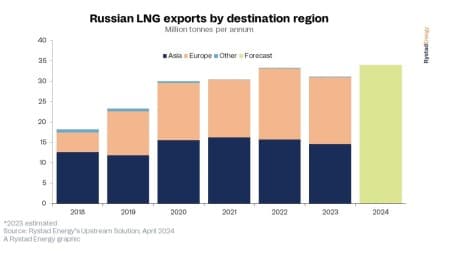

Although European countries have all but cut off Russian gas, Europe still depends on Russia for much of its LNG supplies. LNG exports to Europe increased by around 5% year-on-year in the first quarter of 2024, and replacing these volumes in the near term represents a major challenge for the continent.

“Russian oil exports may have escaped the worst impact of Western sanctions. Piped gas exports have suffered greatly, but the LNG industry has been hardest hit. The Russian government is still optimistic about the country's production, but without a significant change in fortunes, reaching the targets could be just a pipe dream,” says Swapnil Babele, vice president of energy research at Rystad Energy.

In the immediate term, according to Rystad, only the LNG projects of independent Russian gas producer Novatek will proceed, with delays of at least five years due to ship supply challenges and current market conditions. The company's primary objective is to build a low-cost LNG platform, which involves the development of proprietary LNG technologies and the expansion of production through the deployment of these new technologies. The main challenge for Novatek will be the development of logistics and the search for new buyers.

Our current forecasts indicate that Russia will bring online approximately 68 million tonnes of liquefaction capacity by 2035, with actual LNG production of approximately 40 million tpy. Novatek will account for nearly 80% of this total through its Yamal LNG, Arctic LNG-2 and Murmansk LNG projects.

Europe has become the top destination for Russian LNG exports in 2022 , overtaking Asia. Russia's LNG exports increased by 10% in 2022, reaching around 33 million tonnes, of which 17 million tonnes were sent to European markets – a 22% increase from the previous year. Last year, Russian LNG production fell to around 31 million tonnes due to scheduled maintenance of the Sakhalin-2 and Yamal LNG projects in the second half of the year. In 2024, Rystad Energy expects Russian LNG production to amount to around 34 million tonnes, thanks in part to the commissioning of Train 1 of Arctic LNG-2.

Since 2014, when sanctions were first imposed on Russian LNG, the country has prioritized the development of its own liquefaction technologies and is seeking to meet its demand for LNG equipment with local suppliers. Among these suppliers, Atomenergomash, the mechanical engineering division of Rosatom, designs and manufactures cryogenic LNG pumps, heat exchangers and turbo-expanders. Kazancompressormash builds compressor units for LNG plants, and Cryo-LNG supplies containers for LNG transportation and storage. The sanctions have helped Russia to develop its own advanced technological know-how in the sector which can now be offered to third parties at extremely competitive costs.

In 2018, Novatek obtained a patent for its “ Arctic cascade ” technology, which was implemented on the fourth train of Yamal LNG. However, the technology was not fully developed and the project encountered several problems which led to patent changes. In June 2023, the company obtained another patent for the “Arctic mix” technique, designed for large-scale natural gas liquefaction using mixed refrigerants. This technology is expected to be the primary method for future projects.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article Russia and Liquefied Natural Gan: despite efforts, production targets are far away comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/russia-e-gan-naturale-liquefatto-nonostante-gli-sfornzi-gli-obiettivi-di-produzione-sono-lontani/ on Sat, 27 Apr 2024 13:33:37 +0000.