Sectors and companies affected by Western sanctions (eye on Unicredit …)

Police officers walk on Red Square in downtown Moscow on February 19, 2020. – Russia on February 18, 2020 said it would ban all Chinese citizens from entering its territory from February 20, in a drastic measure against the spread of the new coronavirus, local news agencies said. (Photo by Yuri KADOBNOV / AFP)

The Ukraine-Russia clash, together with the reactions of European countries and the US in the form of sanctions, find some Western companies particularly exposed, and others instead in a position of advantage.

Advantageous positions include all oil and energy companies that have no positions in Ukraine or Russia. As for the group of companies heavily penalized by the war, this boils down to a handful of companies because the Ukrainian economy is relatively small and the Russian one is currently rather self-sufficient.

Despite the relatively low exposure, however, energy costs are at the heart of the Fed and ECB's anti-inflation crusade and the Russia / Ukraine crisis could force a reassessment of the Fed's tightening path, and exit from QE of the ECB, with the result that central banks will become less aggressive, while politicians may consider further fiscal stimulus to increase domestic energy production or the development of alternative or otherwise located sources of supply.

That said, Russia is a major producer of nickel, aluminum and diamonds. In 2021, Russia accounted for ~ 35% of the global supply of palladium, ~ 10% of platinum, ~ 6% of primary aluminum, 7% of nickel, 4% of copper and approximately 30% of rough diamonds. Metal prices have already reacted to the risk of supply disruptions, but sanctions on exports of any of these metals / commodities could drive prices up further; global visible stocks are already depleted, which means that metal prices will respond quickly to any supply shocks. Russia's importance to the global auto industry is particularly high (platinum and palladium) and the recent experience of sanctions against leading aluminum producer Rusal in 2018 shows the potential disruption effects on global supply chains.

Given the importance of Russian gas to Europe, Deutsche Bank warns that energy prices could remain high or rise further in Europe in the event of supply disruptions. Aluminum and zinc production is energy intensive with numerous plants in Europe having reduced production in recent months due to high energy prices. The surge in energy prices has led at least seven aluminum smelters in Europe to announce partial or total reductions, totaling more than 700 kt / y in capacity. Europe produced about 4.3 tons of aluminum in 2021, or about 15% of world production excluding China, and is highly dependent on imports (including from Russia).

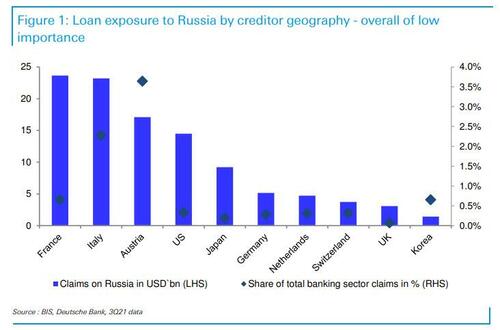

Let's start with financial institutions with direct relationships The good news also in this case is that the direct exposures of European banks to Russia and Ukraine are limited and concentrated among a handful of banks, among which, however, the Italian ones are among the first, even if , however, exposure is limited:

Our banks have $ 23 billion of exposure to Russia, equal to 2.5% of the total. We are the ones with the highest absolute exposures, with France, but, in any case, these are limited figures.

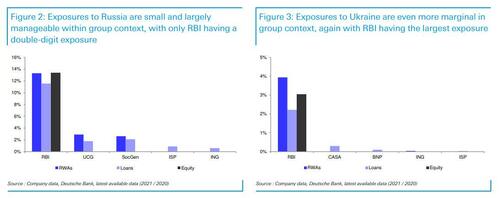

Even at the level of individual banks it does not change much, with the Austrian Raiffeisen Bank International being the most exposed, followed by Unicredit and SocGen, although for both the relative importance is already much lower according to Deutsche Bank. Only the Austrians would have some minor problems

Finally, focusing only on commodities, Deutsche Bank notes that the following companies have significant exposure to aluminum, nickel, zinc and energy:

- Norsk Hydro (aluminum),

- Alcoa (aluminum),

- Anglo (diamonds),

- Boliden (zinc, nickel),

- Glencore (zinc, nickel, thermal carbon),

- BHP (petroleum),

- Teak (zinc)

- Sibanye (rare and precious metals).

The market is the best arbiter, and here are some of the companies that have been hit hardest today:

- London-listed Ferrexpo, which operates iron ore mines in Ukraine, drops to 11%, while Russian gold miner Petropavlovsk loses 15% in UK trade; Eurasia Minerals -29%; Polymetal International -33%, Evraz -30%

- Construction equipment supplier Ferronordic, which has major business in Russia and neighboring states, loses up to 23%, the highest figure ever recorded

- The fashion retailer BVG (Polish), which sells clothes in the Russian area, drops by up to 24%, also the highest ever recorded.

- Raiffeisen Bank drops to 12%, overcoming a sectoral collapse in banking stocks;

- Bank of Georgia group also fell 12%

- Airline operator Wizz Air, operating in CEE, slides up to 17%

- Other decreasing stocks exposed to Russia include Buzzi Unicem -5.8%, Hyve Group -9%

- Bank stocks are among the worst in Europe on Thursday, with the Stoxx 600 Banks down 4.1%: Raiffeisen -10%, Deutsche Bank -5.7%, Commerzbank -5%; UniCredit drops to 7.3%, the most since November

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Sectors and companies affected by Western sanctions (watch out for Unicredit…) comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/settori-e-societa-colpiti-dalle-sanzioni-occidentali-occhio-a-unicredit/ on Thu, 24 Feb 2022 21:57:02 +0000.