Solar energy sector: after a record-breaking 2023, a 2024 of anticipation

In 2023, the US solar sector experienced a very successful year: installed capacity increased by 55% compared to the previous year, reaching a record 33 GW, thanks mainly to strong growth in residential solar and high solar prices. power. Almost surprisingly, the Sunshine State of Florida continues to dominate the rankings of solar energy states, installing 2.5 GW of new capacity in the first half of the year, more than 50% more than second place, Florida. California.

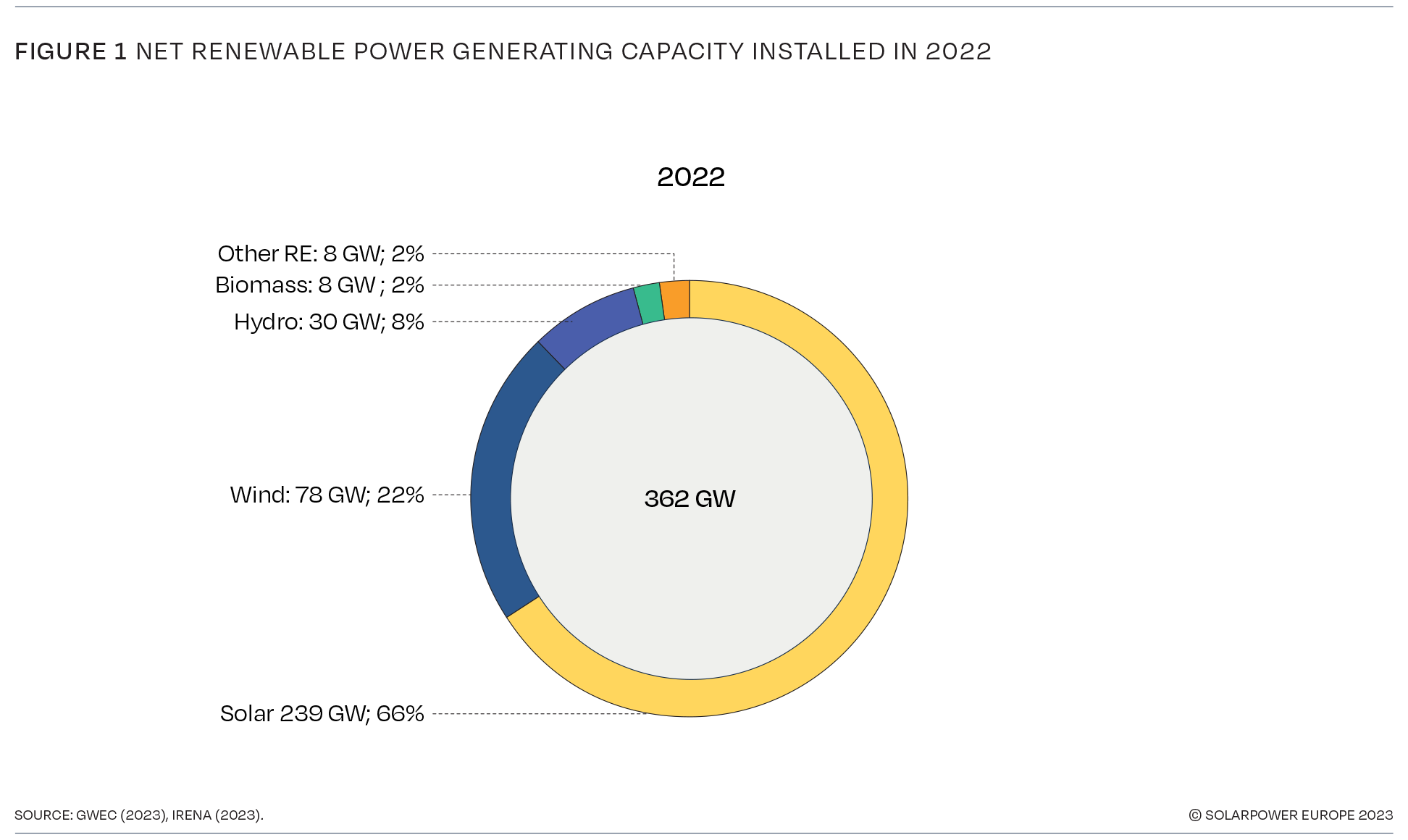

The sector has also grown significantly in Europe. Worldwide there were now 362 GW of energy installed, at the end of 2022, of which 230 GW was solar.

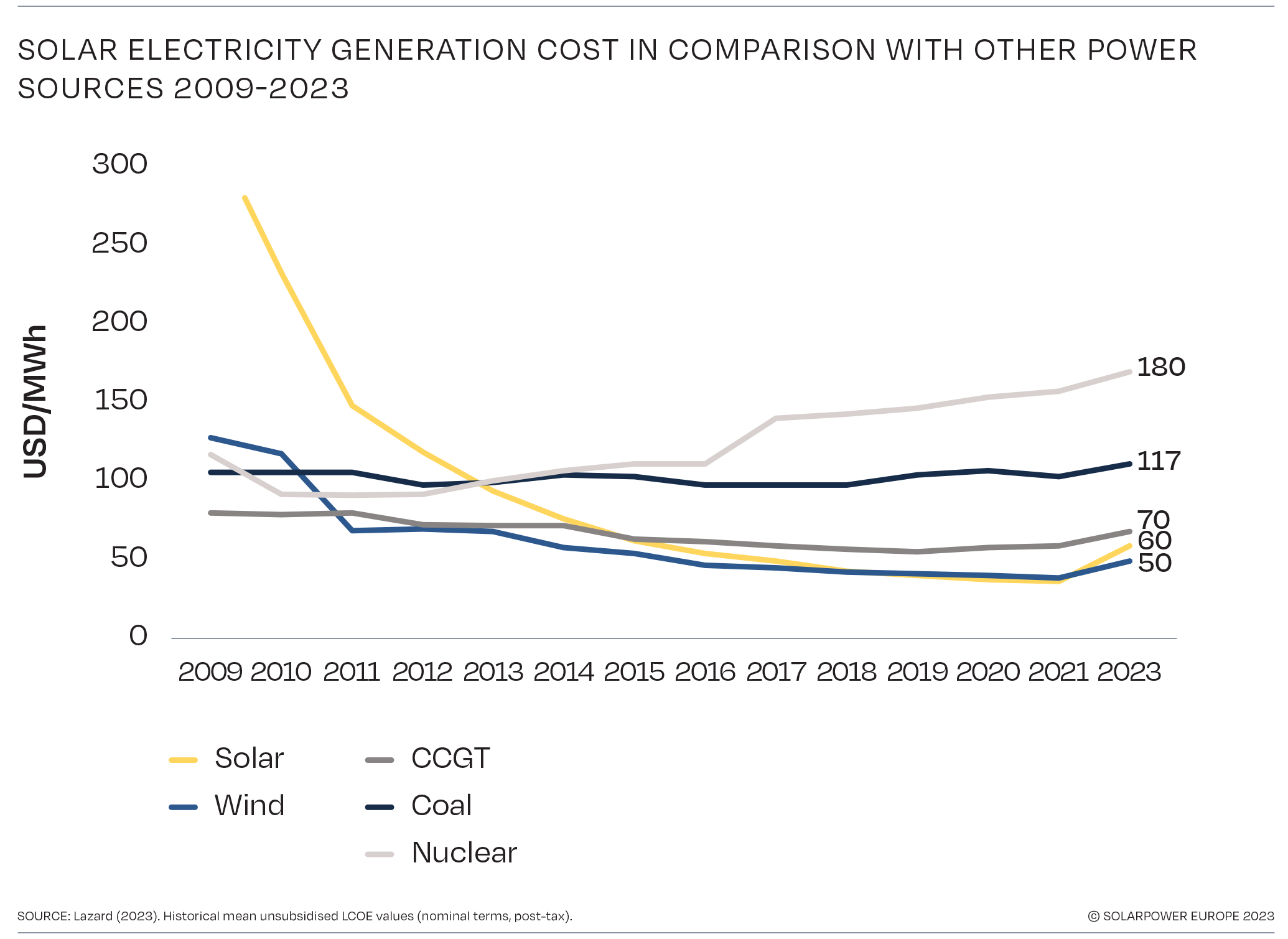

In the meantime, costs per KW have dropped sharply, also due to the drop in production costs, especially in China, and this has made this type of renewable energy among the most convenient

Obviously the leader of the world economy, the USA, has also been at the top in the solar energy sector.

“The United States is now a dominant player in the global clean energy economy, and states like Florida, Texas, Ohio and Georgia are at the forefront of job growth and economic prosperity. The solar and storage industry is providing abundant clean energy that is generating tens of billions of dollars in private investment, and that's just the tip of the iceberg,” said Abigail Ross Hopper, president and CEO of Solar Energy Industries Association.

Earlier this year, the International Energy Association reported that the amount of capital investment flowing into the global solar sector is on track to exceed, for the first time ever, the amount of intended for oil production. According to the IEA, global solar investment is expected to attract more than $1 billion per day in 2023, with more than $1.7 trillion going to clean energy compared to $1.1 trillion going to oil and gas.

Unfortunately for solar advocates, this brisk pace is unlikely to be repeated next year. The U.S. solar sector is expected to see more modest growth of 10% in installed capacity in 2024, hampered by high interest rates and net metering policy in California, according to a report from the Solar Energy Industries Association (SEIA) and Wood Mackenzie.

The interest rate function

U.S. interest rates have risen sharply in recent years, rising from about half a percentage point during the pandemic to the current 4.3% as the Fed withdrew monetary stimulus in an effort to fight inflation. But, at least, it worked: Underlying inflation fell again in October , with Multivariate Core Trend (MCT) inflation coming in at 2.6% in October, up from 2.88% in September. Consumer prices rose 3.2% last month, much less than the 9.1% year-on-year inflation recorded in June 2022.

Unfortunately, investments in renewable energy tend to be very sensitive, and high interest rates tend to hurt them much more than any other part of the energy sector. That's because clean energy projects require developers to borrow large amounts of capital up front to build the projects. But this is only part of the picture. The cost of electricity generated from renewable energy is much more affected by rising rates than electricity generated from fossil fuels: the International Energy Agency found that a 5% increase in interest rates increases the levelized cost of electricity produced by wind and solar energy by as much as 33%, but only marginally for natural gas plants .

This is very bad news for clean energy, considering that the current inflation rate is still a little above the 2% target of the central bank, which has signaled its willingness to further reduce its balance sheet .

Indeed, a monetarily aggressive Fed is the main reason why US solar stocks are faring much worse than their oil and gas brethren, despite record installations: the Invesco Solar ETF fell -42.1 % over the past 12 months, compared to a much smaller loss of -3.7% for the Energy Select Sector SPDR Fund. “There is a dark cloud hanging over green stocks,” Martin Frandsen, portfolio manager at Principal Asset Management, told the Financial Times.

Meanwhile, California's new solar policy could prove problematic for future installations. Called Net Energy Metering 3.0, the overhaul of California's solar energy policy reduces the value of solar energy credits by as much as 75% in an effort to encourage customers to purchase battery storage with their solar system. Essentially, the California Public Utilities Commission (CPUC) wants state residents to store more excess solar energy instead of sending it to the grid. The new policy has come under heavy criticism from both residents and solar equipment manufacturers, who say it discourages the adoption of solar energy and makes it less affordable.

Not everyone, however, agrees with this bearish view. EnergySage argued that solar buyers in California still see very favorable economics:

All three California utilities increased their electric rates significantly, with San Diego Gas & Electric increasing its rates by 25% over those under NEM 3.0. This directly translates into shorter payback periods.

Solar prices in California have fallen more than 5% since peaking in April 2023. Paying less for solar installations means faster payback times.

Does NEM 3.0 actually result in a shorter payback period?

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article Solar energy sector: after a record-breaking 2023, a waiting 2024 comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/settore-dellenergia-solare-dopo-il-2023-da-record-un-2024-di-attesa/ on Mon, 11 Dec 2023 12:08:22 +0000.