Russia: public debt costs too much? I don’t issue any more ..

The increase in the yield on Russian government bonds has reached almost 10% per annum. This forced the Ministry of Finance, for the second time since the beginning of the year, to stop the auctions for the placement of OFZ, the Russian public debt securities . For investors, the rates have become interesting, but the expectations of a further drop in prices in the coming days, driven by the crisis in Ukraine, push them to delay purchases, but no problem for the Moscow coffers: the rich royalties deriving from the oil, at high prices, makes it possible to avoid issuing debt. The situation is different for private individuals, who may find themselves in serious financial difficulties.

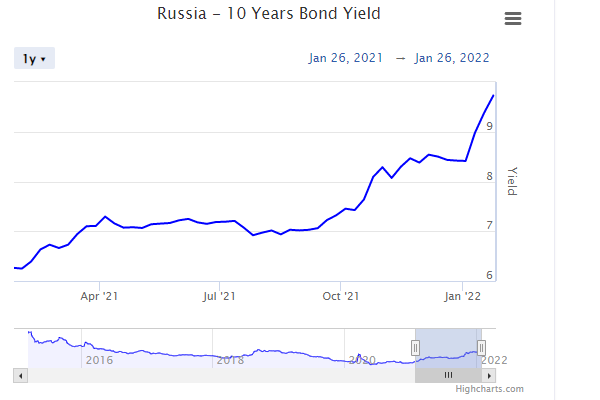

The Ministry of Finance has again refused to hold auctions for the placement of OFZ. Just like a week ago, this was done "to help stabilize the market situation". Yields had grown a lot (worldgovernementbonds data)

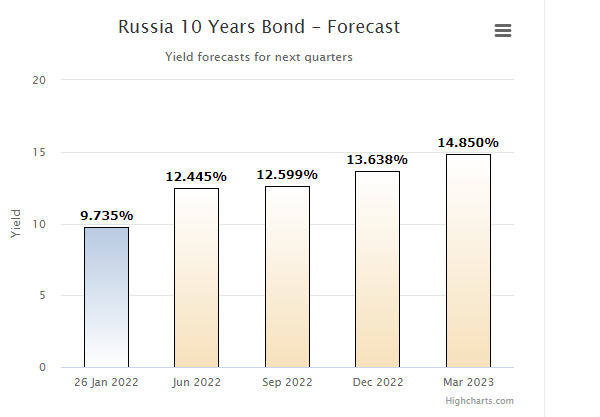

Not only that, the forecasts for subsequent issues saw further growth in yields

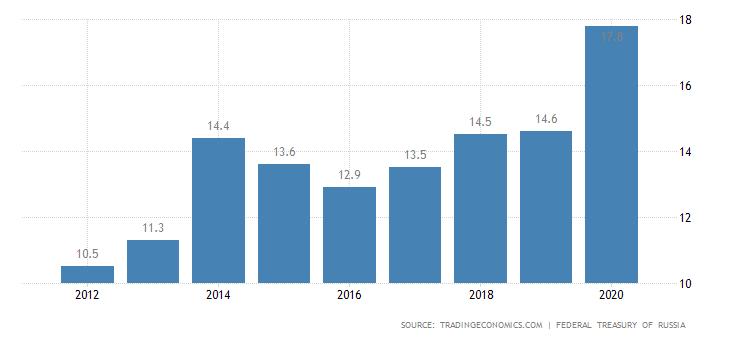

For these reasons, the Russian finance ministry has ordered the auction to stop. which is possible, as we have said, due to the high income from energy royalties and because the Russian debt is very low:

The start of the year was generally negative for the Russian financial market in a context of growing geopolitical risks. In addition to the collapse of stocks and the sharp weakening of the ruble (see Kommersant on January 25), debt market rates have also skyrocketed. According to the Moscow Stock Exchange, the yield on short government bonds already exceeds 10% per annum, long government bonds are traded with a yield of 9.6-9.8% per annum. At the same time, two weeks ago, the yield on short-term government bonds was 8.5-8.7% per annum, long-term, at the level of 8.5% per annum.

This year, in a context of increasing volatility, issuers have also reduced their activity. According to daily reports of the Moscow Exchange, large issues (more than 100 million rubles and excluding short-term bonds of VTB and VEB) were placed only by Sberbank and VTB, mainly in the form of investment bonds, as well as by small issuers (Sibneftekhimtrade). Last week, Sberbank postponed the placement of subordinated bonds and this week the issue was postponed by A Development. This situation is more dangerous because it can lead to a slowdown in Russian industrial investments, including in energy, which are the basis of Moscow's current wealth.

The total volume of placements in the first quarter is expected to amount to 700 billion rubles (780 million euros). Taking into account the placements already made in the first working week (for 28.5 billion rubles, 30 million euros), the ministry will have to place an average of 84 billion rubles in the remaining auction days. However, the Ministry of Finance has no strict issuance obligations and last year, when the market situation worsened, the department also refused to hold the auctions even though the current plan was not followed.

Moscow's rather small financial problems are all connected with political issues, namely the Ukrainian situation. But whoever thinks of throttling Moscow financially, with gas and oil prices at current levels, has really made a big mistake. Can Moscow wait to sell bonds, can Europe wait to buy gas?

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Russia: public debt costs too much? I do not issue any more .. it comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/russia-debito-pubblico-costa-troppo-non-ne-emetto-piu/ on Wed, 26 Jan 2022 10:00:52 +0000.