Stocks and Inflation: Are They Good Together? A possible answer ..

Stocks and inflation: do they go well together? At a time when the West is filled with more or less justified inflationary fears, what will happen to stocks? Will they prove to be a good investment?

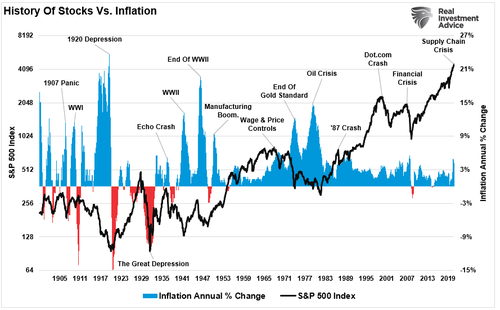

Let's consider the US stock market and especially the S & P500. Since 1991, the period in which they chose to represent the market, the S&P 500 has had an average annualized return of 8.5% after adjusting for inflation. It seems an exceptional figure, but if instead we start our analysis from 1929, to include that crisis and above all times of high inflation, the return on shares net of inflation is reduced to 7.3%.

Theoretically, those who invest in stocks should not worry about inflation because the investment will exceed inflation in the medium term. Moreover, the shares, at least theoretically, represent real assets, company shares, which therefore revalue themselves. However, often the evaluation of the average return, as the previous analysis shows, depends on the year considered as year zero. Furthermore, the average return is not the exact one year by year, and many years may NOT correspond to what is indicated by the averages. The usual problem of Trilussa.

Furthermore, it is necessary to understand what is driving inflation. Take, for example, the 1970s: in these years, inflation had an external origin, and severe problems in oil supplies caused forecast profits to jump. In general, a stagflationary push, such as the current one, compresses the purchasing capacity of consumers and therefore destroys company profit forecasts. On the other hand, inflation that is not excessive, constant, typical of a growing economy and offset by adequate income growth, is not a problem for corporate profits. We see this effect clearly from the following chart which correlates SP500 and inflation

But beware that even strongly deflationary moments, such as the 1930s, are extremely negative

So often inflationary or deflationary peaks coincided with moments of severe crisis which obviously influenced the prices of equities. So the claim that stocks are a safeguard from inflation, while valid in general and on average, may be incorrect at specific historical moments.

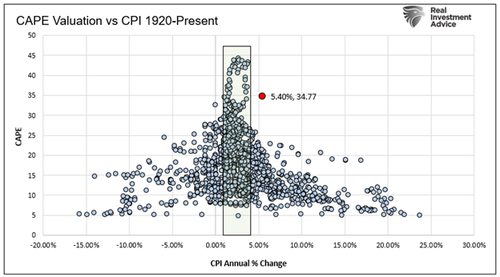

Overall, which inflationary level ensures the best equity return? Let's read the following graph that correlates the CAPE, corrected price-to-earnings ratio based on the economic cycle and inflation, and the different levels of inflation recorded from 1920 to today.

The best level of return on the stock market, indicated by the P / E, historically occurs with inflation between 0 and 5% . So neither deflation nor excessive inflation. The problem now is this: if we take 2021 as year zero, isn't it that we will still be punished because we are at the top of a bubble?

Posterity will judge.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Stocks and Inflation: do they fit together? A possible answer .. comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/azioni-e-inflazione-vanno-bene-assieme-una-possibile-risposta/ on Sat, 06 Nov 2021 18:06:29 +0000.