Spain: A devastating real estate crisis is brewing. This is the consequence of the Euro and the policy of the ECB

Spain is one of the European economies hardest hit by the COVID-19 virus crisis, partly due to its huge dependence on tourism. In fact, according to data published in February by the Organization for Economic Co-operation and Development, Spain is the OECD country (out of 38) where real household income has declined the most since the pandemic. It is also the EU country that has suffered the largest decline in per capita income since 2020, and has been overtaken on this indicator by Slovenia, Lithuania and Estonia.

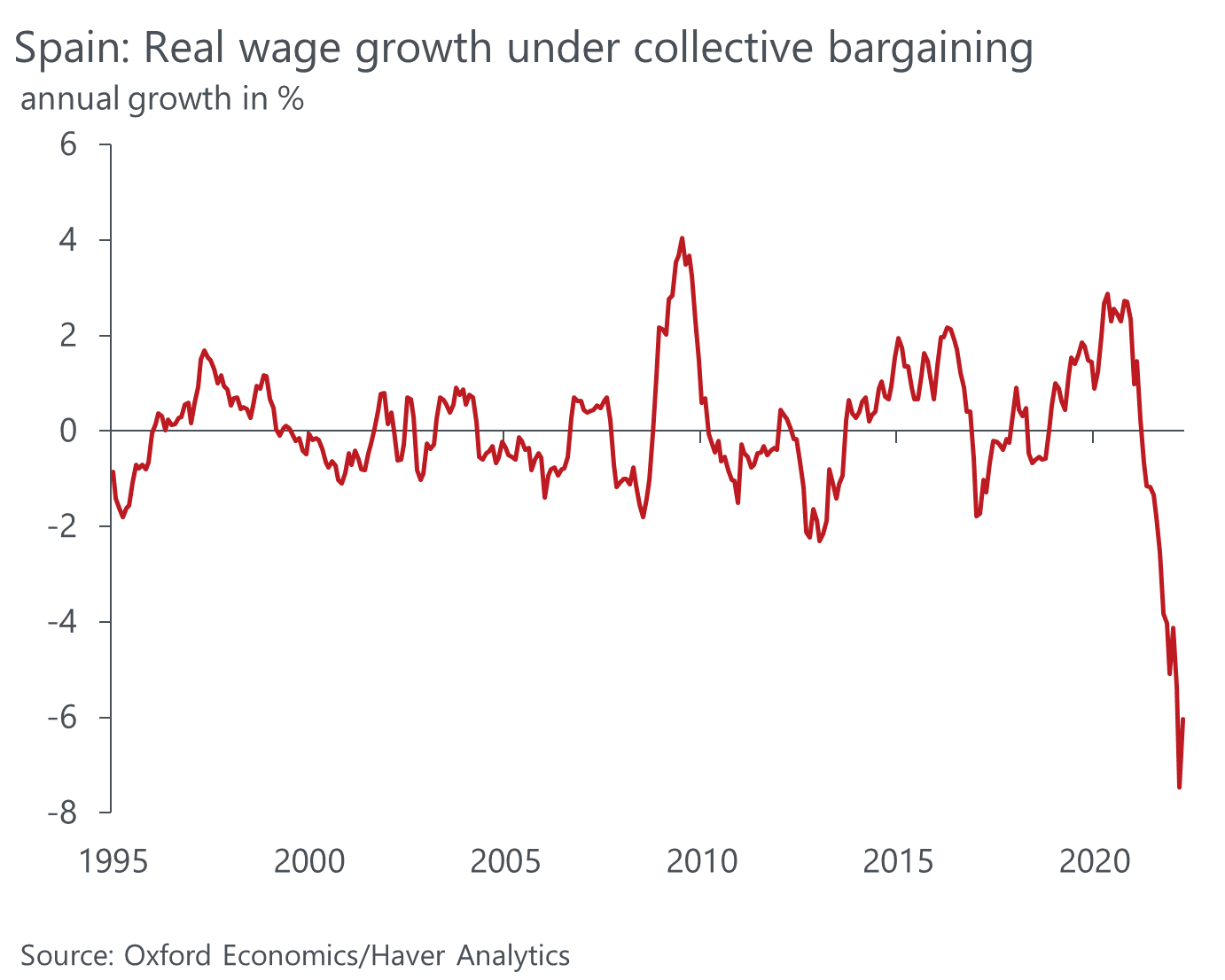

Now, after years of falling real incomes, millions of households are facing skyrocketing mortgage payments due to rapid interest rate hikes by the European Central Bank, with real wages plummeting as can be seen below

Poverty never has fathers

Obviously nobody wants to take responsibility for this disaster. After taking a beating in recent local and regional elections, Pedro Sánchez's government now faces an uphill battle in next month's general elections. As mortgage costs rise, the government is desperate to hold the European Central Bank (ECB) and its Spanish branch, the Bank of Spain, accountable. Asked in an interview about the state of the Spanish economy and the potential impact of the latest round of ECB interest rate hikes on Spanish homeowners, Spanish Economy Minister Nadia Calviño said:

“You have to ask [Luis de] Guindos, [vice president of the European Central Bank], and [Fernando] De Cos [governor of the Bank of Spain]; they are the Spaniards behind the increase in mortgages”.

Calvino is right, of course. Just like Sánchez himself when he said on Tuesday that "the [Spanish] government has no powers over monetary policy", even if the government is indirectly to blame: someone will have signed the accession to the Euro and the renunciation of the Peseta , this did not happen by itself. Then his government – like all EU governments – is partly to blame for the high inflation due to its continued support for sanctions against Russia, Europe's main supplier of energy and other vital goods. This is, without a doubt, one of the main factors behind the massive spike in Europe's energy prices and overall inflation.

But the mere fact that Spain's prime minister and economy minister are both trying to shift the burden of responsibility for rising mortgage rates onto central bankers is remarkable, since top politicians rarely blame the banks central to something, unless they are in a real squeeze situation. Of course, Sánchez could have added that the Spanish central bank also has no significant influence over monetary policy in Spain, since the Spanish government ceded all decision-making powers in this area to the ECB when it joined the euro at the start of this century. But no one has the courage, for now, to affirm that the Euro was the mistake it is…

For Spain, where the consumer price index (CPI) stood at a relatively low 3.2% in May, no further interest rate hikes are needed, Calviño said, adding a caveat: the ECB must consider Europe “as a whole”. In the euro area as a whole, average inflation was 6.1% in May, almost double that of Spain. In six countries, all in Eastern Europe (Lithuania, Estonia, Latvia, Slovakia, the Czech Republic and Poland), inflation is still above 10%. So we have a classic situation for the Eurozone: too “Narrow” for some countries, and too “Broad” for others, the currency is unsuitable for everyone.

The ECB embarked on its current hike path in July 2022, when it raised the main deposit rate from -0.5% to 0%. It has since made seven more hikes, to the current rate of 3.5%, the highest since 2001. All of this is apparently needed to squeeze as much life out of the economy as possible, stifling consumer demand, triggering a recession, destroying millions of people, with the ostensible goal of bringing inflation down to a more manageable level. This ignores the fact that the spike in prices is, to a large extent, the result of supply-side factors, including, of course, the boomerang effects of the EU's 11 sanctions packages against Russia, its main supplier of power.

Although inflation has actually come down, the euro area, like the US, still has negative real rates. Meanwhile, the ECB's rapid rate hikes are triggering all sorts of unfortunate side effects, many of them intended. Among them is the rapid rise in costs for homeowners as mortgage rates soar. Spain is particularly vulnerable to this trend, as around three-quarters of its mortgage owners have variable-rate loan agreements tied to the ECB's deposit rate, even though they typically only adjust once a year.

Real estate crisis 2.0?

Spain has already witnessed one of the most spectacular real estate booms and busts of this century in its early years. During the height of the boom, from 2003 to 2005, some 700,000 homes were built each year, more than were built in Germany, France, Italy and the United Kingdom combined, with a total population four times higher than the Spanish one. When the dust of the subsequent collapse had largely settled, around 2015, over 600,000 families had lost their homes (and bear in mind that in Spain mortgages are with recourse, as in Italy, i.e. debts do not disappear once the the guarantee.So hundreds of thousands of families were ruined for life.

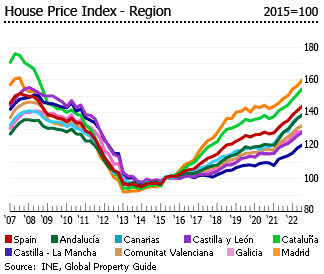

In recent years, banks, developers, big developers and the former Rajoy government have done everything to create a new housing bubble , with some degree of success. In 2019 the prices of some of the most important real estate markets in the country, such as Madrid, Barcelona and some coastal and island markets, had recovered much, but not all, of the ground lost in the previous crisis. However, in other less attractive markets, house prices barely increased and in some cases remained below their Q1 2015 level, when the national trough occurred.

In 2020, the year of the covid, the Spanish real estate market suffered a setback, as in most countries, before picking up the pace in 2021. In 2022, the total number of residential property sales reached 650,000 , the highest level in 15 years.

But this partial recovery is now in serious danger. As I reported in Something Just Cracked in Spain's Mortgage Market in late November, Spain was one of the first European countries to introduce emergency measures to cushion the impact of rapidly rising interest rates on households already grappling with soaring of inflation:

As data from the Spanish National Institute of Statistics show, in August 2022, 72% of new mortgages signed were at a fixed rate, while 28% were at a variable rate. But this is a relatively new trend. In 2020, the ratio was roughly 50/50. In 2016, 90% of all new mortgages were adjustable rate and in 2009 the percentage was as high as 96%.

The result is that about four million of the 5.5 million Spaniards have an adjustable rate mortgage. Of these, just over a million qualified for the government's relief package. The measures, which will be in force for two years, are intended to help households adapt more gradually to the new interest rate environment. To be eligible for relief, a family must have an annual income of less than €29,400. The mortgage burden must also represent more than 30% of the income and the monthly installments must have increased by at least 20% due to the recent ECB rate hikes.

Obviously, under these conditions, the demand for real estate in Spain has started to decline. Indeed, sales began to stagnate in December 2022. Just 27,000 mortgages were signed in April, 18% less than in the same month of the previous year. This should come as no surprise, given that since November the ECB has raised key interest rates in the euro area from 1.5% to 3.5%. For holders of adjustable-rate mortgages, this has meant having to pay significantly higher monthly payments, even as the prices of many staples, including groceries, have risen. From Capital Madrid:

According to data from the Bank of Spain, in 2023 households allocated 41.5% of their income to mortgage payments, generating additional expenses of 18 billion euros in the first two months of the year. A specialist agent report analyzed data from more than 2,000 transactions concluded between May 2022 and May 2023, and the outlook is bleak due to rising interest rates.

According to data from the Housfy company, the forecast for the increase in the cost of the average mortgage payment in Spain by the end of the year is to exceed 5,000 euros per year on average. “Everything will depend on performance in the last quarter, but we can expect the increases to hit households significantly,” says David Espiago, director of banking at Housfy. According to data from the INE (National Institute of Statistics), in the last year the average mortgage payment in Spain has increased by 256 euros per month and by 3,073 euros per year.

As I noted in my previous article, the government's mortgage relief package will almost certainly not cover enough households:

An average income of 29,400 euros may be sufficient to obtain a 25 or 30 year mortgage in one of the poorest areas of Spain, such as Extremadura, some parts of Andalusia, Castilla la Mancha, Murcia, Ceuta and Melilla, but not to obtain a mortgage in major centers of economic activity such as Madrid, Barcelona, Bilbao, Valencia, Palma de Mallorca and San Sebastian. Many mortgage holders in these cities are also struggling with rising costs, but will not be eligible for mortgage relief, unless, of course, the relief package is expanded.

It is in this direction that we may soon be heading. In recent days, Labor Minister Yolanda Díaz – whose success in restoring workplace protections has made her one of Spain's most popular politicians – has proposed granting a one-off €1,000 "bonus" to all families with variable rate mortgages, provided that the loan is in the first 10 years of life and has been issued for a primary residence with a maximum value of 300,000 euros. Díaz argues that such a measure is necessary to cushion the impact of "double inflation" (rising prices of basic goods and services together with the rapid increase in mortgage payments) affecting these families.

According to Díaz, around one million families would be eligible for the emergency bonus, which means that the total cost would be around 1 billion euros. Apparently, it would be funded through a tax on bank profits, which was introduced earlier this year.

But Diaz's proposal has been roundly criticized, even by her own coalition partners. The Spanish Ministry of Economy argues that the emergency bonus would amount to a transfer of income from all taxpayers to the banks, given that they would be the final recipients:

Not surprisingly, the banks want to pass the cost of the measures on to the public sector. What amazes us is that this proposal can have the support of someone other than the People's Party, which defends the interests of financial institutions.

The Ministry is not entirely wrong. After all, the latest financial crisis ended up destroying the living standards and job opportunities of millions of (especially young) Spaniards, many of whom ended up migrating to Northern Europe and Latin America. Between 2010 and 2017, the median gross income of heads of household under the age of 35 fell by 18%, from €27,700 to €22,800. The median wealth of millennials has fallen by 92% to 5,300 euros, mainly because after the crisis almost all under 35s were financially excluded from the real estate market, largely due to the contraction of their incomes.

Many of these people can barely afford to pay rent, which in many regions has risen for much of the last decade, let alone subsidize struggling mortgage holders. But, in my opinion, there are only two alternatives.

What can be done ? The first is to force the banks to share the economic pain, drastically limiting the increase in mortgage payments.

This is already happening in Greece, where the four largest banks will have to absorb any further increases in mortgage interest rates from May 2023 to May 2024, to help households cope with rising housing costs. However, a measure of this kind would have enormous costs and would seriously endanger the Spanish credit system. Already fragile banks would see their operating income cut at a time when there is an increase in NPLs due to the decline in real incomes of heavily indebted citizens, and this can only cause a wide-ranging credit crisis.

An alternative for the government would be to act at a European level to put pressure on the ECB to change its monetary policy. In this he would certainly have the support of Italy, France, Greece, but it is a question of opposing Germany, the Netherlands and Austria and Spain has rarely had this courage. Those who tell me that the ECB is independent bite their tongues: independence does not exist, if ever there is the possibility of choosing which influence to follow .

The other alternative is to do nothing, but this risks triggering another housing crisis. That's probably what will happen.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Spain: a devastating real estate crisis is brewing. This is the consequence of the Euro and the ECB policy comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/spagna-si-sta-preparando-una-crisi-immobiliare-devastante-questa-e-la-conseguenza-delleuro-e-della-politica-della-bce/ on Sat, 24 Jun 2023 16:20:50 +0000.