The 6 figures of the Chinese economy that are worrying

China's economic growth continued to lose momentum in May on weak retail sales and industrial production, while youth unemployment rose to another record high, according to data released on Thursday.

“All the data so far sends consistent signals of weakening economic momentum,” said Zhang Zhiwei, chief economist at Pinpoint Asset Management. “To make the economic recovery sustainable, a significant boost from government policies appears to be needed.” Here are the six most worrying indicators relating to the Chinese economy

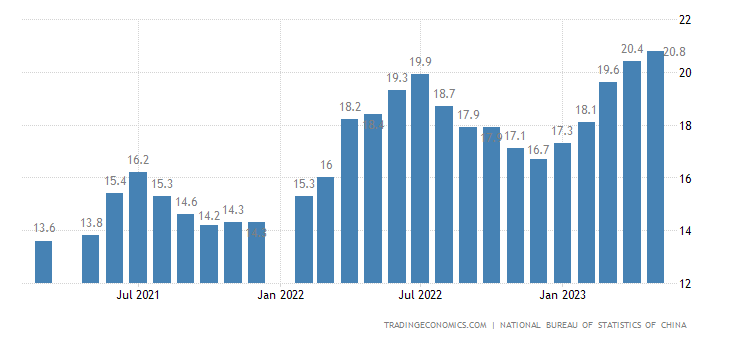

1. Youth unemployment is on the rise

The unemployment rate among Chinese youth aged 16-24 reached a new high of 20.8% in May, up from 20.4% in April.

But National Bureau of Statistics spokesman Fu Linghui said "some people have misunderstood the overall volume of our numbers," noting that only 33 million of the 96 million people in the 16-24 age group are currently in able to work, as many are students. And of those 33 million, he added, only a fifth were unable to find work.

Youth unemployment rate in China (16-24)

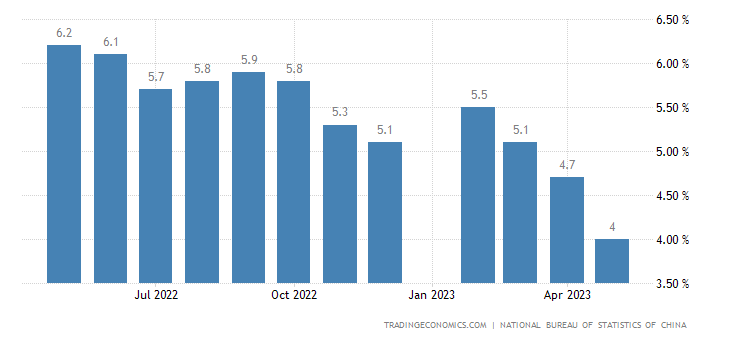

Meanwhile, the overall surveyed urban unemployment rate came in at 5.2% in May, unchanged from April.

2. Slowdown in retail sales

Retail sales posted a year-on-year increase of 12.7% in May, below the expected increase of 13.6% and lower than April's 18.4% increase.

Analysts attributed the slowdown to slower growth in coronavirus-sensitive food service sales and auto sales.

“Retail sales are our focus, as they are currently the only functioning engine of China's growth,” said Robert Carnell, regional research manager for Asia-Pacific at ING.

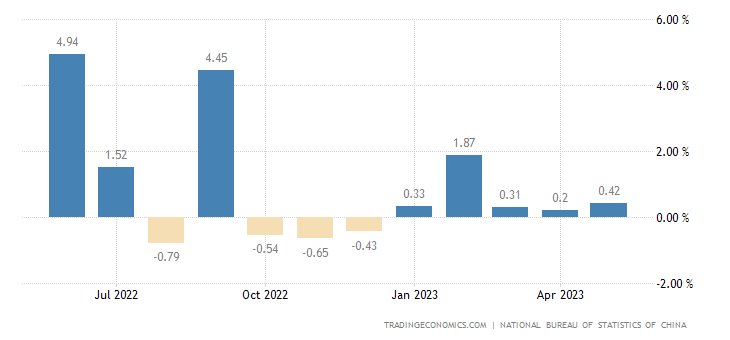

“And while the 12.7% year-over-year growth rate sounds impressive, this equates to a seasonally adjusted month-over-month decline in sales and shows that reopening momentum is ebbing.” Here is the month-over-month sales graph

3. Declining industrial production

Industrial production rose 3.5% year-on-year in May, below estimates for a 4.1% increase and down from April's 5.6% growth. According to analysts, the slowdown was led by the manufacturing and extractive sectors, while growth in the services sector remained unchanged.

The level of production is still consistent with relatively contained growth in the demand for goods, and therefore not cause for much celebration.

“Industrial production improved last month, expanding 0.7% MoM. However, it made up some ground after the April contraction,” said Julian Evans-Pritchard, head of the China economy at Capital Economics.

"The level of production is still consistent with a relatively contained growth in the demand for goods, and therefore it is not a reason for great satisfaction". Industrial production by private firms grew by just 0.7% last month, far less than the 4.4% increase recorded by state-owned enterprises, but private firms produce for the market, not for often eccentric projects.

4. Investments are declining on a massive scale

Fixed asset investment rose 4% in the first five months of 2023, year-on-year, but down from the 4.7% increase seen in the first four months. The decline, according to analysts, was large-scale, except for infrastructure, with the largest share of the real estate sector.

Real estate investments fell 7.2% in the first five months of the year, compared to a 6.2% decline in the first four months.

The growth of investments in infrastructure slowed down due to the lack of fiscal support and the contraction in real estate investments further accentuated.

Fixed assets investment by private enterprises fell by 0.1%, compared with a 0.4% increase in the first four months and in stark contrast to the 8.4% growth of state-owned enterprises from January to May. Investment by state-owned enterprises increased by 9.4% from January to April.

“Infrastructure investment growth slowed as fiscal support fell and the real estate investment contraction deepened further,” added Evans-Pritchard of Capital Economics.

“Broader housing data was also weak. Home sales have declined, price growth has cooled and new home starts have continued to decline. Here is the related graph

5. Why is the PBOC putting so much effort into supporting the economy?

Ahead of Thursday's data release, China's central bank cut the interest rate on medium-term loans for financial institutions, marking the third policy rate change in three days as part of efforts to prop up the slowing economy through new monetary easing.

The People's Bank of China (PBOC) lowered its rate on medium-term loans to financial institutions from 2.75% to 2.65%, after cutting the rate on seven-day repurchase agreements and lending transactions on Tuesday permanent.

“These largely symbolic monetary policy responses respond to rising expectations of market easing and further cuts are likely,” said Louise Loo, chief economist at Oxford Economics.

These cuts are signs of Chinese authorities' concern for economic growth and its strength. The problem is there, and it's serious.

6. The authorities' next moves

The PBOC will announce next week the setting of its two key lending rates for June.

The one-year benchmark rate (LPR) — on which most new and outstanding loans are based — and the five-year LPR — a benchmark rate for mortgages — will be announced on Tuesday.

“We expect further (targeted) easing measures in the coming months, especially in the fiscal and real estate fields, to counter the continued weakness in the economy, although the size of the stimulus is expected to be smaller than in previous easing cycles,” they said. the economists of Goldman Sachs.

Furthermore, it is to be expected that there will be a further series of recovery measures, probably linked to more tangible aid to industrial sectors, such as consumer incentives in key sectors such as electronics and cars. In addition, the financial aid to the provinces will continue for the development of the local real estate sectors.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article The 6 worrying data on the Chinese economy comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/i-6-dati-delleconomia-cinese-che-preoccupano/ on Sat, 17 Jun 2023 08:09:15 +0000.