The Bank of Japan does not raise rates: it is now looking beyond inflation

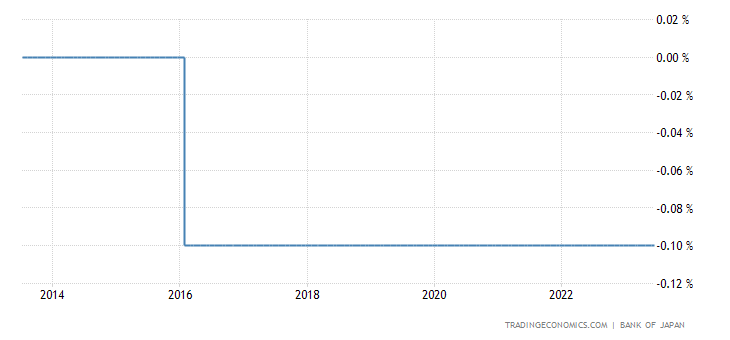

Tokyo is not Frankfurt, luckily for the Japanese. At its June meeting, the Bank of Japan kept its short-term benchmark interest rate unchanged at -0.1% and 10-year bond yields at around 0%, by unanimous vote. The board also made no changes to the 0.5% yield ceiling set for bond purchases.

While stating that inflation in the country will ease over the course of the year, policy makers added that they will patiently continue with monetary easing and respond to the uncertainties of the economy and the dynamics of prices and financial conditions. In this way, the central bank aims to achieve a price stability target of 2% in a sustainable way, accompanied by wage increases. Here is the graph relating to the interest rates applied by the BoJ, practically a flat electrocardiogram.

Friday's move was in stark contrast to that of the ECB, which raised borrowing costs to a 22-year high and announced further rate hikes. In the US, the Fed has signaled that it has not yet finished the fight against inflation. Turning to the broader economy, the Board considered it likely that manufacturing in Japan would pick up in the middle of fiscal 2023, supported by pent-up demand.

“Despite the positive surprises on the growth and inflation front, we believe the BOJ will maintain the status quo for another year or so, to assess whether the economy is on track to reach 2% inflation within the five-year mandate of the Governor Ueda,” said Shigeto Nagai, head of Japan Economics at Oxford Economics .

In this situation, the Yen appears to depreciate slightly in control of the Dollar, but nothing dramatic or serious, remaining far from last autumn's lows.

The situation is simple: the governor of the Bank of Japan, Ueda, has a mandate to preserve economic stability and growth, so he acts to control the cost of financing public debt and preserve growth and employment. Japanese 10 year bonds pay from 0.2% to 0.5%, or rather 0.25% with a fluctuation band of 0.25.%.

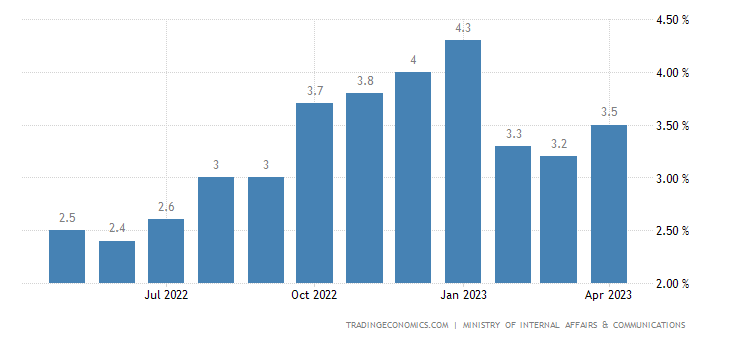

By working well, Ueda also achieves the inflationary objective: prices, as you can see, are under control

The ECB fails to control inflation, which is also its main, indeed only, goal. Something obviously isn't working in Frankfurt, while it's working well in Tokyo.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article The Bank of Japan does not raise rates: it is now looking beyond inflation comes from Scenari Economics .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-bank-of-japan-non-aumenta-i-tassi-ormai-guarda-oltre-linflazione/ on Fri, 16 Jun 2023 08:30:25 +0000.